The “buzz word” here recently has been (and will likely continue to be) inflation. It is one of those things that gets thrown around regularly when any discussion of politics, the economy or your dad’s rant about the “Good Ole Days” comes up. For most people, they can point to what “inflation” is, but it’s more of an accepted nebulous idea than something that we really try to understand.

Simply put, inflation is the rate of increase in prices over a given period of time. Familiar examples are the cost of groceries and a gallon of gas. Thirty years ago, the cost of a dozen eggs was $1.01 and the cost of a gallon of milk was $2.80. When you pulled up to the pump, the average price per gallon was $1.14. And the average price of a home was $147,200.

Fast forward to today and we are experiencing a significant increase in house prices across the country and gas has swelled to more than $3 per gallon on average. Recently, the local butcher told me that chicken wings were selling for more per pound than a ribeye steak! And after record low interest rates for many years, we are also seeing rates start to go up (Hooray! for savings accounts and Boo! for new mortgages). The real debate is whether this surge in prices is transitory (i.e. temporary) or a signal of more permanent increases in the cost of goods and services. Are we experiencing pent up consumer demand from the country after the pandemic lockdown and bottlenecks in supply chains or are higher prices here to stay?

If you have any experience with the financial markets, these kinds of events make you nervous about inflation’s sibling… volatility. For many of us, the market crashing in 2008… and 2000… and 1987 (you really “timed” the market wrong if you have experienced all of these as an investor) makes us all too familiar with rising costs and swings in the market. We have cautiously enjoyed (hopefully) the growth in our portfolios since 2009 and are quite sure that we don’t want to experience another major pullback. Afterall, we are now much closer to, and in some cases already enjoying, retirement.

Here’s the good news and the bad news: to protect your portfolio—and ultimately your lifestyle—from inflation, investing in the markets is the most accessible way to do just that. With inflation averaging somewhere between 2.5% and 3%, the urge to shove cash under your mattress as a retirement plan needs to be tempered. Although it may feel good to know that you can’t “lose” any money with that approach, the truth is you are losing money in terms of purchasing power. A dollar today is worth 2.5-3% less each year because of rising prices. In years like this one, the erosion of your money could be even more pronounced (as of July 2021, the inflation rate sat at 5.37%).

This is also the time when the salesmen (and saleswomen!) break out their fear tactics to sell you insurance products (most commonly peddling life insurance and annuities) that make a lot more sense for their wallets than for your financial security. With a promise to protect you from losses, the sales pitch sounds great. Take a closer look at the sales material and you will find disclosures that alert you to high internal fees and caps on the upside. Just remember, insurance companies are not non-profit agencies. To be able to offer you a false sense of security, they make their money through egregious fees or the spread in investment returns between what they pay you and what they earn.

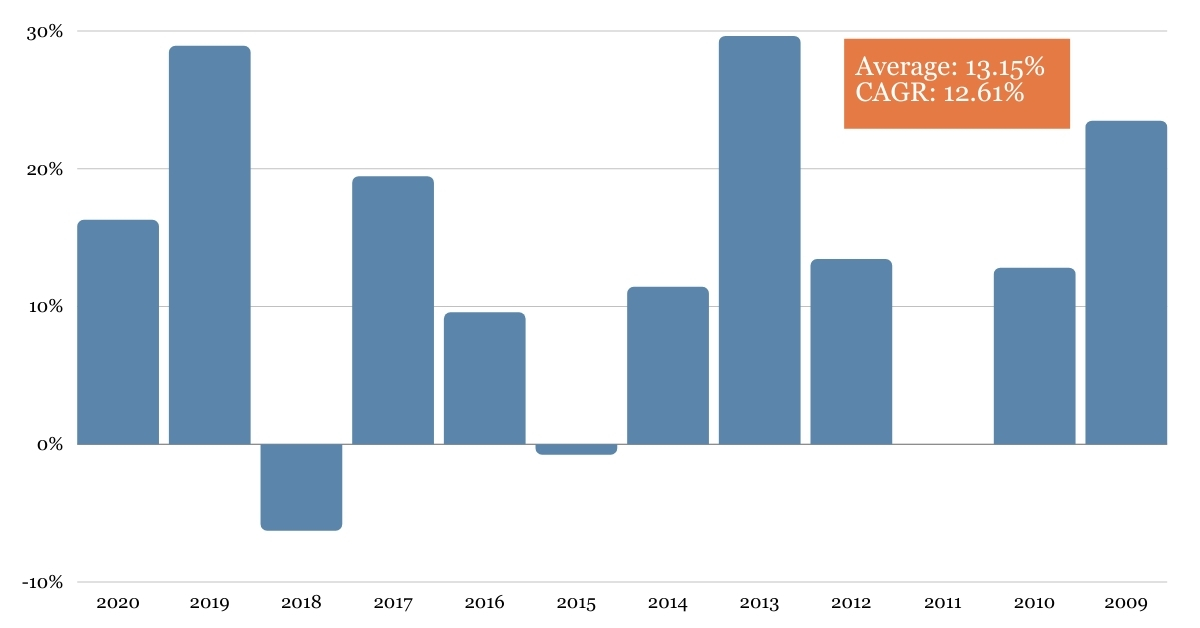

Preparing for instability in the financial markets is more than just moving to cash when you think the market has reached the top. I’m sure you can think of someone who has been sitting in a money market account for years waiting for the moment to tell everyone “I told you so” when the markets do finally correct. Unfortunately for them, they have missed out on some pretty incredible returns. As of this writing, the market is up 16.11% YTD. And since 2009, the average return of the S&P 500 has been 13.15% with a compound annual growth rate (i.e. how much money did I actually make?) of 12.61%. In other words, $100 invested in an S&P 500 index fund at the beginning of 2009 would be worth $415.84 at the end of 2020.

The long-term historical performance of the markets has been the most reliable way to combat inflation throughout our economic history. Access to financial markets has become easier than ever with employer retirement plans and regular contributions through payroll deduction (see: dollar cost averaging) making overcoming rising prices more doable than ever before. Reviewing your investment strategy to make sure you are confident in your investment plan before volatility and inflation creep in will also help you to avoid any knee jerk reactions in the heat of the moment. Reasonable inflation is an important component to a healthy economy spurring consumer spending, increased outputs of good and services and jobs creation. Making sure your dollars maintain their purchasing power is just as important for your long term financial security.