When election years come around, many investors brace themselves for potential market volatility. However, history shows that while markets may experience short-term fluctuations due to political uncertainty, the overall impact of elections on long-term market performance tends to be minimal.

Data suggests that U.S. equities markets have generally performed well during election years, regardless of which party wins. For instance, the Dow Jones Industrial Average has historically posted gains in the 12 months following most presidential elections. While volatility might increase due to uncertainty in the months leading up to an election, markets typically rebound once the results are clear.

1. Presidential Elections and Market Cycles

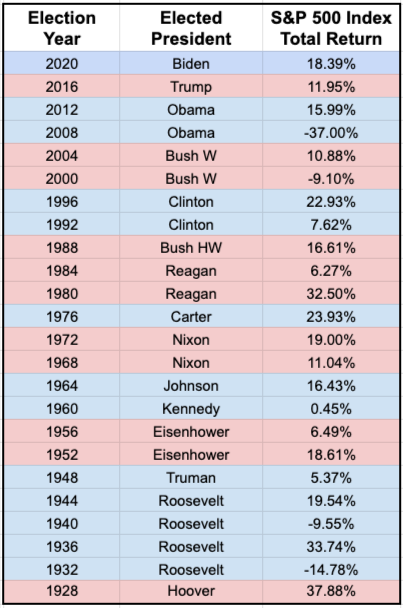

Presidential election years often see heightened volatility as investors react to potential changes in government policies. Despite this, the stock market has historically shown resilience, with many election years ending on a positive note. For example, in the past 23 presidential election years, the S&P 500 index has delivered positive returns in 19 of them, regardless of the party in power.

This suggests that while elections can cause short-term disruptions due to investor uncertainty, market fundamentals and broader economic conditions play a larger role in determining long-term performance.

2. Political Party Control and Market Outcomes

A common assumption is that the market performs better under one political party versus another. However, research shows that there’s no clear correlation between market performance and the political party of the president. While fiscal policies may differ between parties, the stock market is influenced by a wide range of factors such as interest rates, global economic conditions, and corporate earnings, which often outweigh the effect of election outcomes.

For instance, during Barack Obama’s presidency (Democratic control), the market experienced a significant recovery following the 2008 financial crisis. Likewise, under Donald Trump (Republican control), the market saw robust growth, particularly due to tax cuts and deregulation efforts. Yet, both presidencies saw positive long-term growth despite different political ideologies.

3. Unified vs. Divided Government

Another factor investors consider is whether the government is unified (where one party controls both the presidency and Congress) or divided. Historically, markets have performed well under both unified and divided governments. For example, in 2016, when Donald Trump won the presidency and Republicans held Congress, the Dow Jones rose over 12% between October 2016 and March 2017. On the other hand, during Bill Clinton’s presidency (with a Republican-controlled Congress), the stock market also saw strong gains.

This suggests that the stock market tends to adapt regardless of the balance of political power, with economic policies, interest rates, and corporate performance being the key drivers of market behavior.

4. The Role of Uncertainty

While the party in power might not have a lasting impact on the market, uncertainty surrounding elections can create temporary volatility. As investors speculate on potential policy changes—ranging from tax reform to trade policies—there can be short-term fluctuations in the market. Once the election results are clear and uncertainty subsides, markets tend to stabilize and return to normal trends.

Historically, markets have shown resilience during election years, despite the uncertainty they often bring. While short-term volatility is common, long-term market performance is driven more by fundamentals than by election outcomes. Investors are advised to stay the course, maintain a diversified portfolio, and avoid making reactionary decisions based on political developments.

By focusing on the bigger picture, investors can weather election cycles without being swayed by temporary market disruptions.