How to Take Advantage of Inflation

Blaise Stevens, Strategic Advisory Partners

It has been several decades since inflation has taken center stage in our lives like it is right now. It’s important to realize that the headwinds we are facing are MORE than just inflation and in totality, we have quite a few fronts to work through before we find an equilibrium (fuel shortages, food security, and asset valuation to name a few).

Here’s what you should focus on:

What is inflation?

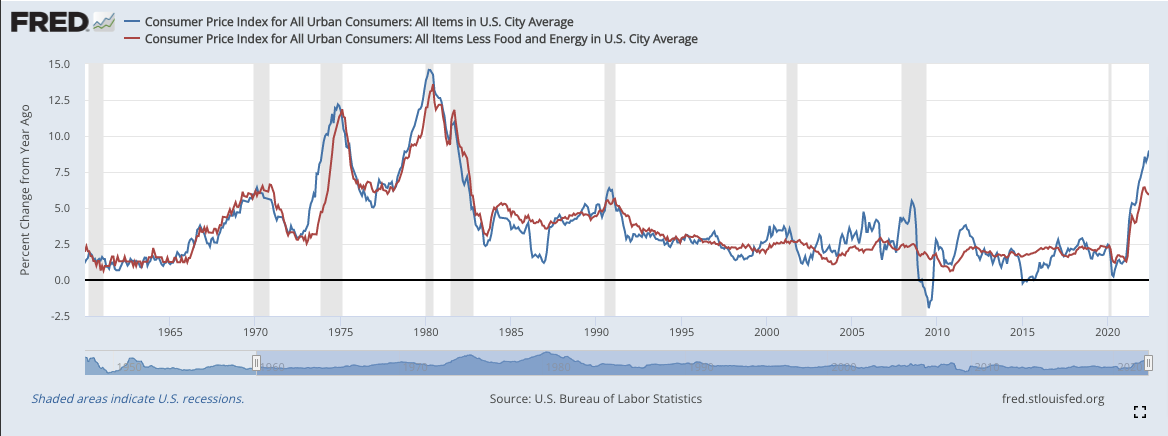

Inflation describes a situation where prices tend to rise. In a healthy economy, there is an expectation that prices in the future will be higher than they are today. The basic measurement of this is the Consumer Price Index, or CPI. CPI measures the average change over time in the prices paid for consumer goods and services.(1)

This is important because it drives a lot of decisions by businesses and individual households that lead to abundance and prosperity.

Expecting things to be more expensive in the future encourages buying today. When products are purchased, companies make a profit that can go towards things like creating new products or increasing salaries of workers. This, in turn, gives people more money to spend and more things to spend it on.

Why is inflation important?

The U.S. central banking system–known as the Federal Reserve, or Fed– is responsible for controlling inflation by setting interest rates and controlling the money supply (how much money is available). The Fed’s long-term inflation target is 2%. When inflation, as measured by CPI, moves significantly above (usually the case) or below the target, the Fed will try to bring inflation back in line using the aforementioned tools.

These “levers” that the Fed can pull, creates incentives or disincentives for spending. With the CPI reaching over 9% (levels not seen since the early 1980’s), there are a few things you and your household can do to make the most of the current situation as it pertains to inflation.

What can you do to benefit from the current inflationary environment?

Lock in any long term debt that you have (the most prevalent would be mortgages), if you haven’t already. Most folks have fixed rate mortgages and are enjoying historically low rates (some as low as 2%!). As the cost of things go up, it tends to have a positive effect on your house’s value.

Although housing reacts slower to some of the other sectors of the market, having one of the biggest household expenses locked in, will help you build wealth through the appreciation in the value of your home and the corresponding equity.

If you have any kind of variable loan, now is the time to lock it in before interest rates rise any further. The same goes for student loans, car loans or business loans.

Whenever there are unknowns in the job market or worries about job loss, it’s important to shore up your emergency funds. The good news is, as a saver, you should start to see your financial institution raising interest rates on savings and money market accounts.

Now’s also a good time to compare the savings rates you are getting with other banks to make sure you are maximizing your returns. What was once laughable in savings rates has started to improve a bit. As interest rates continue to rise (as we expect they will), you will continue to see your savings rates come up as well.

Another place to find a nice investment return right now are I-bonds. The “I” stands for inflation and they are designed to offset inflation. Each bond issued has a fixed rate portion of the coupon payment along with a variable rate that adjusts based on CPI.

Currently, I-bonds purchased through October 2022 are paying 9.62%. There are some limitations to the amount you can purchase (up to $10,000 per social security number plus an additional $5,000 through your tax refund) but it is a nice way to get a little higher return for money that won’t be needed in the immediate future. Buy them through www.treasurydirect.gov. Make sure you read all of the guidelines and limitations before purchasing.

Inflation, in moderation, is healthy for the economy.

As I mentioned at the outset, there are quite a few factors that are currently causing trouble in our economy, as well as our financial markets. The excessive government spending and stimulus has created murkiness when trying to value equities in the market. As we understand more about the true value of these companies, we should see our retirement accounts and other investments start to improve as well.

Like most things, inflation, in moderation, is a necessary component for a healthy economy. The current environment calls for a drastic response to get inflation under control and back to a manageable level.

The question will be if the current Fed chair, Jerome Powell, has the stomach to do what Paul Volcker did in the early 1980’s when inflation peaked… raise interest rates significantly. Volcker took interest rates to 20% to break the back of inflation. It may take something similar to avoid a long, drawn out recession and recovery.

(1) www.bls.gov/cpi