Crossing Your Fingers is Not a Strategy

Chris Harris – Financial Advisor

Throughout my life, I have heard many people use expressions like “fingers crossed!” In fact, I have used the same expression when talking about getting into graduate school, getting a job, or winning a game. In each of these events there are only two outcomes:

You get into the school, get the job, win the game… or you don’t.

An argument could be made that we’re more likely to “cross our fingers” when we feel that we have little to no level of control over the outcome. While crossing your fingers provides a level of comfort, it’s not a plan for success. A lot more goes into preparing for grad school or winning a game. Though it won’t promise a victory, hard work and planning is the only way to establish any level of control over the outcome.

Just as you’d need to work hard for good grades in your undergraduate program to get into the graduate school that you want, a financially stable future requires planning and work as well.

Financial planning is not a “zero sum game.” To be successful, someone else isn’t on the other side trying to take your place for the job. It is not a competition where only a certain number of people can win. Instead, for most people, the opponent in financial planning is themselves. If you have particular financial goals you hope to accomplish, it’s up to you to make tradeoffs between what you want now and what you want your future to look like.

There is no doubt that circumstances in life will make it more difficult for some people to stay on track and achieve their goals. The vast majority of people can take proactive steps to influence their financial outcomes – even when they feel like the outcome is very uncertain. I have met with many people who say things like “I don’t make nearly enough to ever have a good retirement” or, “I don’t know what needs to happen, but something has to change if I will ever be able to retire.” I understand these feelings. Individuals feel like too much is out of their control and now they are simply hoping for a good outcome; crossing their fingers.

But what would it take to feel a little more secure in retirement?

For the average household retiring today, a nest egg between $750,000 and $1,000,000 in a retirement account plus social security, would equate to a comfortable retirement.

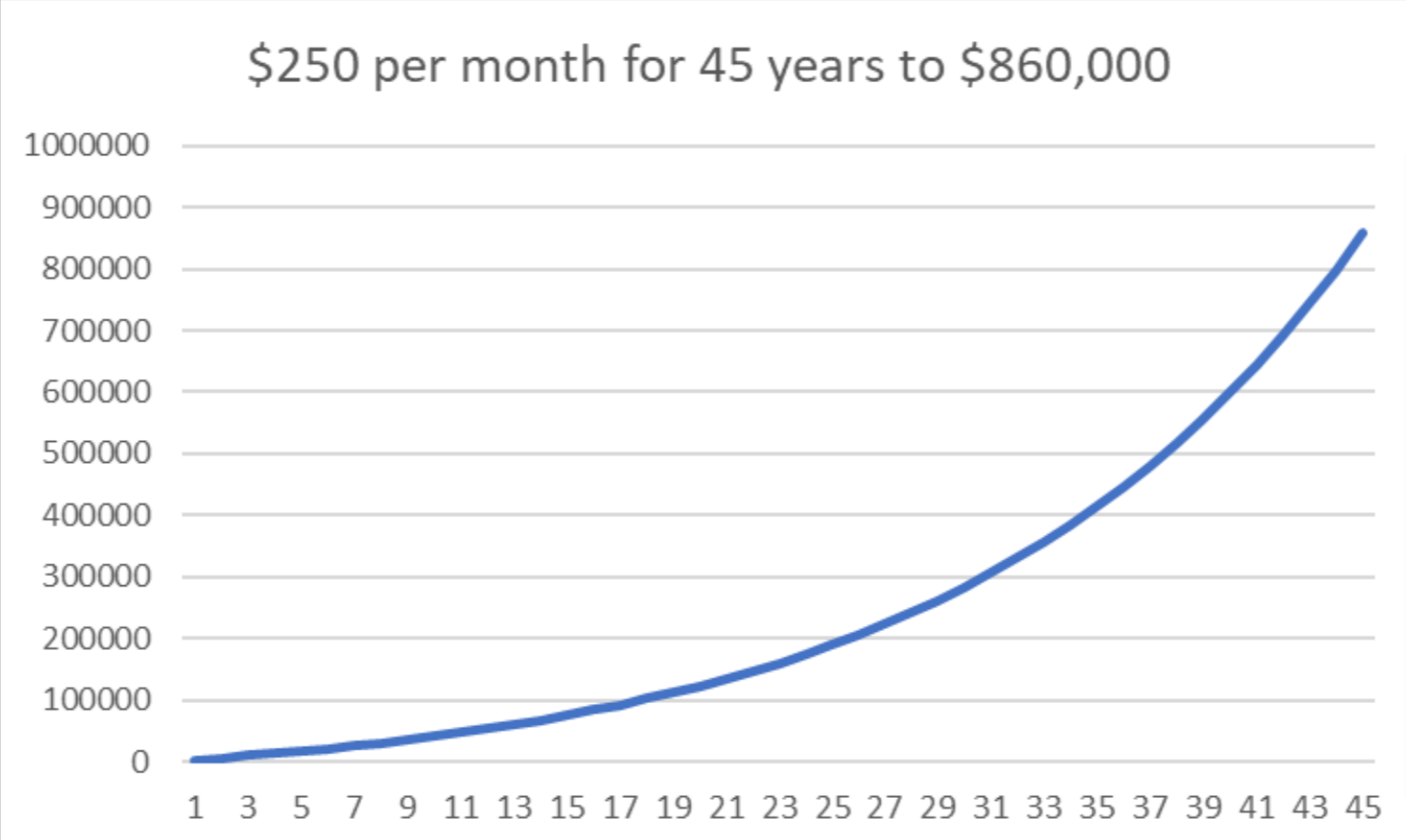

What would it take to fall within this range in a retirement account? Starting at age 22 it would take about $250 a month (using average historical stock returns of about 7%). It would take about $125 per month if stock returns for the next 45 years were the same as they were for the past 45 years.

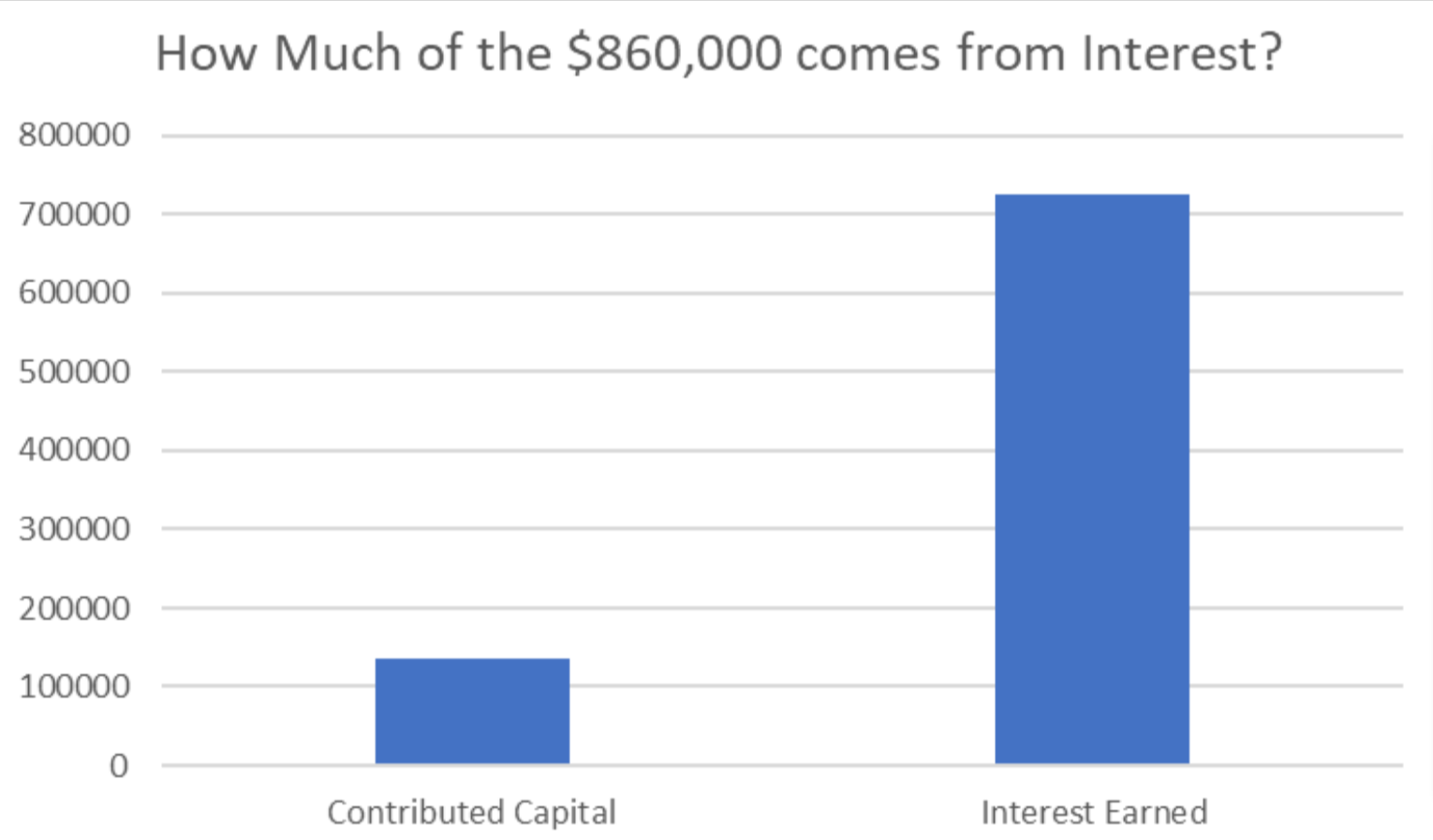

Saving $250 per month for 45 years, you will save $135,000. By starting early, the compounding effect of this savings will result in over $860,000 saved! The earnings over that time period are $725,000!

*Assuming average returns of 7% per year

“He who understands it, earns it; he who doesn’t, pays it.”

-Einstein

Albert Einstein has been attributed to adding an 8th wonder of the world: compound interest.

It is amazing to understand that by starting early, the vast majority of the money in your investment account will come from the interest earned as opposed to money you’ve put in (contributed capital).

Here is a breakdown of the same example, by source:

Sixty-four percent of households believe they are behind in their retirement savings. The same study from the Federal Reserve found that the median retirement savings for Americans is $65,000. In general, most households are behind where they want to be, and behind where they need to be to reach their financial goals.

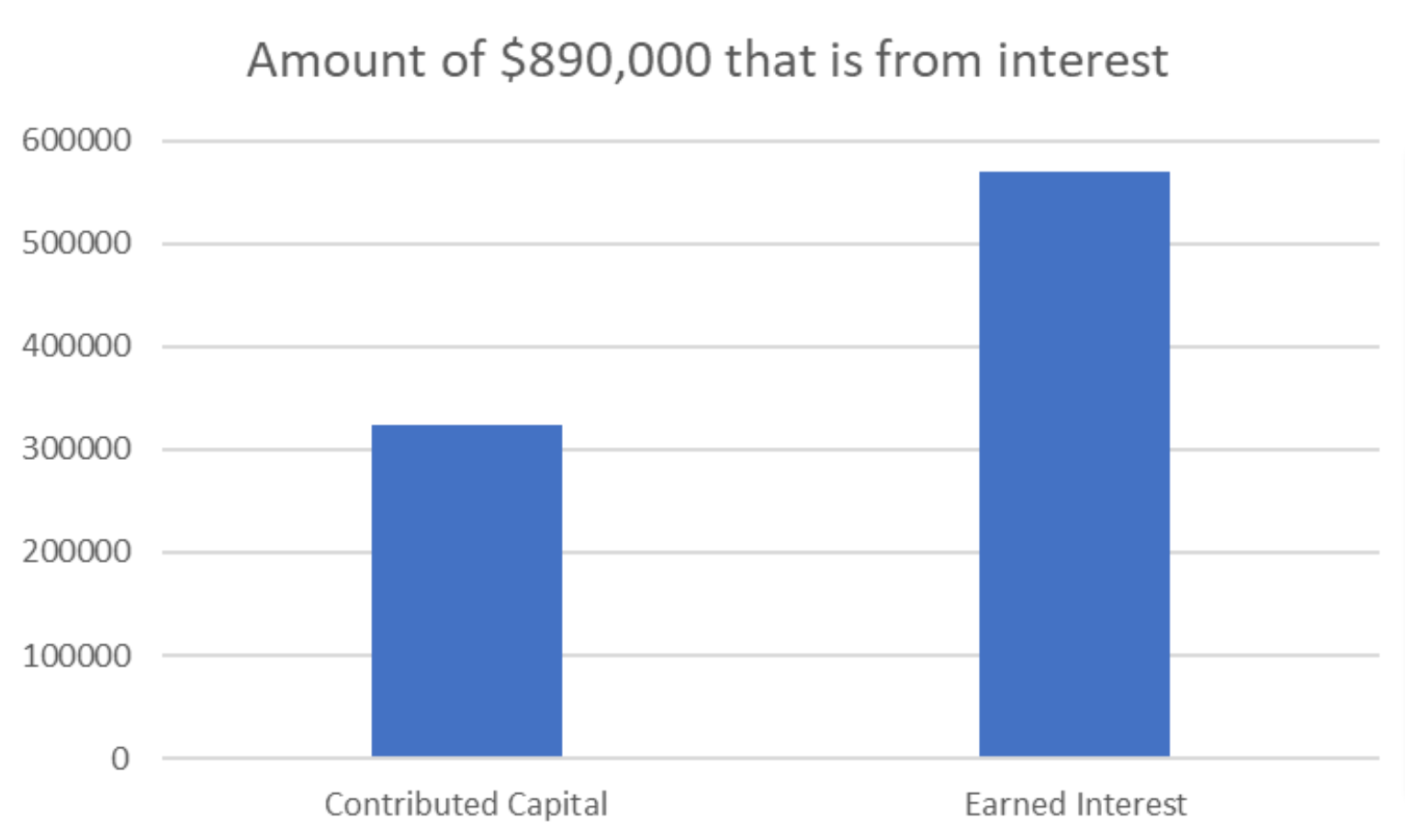

For someone who isn’t on track or feels like they are behind, they may wonder if they can still reach their financial goals. For example, can someone who is 40 still save a similar amount of money? The answer is yes, but it will require more money put into the account from the individual.

To get a similar amount of money saved, the individual will need to be saving closer to $1,000 per month starting at age 40 instead of $250 a month at age 22 – but it is still achievable.

The same 7% investment returns will result in roughly $890,000 in the account after 27 years.

This individual had to increase their contributions significantly, but the majority of the account balance is still a result of interest earned. In this case, about $570,000 of the total amount is still from interest.

Even starting later than they had hoped, an individual can save, invest, and increase their wealth significantly by having a plan.

How does a house get paid off early, retirement or college get funded, or any other major financial goal get accomplished? By establishing a plan with specific steps and then trusting that the process will work. There will be bumps along the way, but history has shown that consistency in saving and starting early pays off in the end.

At Strategic Advisory Partners we work with individuals to create a plan that reaches goals while balancing living life now and preparing for the future. There is a Chinese proverb that can be applied to investing:

You will never be as young as you are today, so there’s never a better time to create a plan and determine how you will reach your financial goals. There may need to be some additional sacrifices (saving more along the way, delaying the timing of your goals, etc.) based on your particular circumstances, but a path can be found that will result in a better financial future.

Doing nothing will not work – and crossing fingers is not a strategy.

1 Economic Well-Being of U.S. Households in 2020 – May 2021

2 http://www.simplestockinvesting.com/SP500-historical-real-total-returns.htm