April 2023

Monthly Investment Update

Control What You Can, Remove the Rest

“Grand strategy is the art of looking beyond the present battle and calculating ahead. Focus on your ultimate goal and plot to reach it.”

–Robert Greene, “The 33 Strategies of War”

When someone asks us to describe our investment strategy, often the result is a conversation that’s less about strategy and substantially more about tactics. The two are complimentary, and both are incredibly important, but they are certainly not interchangeable.

To us, the main difference between strategy and tactics is in the goal you are trying to achieve and the timeframe by which you are measuring success (or failure). Generating a comprehensive understanding of an investment strategy means establishing answers to three questions:

- What is the goal?

- What tactics are used to achieve the goal?

- Over what timeframe are the tactics operating, and what is a reasonable expectation for determining success or failure?

Strategies operate in an inherently longer timeframe than tactics; but on a daily basis, we feel the tactics more. For example, it’s easy to lose sight of a long-term diet plan when a box of Krispy Kreme doughnuts shows up in the break room (how do you say no to just one original glazed?!).

The goal of our strategy is simple: keep an investor’s rate of compounding at or near its highest point. The tactics we use to work toward this goal will depend on what the investment “ride” looks like, but the goal is clear. Sometimes staying on the longer-term strategic path involves tactical pain in the short run. Our tactics are applied with a long-term view, which is why you must be prepared to sometimes give up a little in the short run.

In this monthly note, we consider both the bull and bear case for equities. We also highlight why our focus remains on controlling what we can control by being disciplined about our systematic investing process. Focusing on a repeatable process, and not short-term outcomes, is how we will achieve the long-term strategic goals for our clients.

Here’s a summary of what transpired in the markets in March.

U.S. Equities

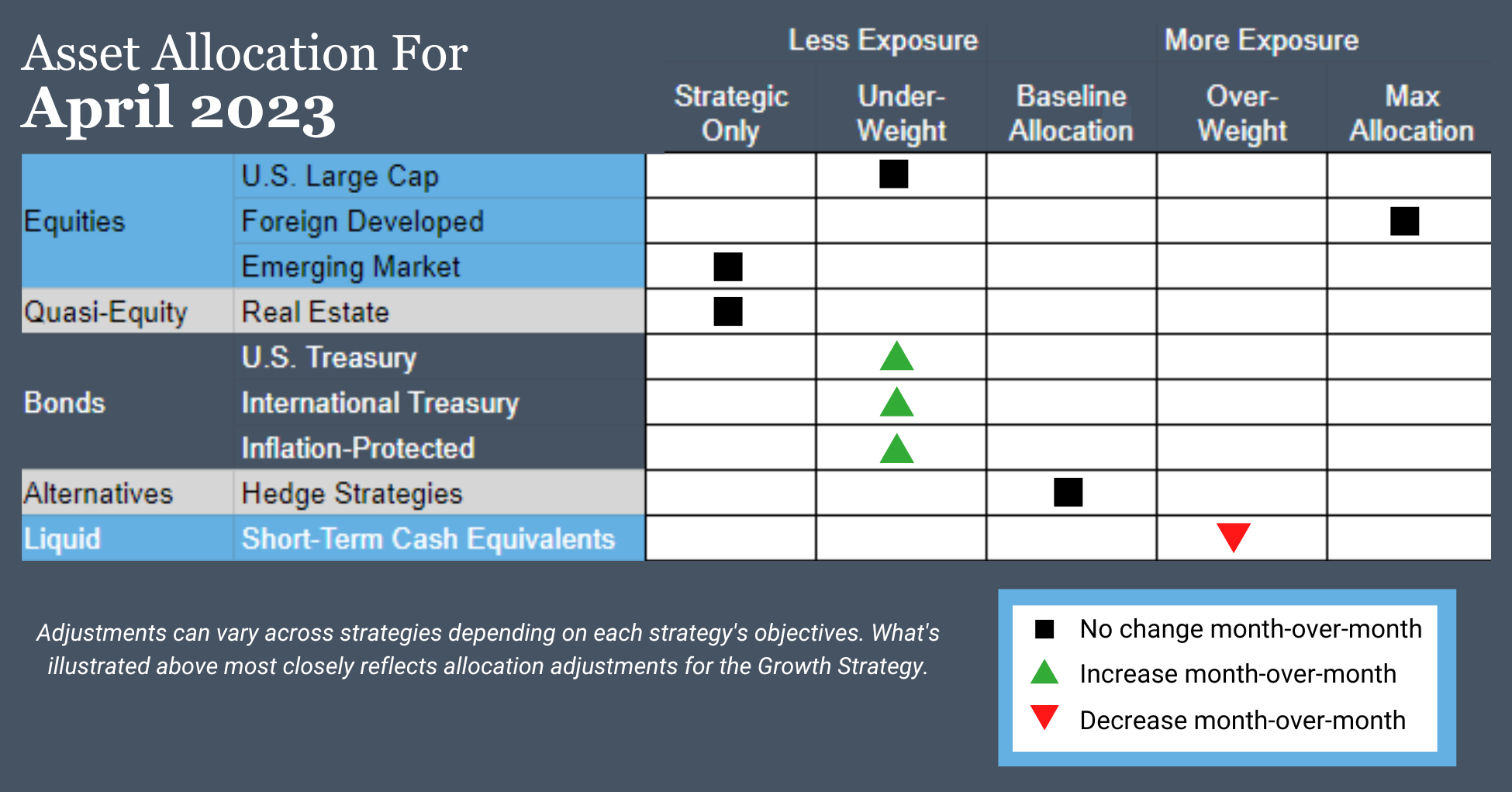

Overall exposure will not change. The intermediate-term timeframe remains in an uptrend, while the long-term timeframe is in a downtrend. Within the asset class, exposure will decrease among small and mid-caps and increase for large caps.

Intl Equities

Exposure will not change. Foreign-developed equities continue to experience uptrends across both timeframes while emerging market equities continue to have downtrends.

Real Estate

Exposure will not change, with downtrends across both timeframes.

U.S. & Intl Treasuries

Exposure will increase but remain underweight. Intermediate-term trends have turned positive, while long-term trends remain negative.

Inflation-Protected Bonds

Exposure will increase for the first time in over a year but remain underweight. Intermediate-term trends have turned positive while the long-term trends are negative.

Alternatives

Exposure will not change. The baseline allocation for gold is also our highest limit, so we are already at the maximum allocation as the asset class continues to experience uptrends over both timeframes.

Short-Term Fixed Income

Exposure will decrease, as allocations are returned to slightly strengthening U.S. and international Treasuries.

Asset Level Overview

Equities & Real Estate

Despite a crisis that shut down multiple banks and threatened many others, large-cap U.S. equities managed to produce a small, but respectable, gain in March. Given most of the banking stress focused on middle- and small-sized names, it is no surprise that mid and small-caps as a whole fared much worse, resulting in significant decreases.

Interestingly, growth and technology led the way domestically while value, which generally has exposure to financial firms, underperformed.

As a whole, U.S. equities barely retained their intermediate-term uptrend status and continue to experience downtrends over the long-term timeframe. As a result, our portfolios continue to underweight the baseline target.

Similar to U.S. stocks, international equities experienced a roller coaster and ultimately ended March near where they started the month. Developed markets managed to hold their uptrends across both time frames while emerging markets remained in downtrends. Developed markets remain much stronger, meaning our portfolios are tilted much more in that direction. In fact, developed markets continue to be at their maximum allocation, with emerging markets at their minimum.

Real estate securities continue to experience downtrends across both time frames;they nearly repeated the 2022 low. A bounce in the last few days has created some distance from that low, but this asset class remains the weakest right now. As expected, exposure in our portfolios remains at or near its low.

Fixed Income & Alternatives

Bonds have joined equities in a large see-saw pattern by following February’s retracement with a rally in March. While not enough to break the 200-day exponential moving average, the increases caused an intermediate-term uptrend. The result in our portfolios is an uptick in exposure, but exposure is still below the baseline allocation in the U.S. and internationally.

After declining for almost all of February, gold staged a powerful rally in March, making a new 2023 high and producing strong returns. This asset class sits near a 1-year high and continues to hold its uptrend status across both time frames we monitor. All our portfolios are at their maximum allocation, and that will not change for April.

3 Potential Catalysts for Trend Changes

Last Hike:

The Federal Reserve approved another 0.25% rate increase but signaled that recent banking-system turmoil might end its rate-rise campaign sooner than expected. The decision marked the Fed’s ninth consecutive rate increase and brings the benchmark federal funds rate to a range between 4.75% and 5%, which is the highest level since September 2007. Fed Chair Jerome Powell indicated that credit tightening from banks might further slow the economy and allow the Federal Reserve to pause on rate hikes in upcoming meetings as they assess the damage done by recent banking failures.

Pointing Fingers About Bank Collapse:

Senators criticized the Federal Reserve for failing to prevent the collapse of Silicon Valley Bank despite identifying risks beforehand. The central bank’s top regulator blamed the bank’s executives for not fixing its problems. The Fed’s Vice Chairman for Supervision, Michael Barr, appeared before the Senate Banking Committee and defended the actions of the Fed’s supervisors. He indicated that the central bank had privately raised concerns with SVB before its collapse.

Inflation Abating:

U.S. consumers were less worried about inflation in February than in January. According to a recent survey by the New York Federal Reserve, expectations for price increases over the coming year fell to 4.2% from 5% a month earlier. They are down from a high of almost 7% in 2022. Three-year-ahead expectations held steady at 2.7%, down from a peak of 4%. Fed officials want to keep inflation expectations anchored close to their 2% goal, with some worrying that high and rising forecasts could become a self-fulfilling prophecy. Inflation is a measure the Fed tracks closely for setting the base Federal Funds rate.

The Bear Case & Bull Case for U.S. Equities

“There is a call for strategy every time the path to a given destination is not straightforward.” –Lawrence Freedman, “Strategy: A History”

Here are two schools of thought about the direction of the global economy and financial markets:

#1 – The Bear Case:

The case for declining equity markets is based on three historically sure-fire ingredients for a lasting bear market: rising interest rates caused by inflation, financial instability, and tightening credit. Even one or two of these factors has historically been a catalyst for economic and equity market weakness, so all three happening simultaneously is concerning.

While the growth rate of inflation has steadied, it remains stubbornly high despite substantial rate hikes thus far. Employment and wage growth remain strong, leaving little room for hope that price declines on key inputs are imminent. The Federal Reserve has made it clear that fighting inflation is its number one priority, and essentially the only tool at its disposal is interest rates, so rates will likely continue higher and remain that way for a long time.

Strike 1.

The financial sector has been in freefall in March, with the S&P 500 Financials Sector SPDR ETF (XLF) declining about 12% for the month, with a low of almost -15%. Emergency government meetings have convened to rescue multiple banks, while scores of others have endured runs on deposits and sharp stock price declines in recent weeks. Comparisons with the Great Financial Crisis have been common, as this has been the worst stretch of bank instability since 2008.

Strike 2.

With the public nervous about the banking system, what is the likely behavior from bank leaders? The answer is tightening credit. As scrutiny of bank balance sheets escalates, it is reasonable to assume that lending standards will stiffen until sentiment improves. Reduced access to capital impedes growth, which becomes another headwind for economic growth.

Strike 3 – you’re out.

#2 – The Bull Case:

But, markets are discounting machines. What do we mean by that?

The markets have historically been forward-looking. In the past, you’d hear a few stories of market participants who were able to identify inefficiency, exploit it, and profit profoundly – but those were the exceptions, not the rule.

The advent of algorithmic trading and instantaneous execution has made profitably exploiting market inefficiencies even more difficult in the traditional sense. Changes in the market and market participants reacting to those changes are essentially happening simultaneously.

In general, if one is witnessing and reacting to a financial event, the assumption should be that the markets have already done so prior, and the opportunity is gone.

Why does this matter right now, and how does that make a case for a bull market?

The answer lies in market behavior since the last all-time high in U.S. stocks in December 2021. The markets spent 2022 pricing in the bear case presented above. High inflation, interest rate hikes, tightening credit, and a recession were progressively priced in with a few false rallies popping up when the hope of a soft landing ebbed and flowed. The pattern was a lower high followed by a new low.

In 2023, U.S. markets broke this pattern and broadly formed a series of higher lows. Cost reductions and more sober revenue expectations pushed growth stocks to resume their leadership after experiencing a healthy retracement in 2022. Additionally, the speculative fervor in digital assets has been squashed, bringing some normalcy back to investor expectations.

The fact that material bank issues have done little to alter this pattern of higher lows is arguably the strongest bull case of all. Investors are largely seeing this for what it is – a few banks paying the price for reckless decisions. Sadly, these types of situations have always existed and will likely continue.

There’s a solid argument to make about markets having already priced in all the bear scenarios. With the worst seeming to be behind us in regard to inflation, rate hikes, and banking issues, the markets may be slowly weeding out the remaining bears. In the absence of selling, the markets naturally tend to climb. If we’re about to climb, you want to be on board or get on board.

It appears that we have a stalemate between the bulls and the bears at the moment. Equities (and bonds for that matter) have yet to seriously retest lows from 2022, but as mentioned above are not threatening new highs either. There seems to be an underlying desire from investors to push the market higher, they are just looking for a reason to buy. Economic data and subsequent Federal Reserve commentary continues to stand in the way.

Some could argue that directionless markets are the Achilles heel for trend following strategies, but we want to highlight two areas that show why systematic portfolio management via trend following still shines.

The Conclusion:

It’s amazing how easy it was for us to articulate those two cases. Yet, as we conclude writing this monthly note, we’re still conflicted about which case is more or less true.

The beauty of our systematic investing process is that we don’t have to predict.

· We didn’t know how good things would be in 2021, and it didn’t stop us from capitalizing on it.

· We didn’t know how bad things would be in 2022, and it didn’t stop us from being defensive for most of the year – especially as markets made new lows.

· We don’t know what remains in store in 2023, and it won’t stop us from continuing to follow our process.

Our trend-following systems will adapt like they always have. They’ll seek to put us in a strong position to avoid risk or seek opportunistic areas of strength, whichever is most appropriate for the market conditions ahead of us.

Having to chain yourself to one of the scenarios above, and hoping you’re right, is a scary place to be. Systematic investing removes the things you cannot control. What is left are factors that can work to your advantage. This is our belief and why we do what we do for our clients.

Disclosures:

Strategic Advisory Partners is an investment advisor registered pursuant to the laws of the state of North Carolina. Our firm only conducts business in states where licensed, registered, or where an applicable exemption or exclusion is afforded. This material should not be considered a solicitation to buy or an offer to sell securities or financial services. The investment advisory services of Strategic Advisory Partners are not available in those states where our firm is not authorized or permitted by law to solicit or sell advisory services and products. Registration as an investment adviser does not imply any level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. For more information, please visit adviserinfo.sec.gov and search for our firm name.

Past performance is not indicative of future results. The material above has been provided for informational purposes only and is not intended as legal or investment advice or a recommendation of any particular security or strategy. The investment strategy and themes discussed herein may be unsuitable for investors depending on their specific investment objectives and financial situation.

Opinions expressed in this commentary reflect subjective judgments of the author based on conditions at the time of writing and are subject to change without notice.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission from Strategic Advisory Partners.