As I scrolled through the headlines this morning, there were a few things that were prominently discussed. At the top of everyone’s mind is the withdrawal of troops from Afghanistan and the fallout taking place on an international stage as a result. As has been the case for over a year, COVID-19 is a prevalent topic that continues to dictate so many things in our daily lives. The most recent news is a possible booster shot to help increase the efficacy of the vaccine. In fact, I may be able to write a sequel to Billy Joel’s “We Didn’t Start the Fire” with all the headlines.

The last eighteen months have seen more polarizing issues affect us as a country than at any time in recent memory. And through it all, interestingly, the stock markets have continued to reach all-time highs. The Dow Jones Industrial Average (+16.40% YTD) and the S&P 500 Index (+19.27 YTD) both set intraday highs today. Regardless of your opinion on any of the issues we are dealing with as a country, most people I have talked to have expressed concerns over the markets and their ability to continue to climb. That statement is as true today as conversations I was having a year or two ago.

The dichotomy between how people feel or expect the financial markets to react and how the markets actually react/perform is what truly creates the anxiety that a lot of us feel when investing our money. And because we have been taught that you can’t predict the performance of the stock market, it only feeds into our fears.

So, what’s the solution? There are only a few ways to approach your investing strategy. First and foremost, however, it is important to acknowledge that the fear and anxiety around investing are real and can influence your long-term success.

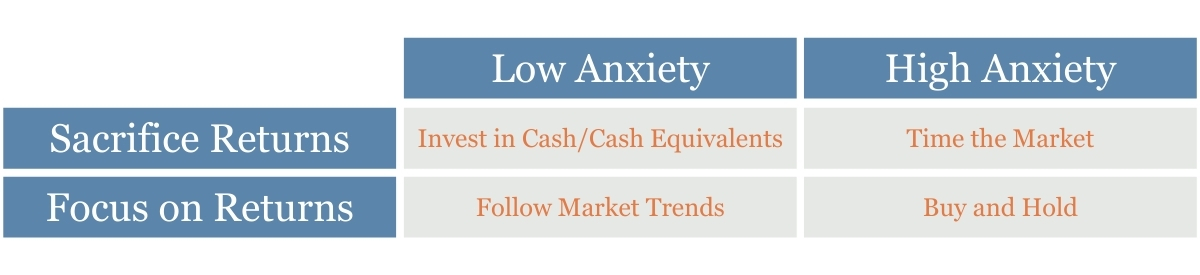

With that in mind, you have four primary choices:

#1 Keep your money in cash/cash equivalents.

Because at some point the market is going to go down and if you aren’t invested in the market, you can’t lose money. The problem with this strategy is that inflation is real (anyone gone out to eat since restaurants opened back up??) and the purchasing power—your ability to buy things you need/want— will be diminished over time if you don’t grow your money.

#2 Time the market.

Look for clues in the media, gossip with friends, or read literature from “experts” on the internet – who are so smart and successful that they must sell you the answer in an exclusive newsletter where they make more money off subscription fees than they do stock picks. Over the long run, this most likely results in doing the opposite of what you set out to do. You end up buying high and selling low, creating results that trail the market indices.

#3 Buy and hold.

Certainly, a better strategy than the first two. Given the long-time horizon investing entails, holding onto quality investments regardless of the gyrations in the markets helps to avoid the pitfalls of buying high and selling low that come with #2. With most people accessing investments through their workplace retirement plans, dollar-cost averaging (putting in the same amount of money regularly) helps investors drive their average share cost down by buying more shares when the market is down.

#4 Follow market trends.

Timing the market is a fool’s game. Even with all the information available, so-called experts have not been able to accurately predict market highs and market lows with any degree of confidence. You can, however, with a system that tracks trends, increase, and decrease exposure in asset classes, or even individual securities, that consistently outperform the market over full market cycles. If you can capture most of the upside while avoiding most of the downside, the math works in your favor.

It’s important to note that each of these strategies benefits different aspects of investing and human behavior. The real question becomes “what’s more important”? Unlike what we have been taught, it doesn’t have to be an either/or proposition. Reducing anxiety and uneasiness is most effective by providing systems and a plan that is decided on before an event that could cause anxiousness takes place. An example could be a person who has a fear of flying. When the plane begins to take off, a coping mechanism is to close your eyes and count to ten while focusing on your breathing. You can practice this and decide that is what you are going to do the next time you get on a plane. Making this decision ahead of time can reduce the anxiety you feel as you prepare to take off.

Here’s how I would categorize the four decisions we just discussed:

Just like the person who makes a plan for coping with flying, it is paramount to have a plan for investing your money. In my experience, it is just as important to address the emotional and psychological hurdles of investing as it is picking the best stock or mutual fund. Following market trends and having a plan before volatility arises helps to address both of these concerns for your long-term goals.

I can’t tell you when the market is going to have a correction. What I can tell you is having a plan you are comfortable with even in turbulent markets will allow you to feel more at ease when that time comes. Happy investing!