Am I Too Young For a Financial Advisor?

– Chris Harris, Strategic Advisory Partners

“Someday” and “Eventually” are two words that seem to be used often for many different topics in life.

“Eventually” I will start my diet.

“Someday” I will have time for my hobby.

“Eventually” I will pay off my debt.

“Someday” I will be able to travel.

“Eventually” I will start sticking to a budget.

“Someday” I will start saving enough for the future.

There is a misconception that financial advisors are only for people who have already built all their wealth. This thought process prevents individuals from seeking high-quality financial advice, and instead causes them to rely on friends and co-workers to make sense of financial decision-making.

Some people suggest you would only consider a financial advisor if you are saving 20% of your income, or if you receive a large inheritance (1). While those would definitely qualify as times to receive financial advice, the reality is that financial advisors often work with clients that are currently aspiring to saving more – and the role of the advisor is to help create the plan for financial independence.

So when is the best time to hire a Financial Advisor?

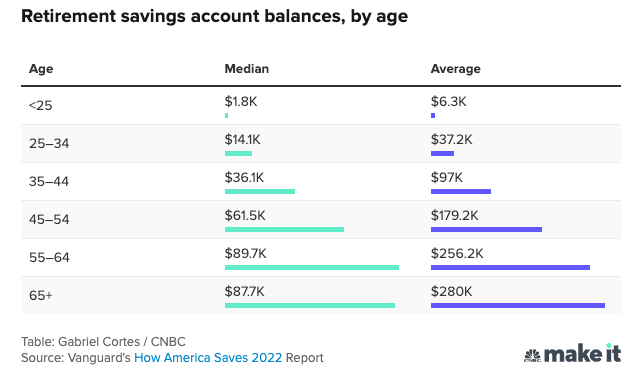

One of the best times to hire a financial advisor is when you are ready to start making plans for your financial future. This is especially critical considering the average American is significantly undersaving for retirement. The median 401(k) balance in the United States is around $35,000 (2).

If most Americans are not saving enough, then why should they consider a financial advisor now, especially if they have just recently begun their professional career? Because, on average, when individuals work with financial advisors they increase their annual returns by 3% (3). This 3% doesn’t even have to be because the advisors are constantly managing investments to try and beat the market.

If you’re asking the question, then the answer is now!

In fact, studies indicate this increase in earnings is not related to investment performance as much as it is a result of the advisors being able to help through behavioral coaching. Being able to adjust behaviors in a way that considers the trade-offs between spending now and saving for the future can make all the difference in achieving financial independence, and this is exactly what a good financial advisor should be able to help with.

The more an advisor can encourage healthy financial habits, and the earlier someone can learn these skills, the greater the impact it can have on their financial future.

If you are wondering “Am I ready for a financial advisor?” or “When should I start working with a financial advisor?” then right now is the time to have that first conversation.

Chris Harris

Financial Advisor

Helping clients define and reach their financial goals with integrity, boldness, accountability, and passion.