Finding your Spaghetti

– Chris Harris, Strategic Advisory Partners

My first job out of college was with a hedge fund as a risk analyst. When I first started the job I wanted to understand the culture and hopefully find my place to fit in.

A common practice for my colleagues was going out to lunch at a local “fast casual” restaurant for about $10-$12 each day. I was a newly graduated, newlywed, and our budget was tight. I followed the common trend for a couple of weeks before I started to really consider the cost of this tradition. I realized that I was not in a position to be saving as much as I wanted personally, and I wanted to identify ways to save more.

Pasta la Vista, Baby!

Finally, one Sunday evening I decided to make a large pot of my favorite food – spaghetti (the best recipe includes high-quality sauce, beef, spinach, olives, mushrooms, and pepperoni!). I portioned this meal into 5 containers and took it to work every day of the week.

At work, it became a joke with many of my colleagues that I was having spaghetti every day. However, I understood why I was making this decision.

First, I was not in a position early in my career to reach my longer-term financial goals if I did not make some adjustments to my short-term lifestyle. Second, I did not see more upside potential to attending these lunches at work that really became just a financial cost. Third, I had found a compromise that allowed me to eat my favorite meal every day and at a fraction of the cost of continuing to go to restaurants.

One week I actually did the math to determine how much I had spent on all of the ingredients to estimate my savings. Per day it would cost me around $3, saving me $7-$9 every single day. While this may not seem like much at first, doing this consistently saved me about $40 each week… and $160 each month.

Just Look at All the Pasta-bilities!

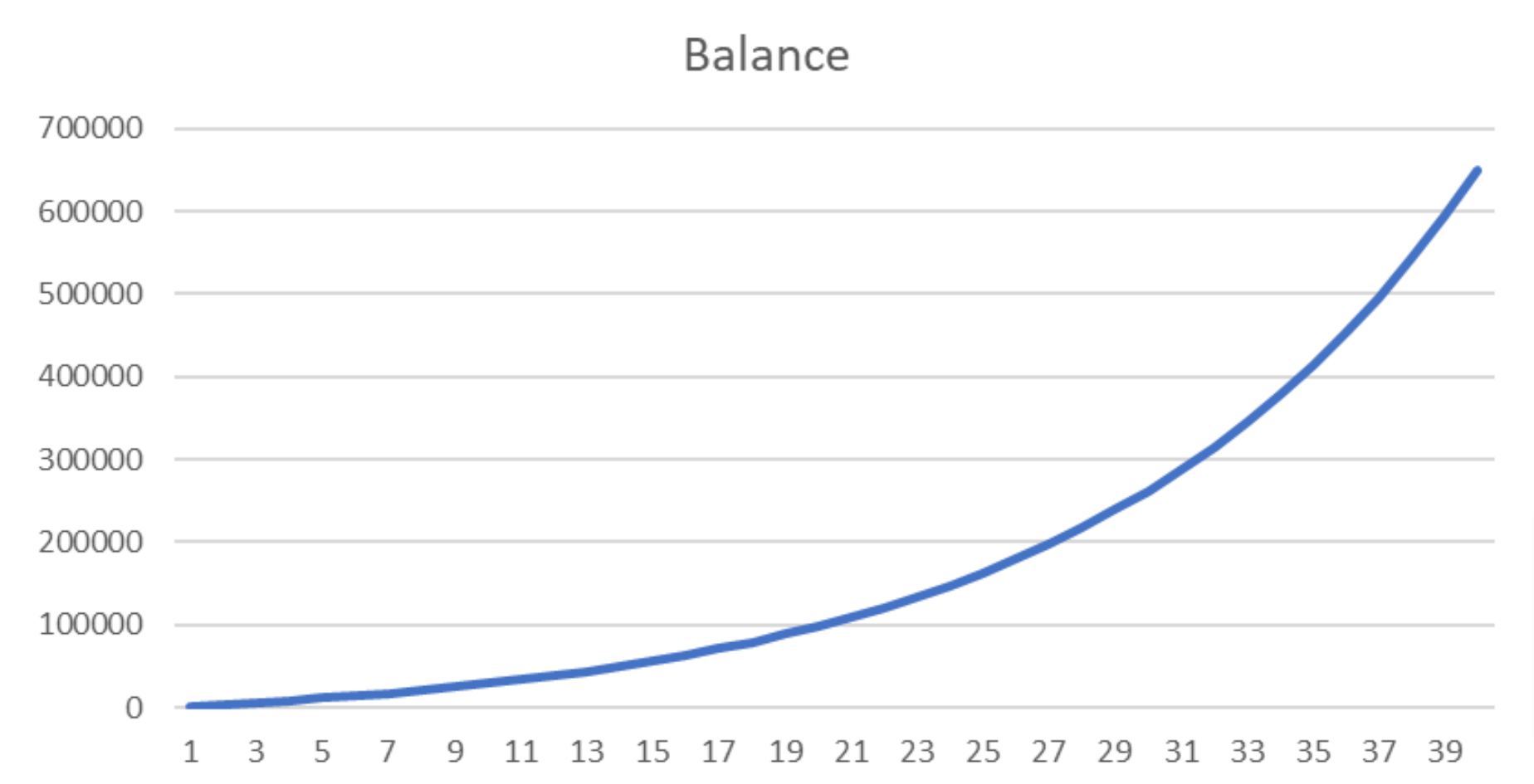

If I took that $160 each month and invested it, I could save about $1,920 every year. Below shows the effect of continuing this habit throughout a 40-year career.

This simple decision to adjust my lunch habit could result in an additional $650,000 at retirement (assuming a 9% average annual return). This is not a trivial amount of savings. Using data from the 2019 Survey of Consumer Finances, we can see that $650,000 saved for retirement puts an individual in the top 5.5% of all Americans!

So, What’s the Secret Sauce?

The challenge many individuals run into is identifying habits in their own lives that, with a small adjustment, can have a significant impact on their financial future. This really means two things:

- Determining where you can afford to make adjustments.

- Learning how to invest the money you’re saving.

At Strategic Advisory Partners we want to help people realize their financial goals. We can help individuals identify what their savings goals are, recognize where there may be opportunities to find those savings, and then put in place the steps to help that money grow over time.

As life progressed and my situation changed, I was able to have the money to save without continuing my daily spaghetti routine. However, it’s still my favorite meal!

You may never need to make these types of adjustments, or only need to make them for a short period of time… but some people choose to continue these routines long-term to stay on track with their financial goals.

Finding Your Spaghetti

The point is to find the areas in your own life that you can compromise without feeling like you are sacrificing all of your present for an uncertain future. The most common reaction to my story is often surprise or disbelief, followed by people thinking it won’t be possible for them.

I have had many people say something like “I could never eat spaghetti every day”, and I always respond the same way – “Then find your spaghetti.” Find what makes the best impact on your long-term financial goals.

Chris Harris

Financial Advisor

Helping clients define and reach their financial goals with integrity, boldness, accountability, and passion.