The Cost of Waiting 5 Years

– Chris Harris, Strategic Advisory Partners

One of the hardest parts of having an investment plan and saving for the future is just getting started. There are always reasons to procrastinate or delay, whether it is just a lack of interest or not wanting to make lifestyle changes. The problem is that most people don’t fully understand what the impact will be if they choose to wait to start investing.

Widen. Your. Scope.

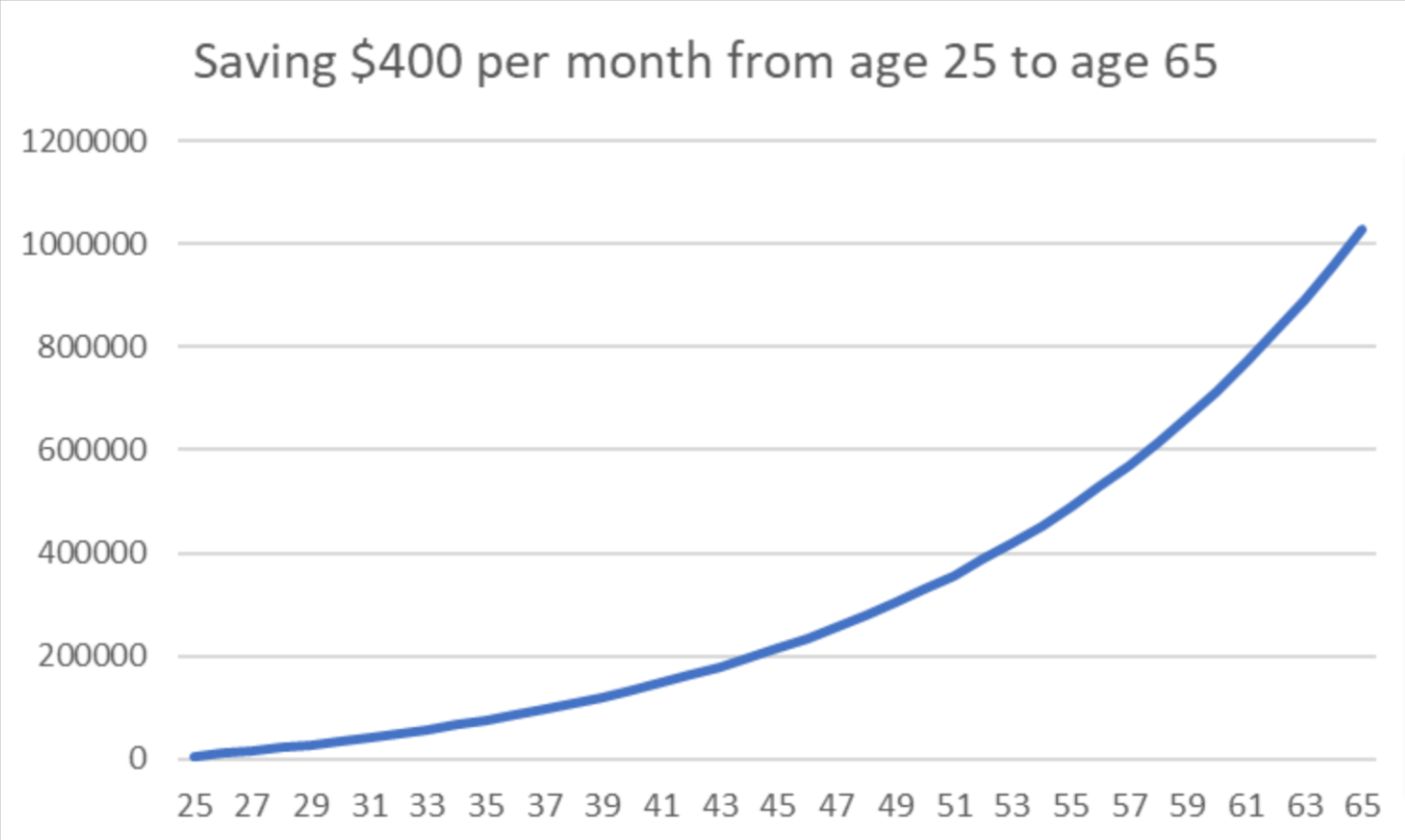

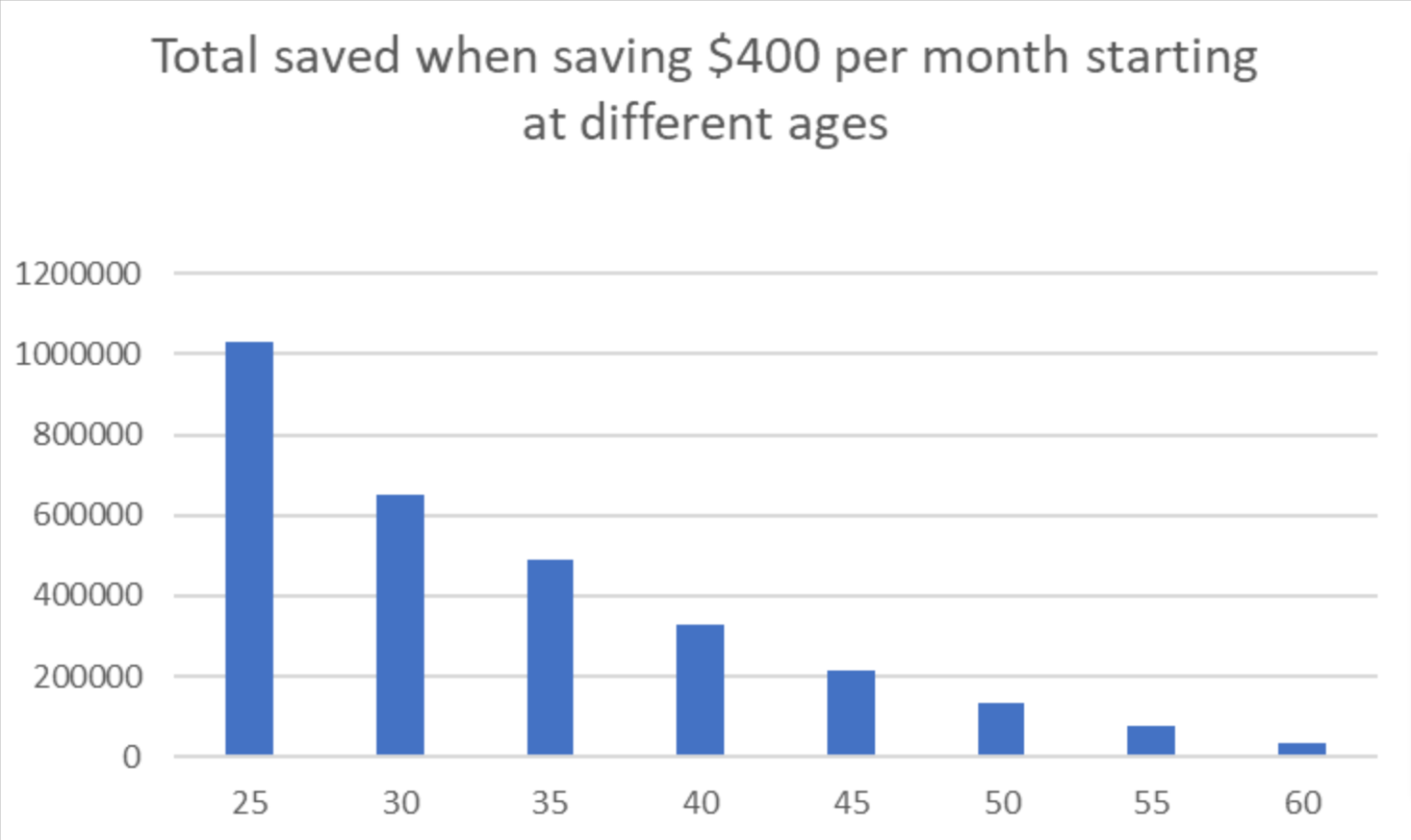

If you start saving for retirement when you are 25 years old, and save $400 each month, you would have $1,030,126! This assumes an average growth rate of 7% per year (the long-term average of the S&P 500).

Instead, many people focus on short-term earnings based on how much they are willing to contribute over the course of a year, or even five years. By limiting your plan to only a few years at a time, you’re not taking into consideration the interest you won’t earn decades from now.

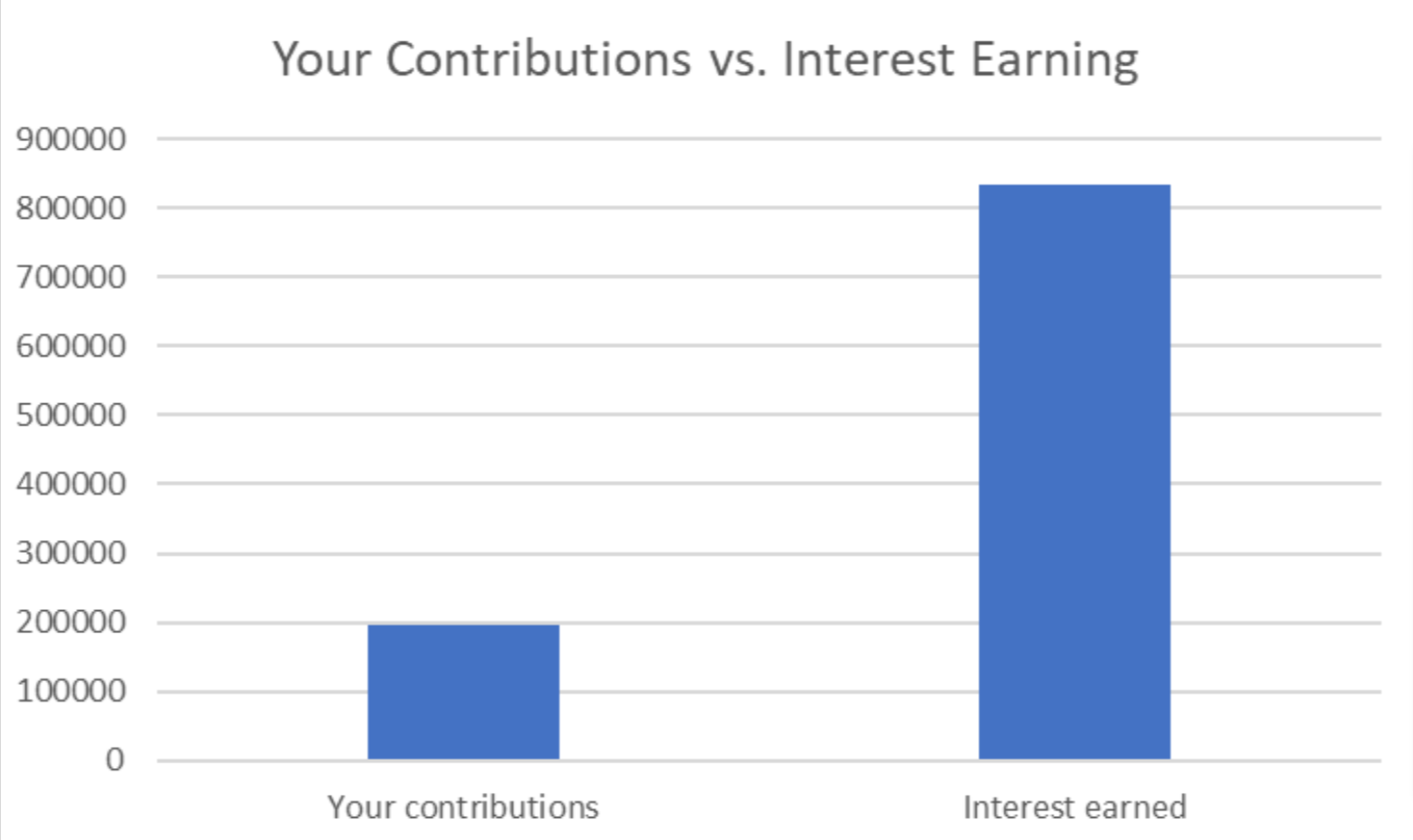

Over this 40-year period, only $196,800 of the account will be your contributions while the vast majority ($833,325) will be from the growth over time.

While these results seem wonderful, it is hard for most people to reconcile that these kinds of balances are possible. A quick look at the account after 10 years and we see the balance is about $75,000.

After 20 years, the balance is $215,000. Halfway through our time period and the amount in the account is far less than the hoped for $1 million.

What happens in the last 20 years to allow for so much interest to be earned?

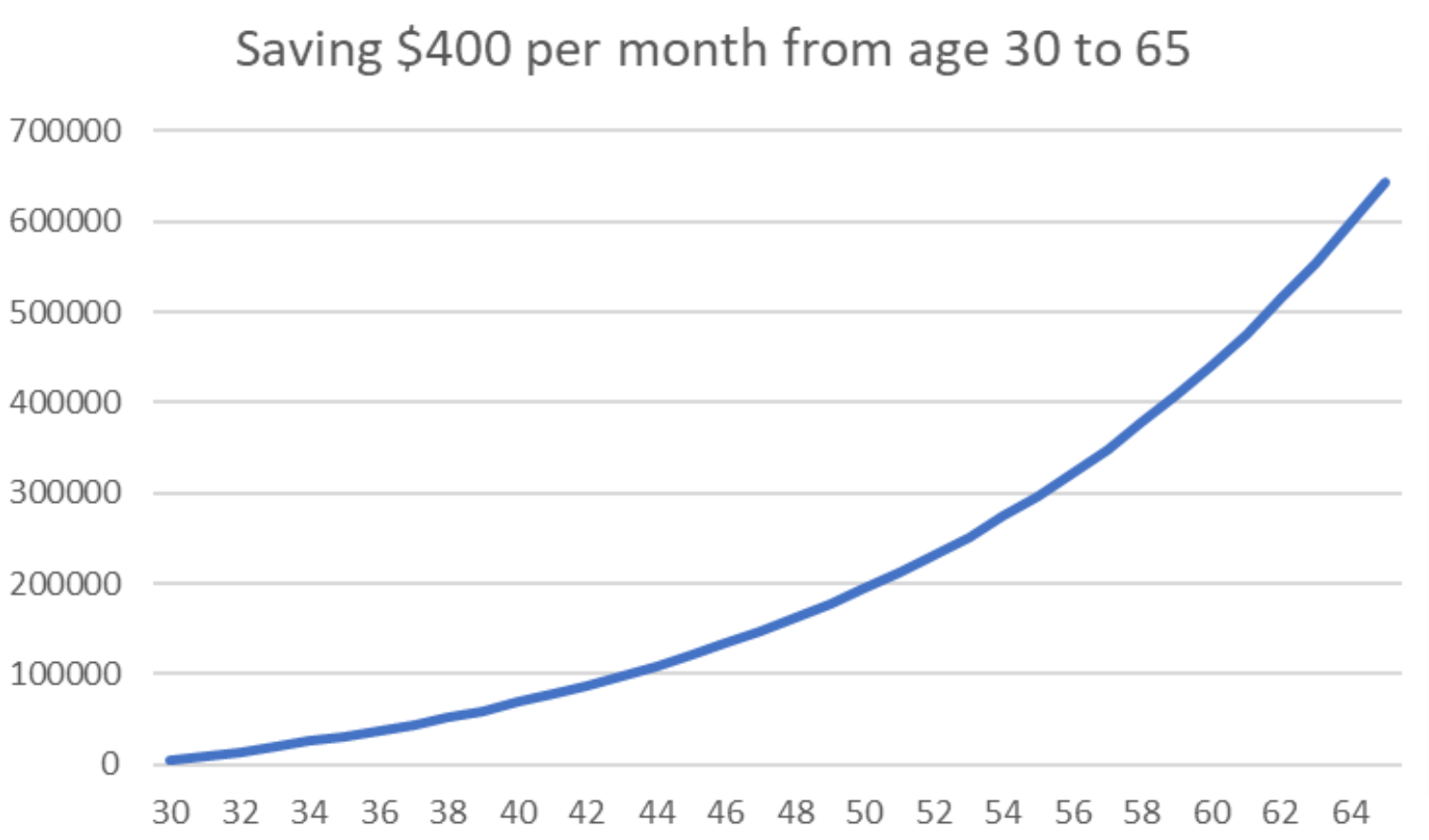

As the amount in the account grows, the 7% growth in the account ends up being 7% of a much larger number. One of the easiest ways to demonstrate this is to compare what would have happened if we had started investing at age 30 instead of age 25. By waiting 5 years, the total balance at age 65 drops to $652,845.

This result is incredible because the individual has only put $29,000 less in the account but losing the five extra years of interest earnings means a loss of nearly $305,000!

To maximize growth in the account, regular investing needs to start as soon as possible.

But what if I didn’t start at 25…or 30?

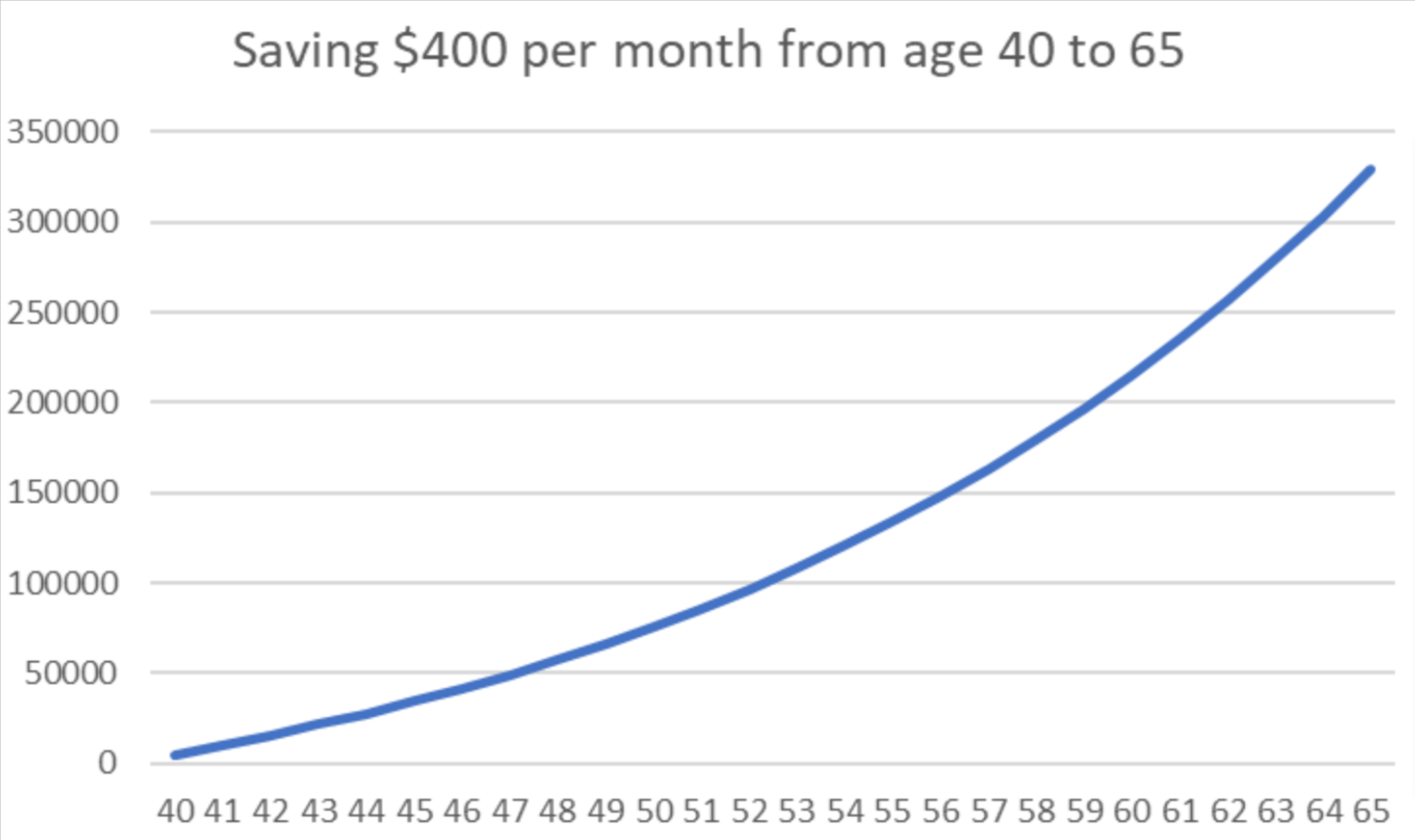

These results are similar even when starting later in life. Suppose someone decides to start saving $400 per month at age 40. By age 65, they will have about $330,000 in their account.

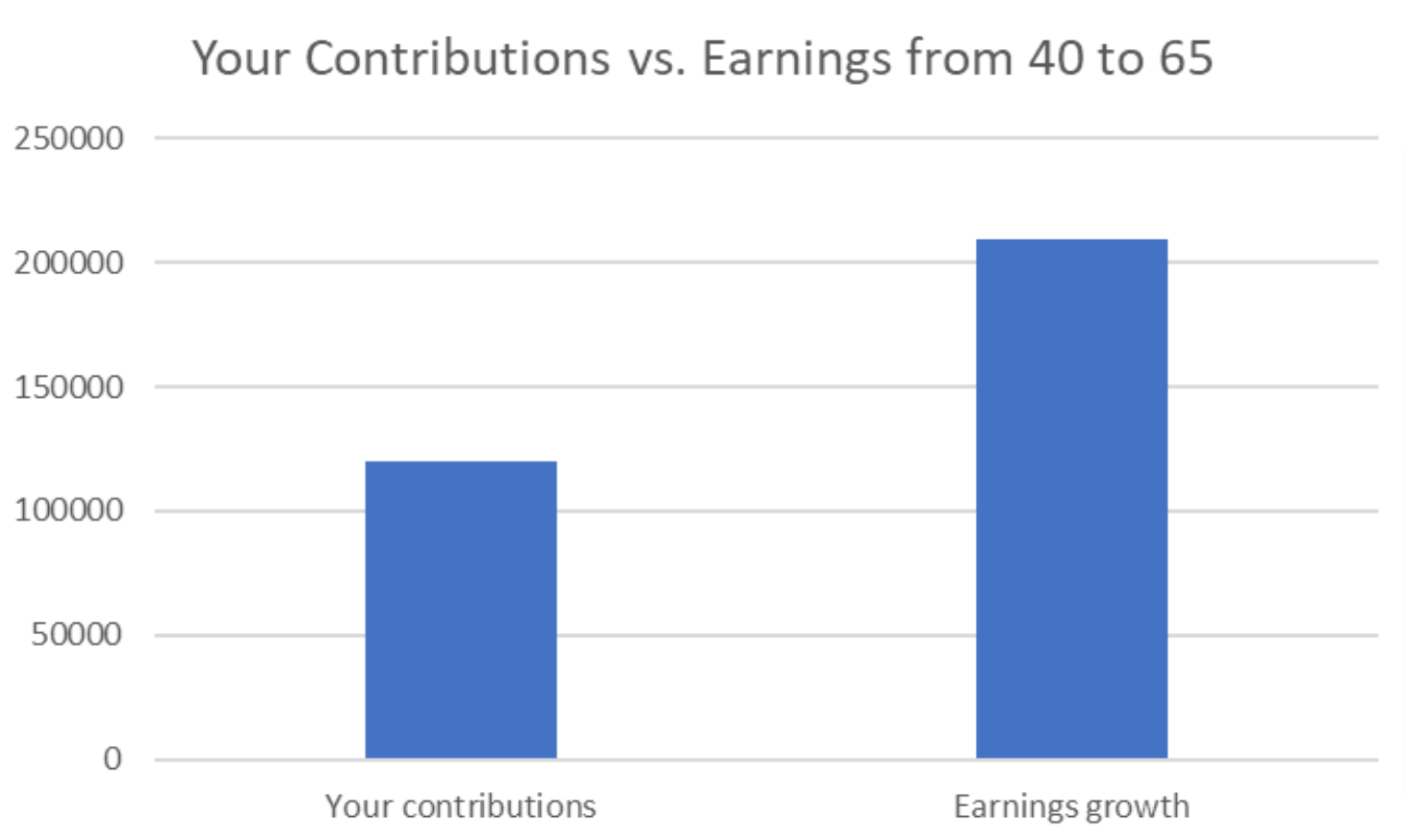

When starting at age 40, this individual has put $120,000 in the account and has about $210,000 in growth.

If this same person decides to wait until age 45 instead of starting at age 40, the account balance is expected to be about $215,000. This means, the individual only puts $29,000 less in the account than if they had started five years earlier and misses out on another $90,000 in earnings growth.

Most people in life are in a perpetual balancing act between their family, work, and personal lives. With so many competing needs for time and money, it can be difficult to make the commitment and get started investing.

Each year you wait significantly decreases the earnings growth over time.

The table below shows what happens for every 5 years an individual waits to start saving.

Of course, there are things you can do to address your savings goals, even if you aren’t 25 years old. Saving more per month, or waiting until a later age to start drawing on the money are two strategies to help reach your long-term plans. You are never as young as you are today, so the most important takeaway should be to start!

Ready to make a plan? Here are 4 things to consider when approaching an investment strategy!

At Strategic Advisory Partners, our goal is to help you get started now, with a plan that works for you. There is no investment or strategy that works for everyone, and everyone is starting from a different place. We understand that and are here to provide professional planning to help you achieve your goals – based on where you are today.