There have been numerous articles written about Millennials (people born between 1981 and 1996) and Generation Z (or Gen Z, born between 1997 and 2012) and their investing preferences. These two generations, more than any other generation in the history of our economy, have come of age during a time when technology makes information readily available.

Additionally, because the information has been at the fingertips of these two generations for the entirety of their lives, it is comfortable, and usually preferred, to get information via a quick Google search. This immediate access (or instant gratification) makes things like investing seem just as innocuous as reading the daily headlines or ordering Starbucks with the click of a button.

The result has created two types of investors unique to Millennials and Gen Z. The first is the do-it-yourselfers who don’t see the big deal with buying individual stocks that they know (see: FAANG stocks and TSLA) and watching the exponential growth happen. Apps like Robinhood and Acorns are built in response to these video gaming generations furthering the laissez-faire attitude of nonchalance. The second is investors that have the confidence that they can get the information they need online to make their own investing decisions

I was recently asked about this group and what I would say to a potential client who had these proclivities. To which I responded that I wouldn’t try to appeal to them at all. As Dale Carnegie, the notable writer and the developer of courses including salesmanship and interpersonal skills once said, “Those convinced against their will are of the same opinion still.” Even if half of all Millennials and Gen Zs (roughly 140 million people) are not interested in a relationship with an advisor, that still leaves a couple hundred million people that I can help.

Truthfully, technology has commoditized some of the functions a financial advisor used to perform. Before the Internet, brokers were an instrumental middle-man necessary to facilitate trades in the stock market. It wasn’t possible to log on to a website and make your own trades or to see the latest value of a stock. Consequently, portfolio values were manually calculated and paper statements were sent to clients regularly.

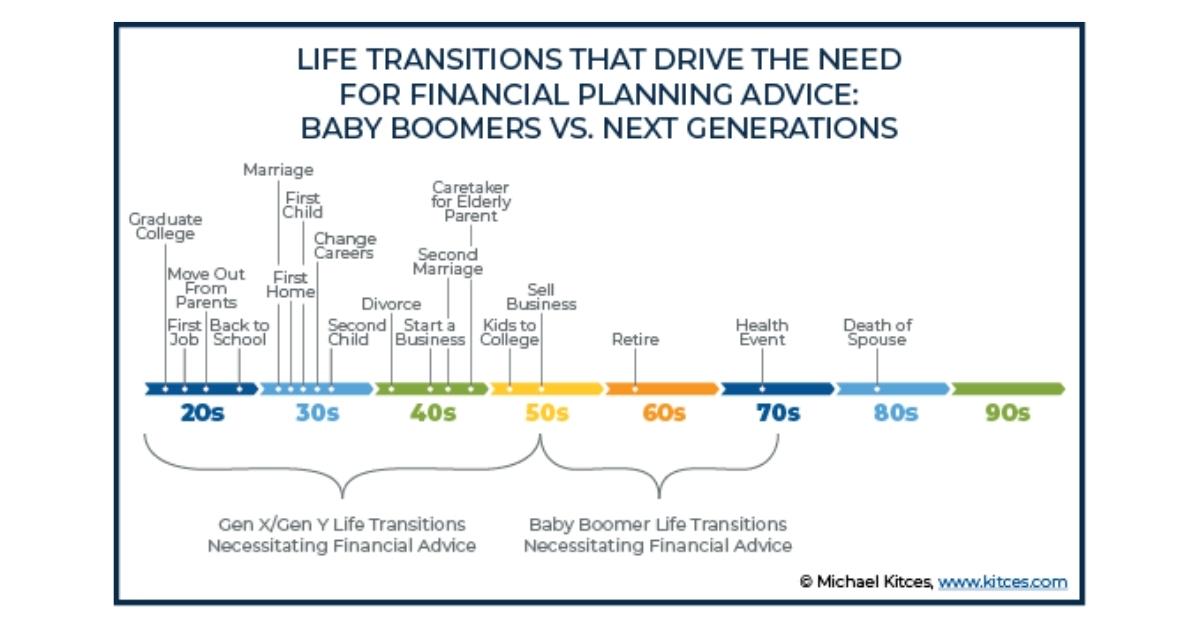

The value that a financial advisor provides that hasn’t changed is the behavioral and psychological support that most investors need to be successful with their long-term investing (most notably, retirement investing). With pensions, mostly a benefit of previous generations, the onus on saving and preparing for retirement now falls squarely on each of us. Beyond that, planning around paying for kids’ college, taxes, estates/death, insurance, long-term care, etc. are all areas that most people do not spend a lot of time learning about or exploring. An investment portfolio and risk tolerance considerations are the easy parts of what a financial planner can do. In fact, as I mentioned earlier, technology takes care of that for us as well. What sets us apart is the nuances of the individual client(s) and their hopes and dreams.

Money is a tool. There are only three things you can do with it: save it, spend it or give it away. Personal finance has little to do with dollars and cents. When I ask clients what retirement looks like, or what they hope to accomplish with their estate plan, I never get a response in dollars. It is always about what the clients hope to do or who the clients want to help or provide hope to. My job as a financial planner is to take the hopes and dreams of my clients and give them the financial roadmap on how to get there. I am the GPS to give the turn-by-turn directions once the client has decided where they are going. One important aspect that the GPS provides—when you are on a trip and you deviate from your original route, the GPS provides updated directions; whether it is an accident (could be a job loss or a health scare) or just heavy traffic (like a salary reduction—hello COVID-19!) any course we choose is almost assuredly not going to be linear.

If you are going to work with a financial advisor/planner, it is paramount that you find someone that makes sense when you meet with them. I always encourage folks that I talk with to interview several advisors to find one that you feel you can build trust with and have confidence in their recommendations. The advice that a financial planner provides isn’t useful if you are second-guessing them. If you are married, I recommend that you and your spouse sit down with each advisor you are interviewing together to make sure that you are both comfortable with them and the team that you may be interacting with.

There will continue to be a significant number of people who want to handle their own investing and, to a lesser extent, financial planning. After all, failing to create a plan is still a plan. There will always be a group of people who value the insight that a financial planner can provide to achieve their long-term goals. Those are the people I look forward to serving as their GPS.