January 2025 Investment Update

Navigating Trade Policy Shifts and Market Dynamics

As we move into February, Strategic Advisory Partners continues to closely monitor significant developments that are reshaping the investment landscape. The start of 2025 has brought both opportunities and challenges, with markets responding to major policy shifts and ongoing economic developments. We remain committed to providing our clients with clear insights and strategic perspective during these dynamic times.

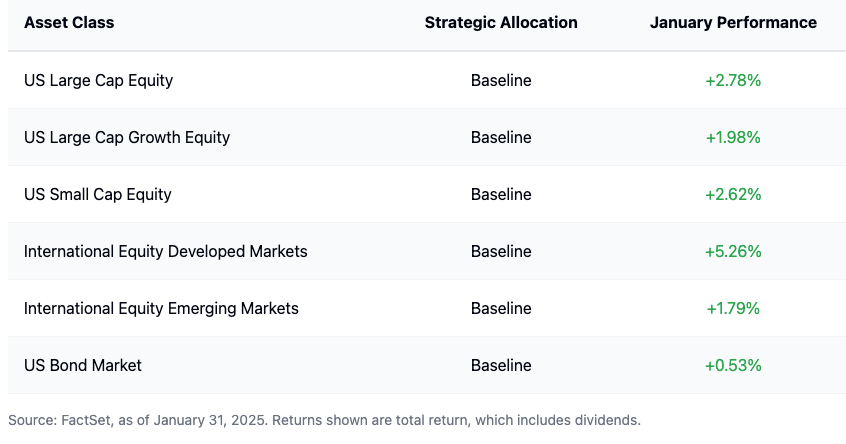

Asset Allocation Update

Our investment approach remains disciplined and strategic. We have maintained our baseline allocations across major asset classes, believing that a well-diversified portfolio continues to serve our clients’ long-term interests effectively.

While overall allocations have remained constant, it’s important to note that individual account returns may vary based on specific portfolio composition and timing of investments. Our investment approach continues to be model-driven rather than following a rigid calendar-based schedule for adjustments, allowing us to make strategic changes when market conditions warrant them.

Market Performance and Economic Landscape

January delivered a positive start to 2025, with most major indices posting gains despite increasing market complexity. The S&P 500 advanced 2.78%, while the Dow Jones Industrial Average demonstrated even stronger performance with a 4.78% increase. International markets showed particular strength, with the MSCI EAFE Index rising 5.26%, led by impressive gains in Germany (+9.35%) and Switzerland (+8.15%).

Sector performance revealed interesting patterns, with Communication Services (+9.12%), Healthcare (+6.79%), and Financials (+6.56%) leading the way. Technology was notably the only S&P 500 sector to end negative, influenced by developments in AI competition and trade policy shifts.

Here’s a fun fact:

According to the Stock Trader’s Almanac, there is a historical pattern known as the “January Barometer” which suggests “As January goes, so goes the year.” Looking at data since 1950, when January has shown positive returns, the S&P 500 has finished the year positive approximately 83% of the time, with an average annual return of around 11.5%.

Trade Policy Developments and Market Implications

Recent trade policy changes have introduced new market dynamics. The implementation of new tariffs on imports from Canada, Mexico, and China represents a significant shift in international trade relations. Based on analysis from Capital Economics, these measures could generate approximately $250 billion in annual revenue for the U.S., equivalent to roughly 0.8% of GDP. However, the broader economic implications warrant careful consideration:

Domestic Impact

U.S. manufacturers may face increased input costs, particularly in technology-related imports

Global Trade

While Chinese exports to the U.S. represent less than 3% of its GDP, the impact on Canada and Mexico is more substantial, with exports to the U.S. comprising nearly 20% of their respective GDPs

Market Volitility

Historical patterns suggest potential for increased market volatility, particularly in sectors with significant global exposure

Economic Indicators and Corporate Performance

The U.S. economy finished 2024 on solid footing, having posted GDP growth of 2.3% in the fourth quarter. Final inflation metrics for December 2024 showed the core Personal Consumption Expenditures (PCE) price index at 2.8% annually, which matched forecasts while remaining above the Federal Reserve’s target.

Corporate earnings for the fourth quarter of 2024 demonstrated resilience, with 77% of S&P 500 companies having surpassed analysts’ estimates by 6.8% in aggregate. The quarter closed with revenue growth of 4.6% and earnings per share (EPS) growth of 10%, improving upon the 8.7% EPS growth that was expected as of December 31, 2024.

Looking at more recent data, January’s PCE report increased 0.3% from the previous month and 2.6% year over year. This latest reading continues to influence the Federal Reserve’s policy considerations as we progress through 2025.

Looking Ahead

As we move further into 2025, several key factors warrant continued attention:

Trade Policy Implementation

The rollout of new tariff measures will likely influence market dynamics across multiple sectors. We’re particularly monitoring impacts on:

-

- Supply chain adjustments

- Corporate earnings expectations

- Consumer price trends

Monetary Policy

With core PCE at 2.8%, we continue to monitor Federal Reserve communications for signals about future policy direction.

Corporate Earnings

Fourth quarter results have been encouraging, with 77% of reporting companies exceeding projections. The aggregate earnings growth rate of 10% suggests continued corporate resilience.

Market Valuations

Current market valuations, particularly in U.S. equities, remain elevated compared to historical averages, suggesting the importance of maintaining disciplined diversification.

In this environment of evolving trade policies and market dynamics, we remain committed to our disciplined investment approach. While near-term volatility may persist, our focus continues to be on long-term strategic positioning aligned with our clients’ financial objectives.

As always, we encourage you to reach out to your Strategic Advisory Partners advisor with any questions about your portfolio or our market outlook. We appreciate the trust you place in us and remain dedicated to helping you navigate these dynamic market conditions.

Important Disclosures

This communication is for informational purposes only and does not constitute investment advice, a recommendation, or an offer to buy or sell any security. Strategic Advisory Partners (“SAP”) is a registered investment advisor. Registration does not imply a certain level of skill or training.

Past performance is not indicative of future results. No investment strategy, including trend following, can guarantee profits or protect against losses. Market indices mentioned are unmanaged and cannot be invested in directly. Index performance does not reflect transaction costs, fees, or expenses.

Forward-looking statements, including projections of market performance, earnings growth, Federal Reserve actions, and economic conditions, are based on various assumptions and beliefs that may not prove to be accurate. These statements should not be relied upon for making investment decisions.

Investment decisions should be based on an individual’s own goals, time horizon, and risk tolerance. Diversification and asset allocation do not ensure a profit or protect against loss.

This material has been prepared from sources believed to be reliable but is not guaranteed as to accuracy or completeness. This information may change at any time based on market or other conditions.

©2025 Strategic Advisory Partners. All rights reserved.