Setting the Stage for Year-End

As we wrap up November and enter the holiday season, we want to take this opportunity to provide you with our latest market insights and portfolio updates. At Strategic Advisory Partners, we believe in keeping our clients well-informed about both our investment strategies and the broader market environment that influences them.

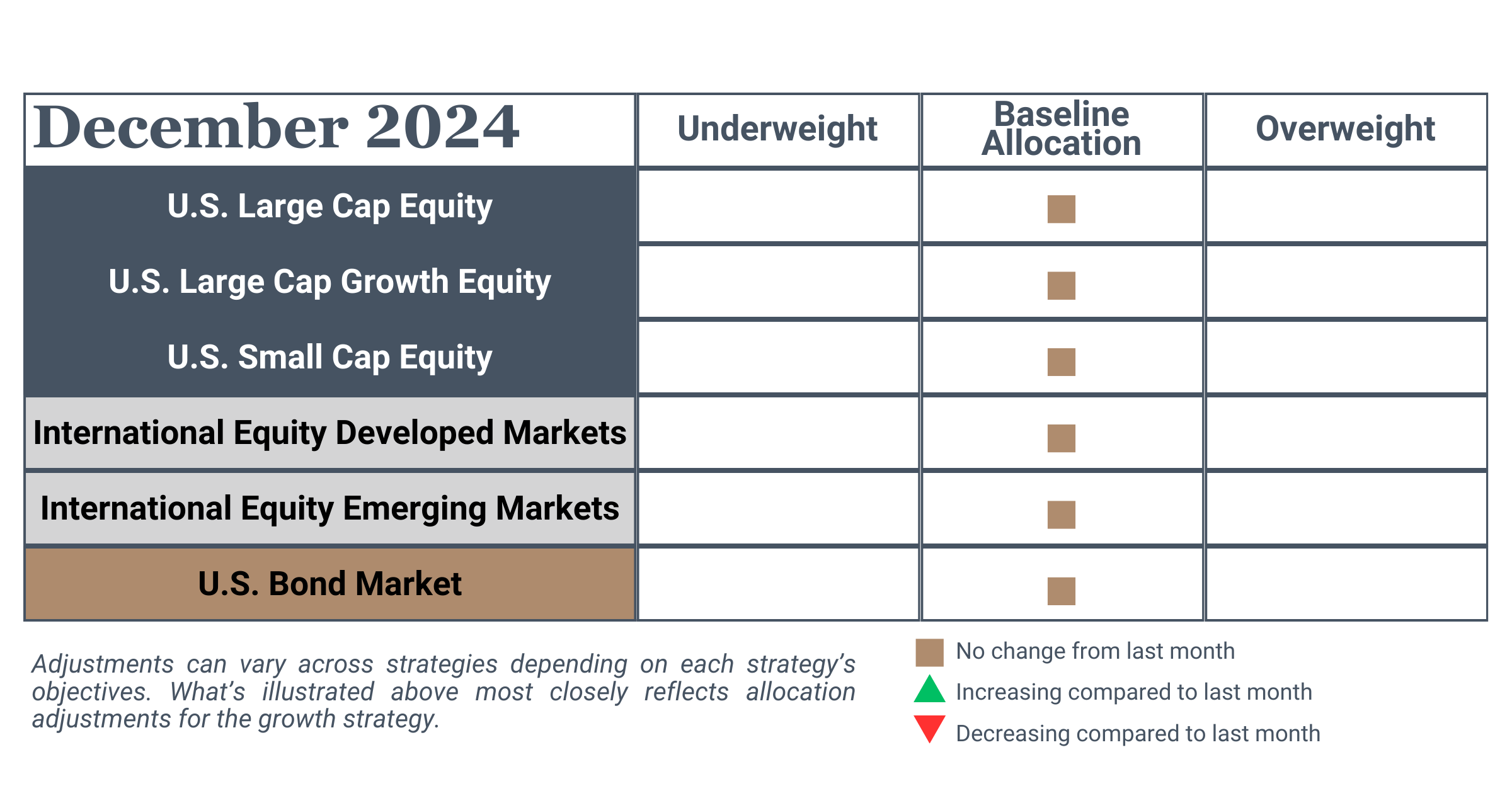

Asset Allocation Update

This month has brought significant developments across financial markets, and we’re pleased to share our perspective on these changes and how we’re positioned to navigate them.

Our investment strategies at Strategic Advisory Partners have maintained their base allocations through November. While overall allocations have not changed, it’s important to understand how returns may vary within individual accounts based on their specific compositions. Our investment approach remains fluid and model-driven, rather than following a rigid calendar-based schedule for adjustments. This allows us to make strategic changes when market conditions warrant them, always keeping your long-term financial goals at the forefront of our decision-making process.

Fall Finale: Markets Rise to the Occasion

Turning to the broader market landscape, November has proven to be a noteworthy month for financial markets. According to Yahoo Finance, U.S. stocks posted their biggest monthly gains of 2024, with both the S&P 500 and Dow Jones Industrial Average reaching record highs. The Dow approached the significant milestone of 45,000 points during a holiday-shortened session at month-end.

The market’s performance has been particularly interesting across different segments. The small-cap Russell 2000 index delivered an impressive gain of approximately 11% for the month. In the technology sector, semiconductor stocks showed strength following reports that the Biden administration’s planned restrictions on industry sales to China may be less severe than initially anticipated.

The bond market has also seen notable movement, with the 10-year Treasury yield declining to 4.192%. Looking ahead, market participants are closely monitoring several key factors, including:

The upcoming November jobs report

Federal Reserve communications, including remarks from Chair Powell

Construction spending data

Ongoing inflation trends

While derivatives traders are pricing in a significant probability of another quarter-point rate cut in December, Federal Reserve officials have indicated they remain data-dependent and could pause if inflation progress stalls due to continued economic strength.

As we look toward December, historically a seasonally strong month for stocks, we maintain our disciplined approach to investment management. We believe this systematic strategy serves our clients well through various market conditions, helping to navigate both opportunities and challenges while staying focused on long-term financial objectives.

Should you have any questions about your portfolio or our market outlook, please don’t hesitate to reach out to your advisor. We’re here to help you understand and feel confident about your investment strategy.