Shouldn’t We Be Enjoying This Ride?

In our recent chats, we’ve been nudging you to savor the present, even amidst the usual bouts of worry that tend to pop up. It’s easy to wonder how long the good times will last or when the next bump in the road might appear. But let’s take a moment to reflect.

We’ve noticed a pattern: whether the market’s roaring or it’s in a slump, worry tends to linger. Even with the turbulence of 2022, there’s a lesson to be learned. Despite the ups and downs, the S&P 500 posted one of its best first-quarter performances in almost a century. So, should we really be stressing?

From our perspective, this perpetual anxiety underscores the value of systematic investing. Our methodical, rules-based approach not only shields against market mood swings but also fosters a healthy dose of emotional detachment. By dialing down the fear and excitement, systematic investing keeps our eyes on the prize: long-term goals driven by strategy, not emotions.

In this edition of our note, we dive into the S&P 500’s Q1 performance, comparing it with historical data dating back to 1928. We’ll also take a peek at how the S&P 500 has fared in the latter part of the year after strong first quarters. Our aim isn’t to play fortune teller, but rather to underscore the resilience of trend following.

But first, here’s a summary of our take on what transpired in the markets in March.

(Sourcing for this section: ICE, S&P 500 TR, 10/1/1928 to 3/25/2024)

Asset-Level Overview

Equities & Real Estate

Equities are on a tear once again, with the S&P 500 hitting yet another all-time high in 2024. The U.S. markets are showing resilience, marking five consecutive months of gains. While growth stocks have been leading the charge this year, March saw a shift with value, dividend, mid-, and small-cap stocks outperforming growth. As trend followers, we’re less concerned with the market’s breadth and more focused on price trends. Based on current trends, we’re maintaining our overweight position in U.S. equities across Strategic Advisory Partners’ portfolios.

On the international front, developed markets have seen positive momentum, slightly outpacing the S&P as March drew to a close. Emerging markets, however, are still playing catch-up. Our portfolios maintain an underweight position in international stocks, with a preference for developed equities.

Meanwhile, in the realm of real estate, sentiment around interest rates continues to influence prices. While prices have remained relatively stable, trends remain favorable. Our approach to real estate holdings remains unchanged heading into April.

Fixed Income & Alternatives

Fixed income investors are keeping a close eye on economic indicators, particularly inflation and employment data, along with signals from the Federal Reserve. Despite stubbornly high inflation, the Fed seems committed to its plan for rate adjustments. This has led to mixed trends in fixed income markets, with ultra-short-term Treasuries showing strength in both price and yield. As a result, our portfolios maintain an overweight position in ultra-short-duration instruments and steer clear of longer-duration assets. Any exposure to intermediate-term bonds remains minimal.

In the realm of alternatives, gold was a standout performer in March, with positive trends persisting. Our portfolio allocations to gold remain unchanged, aligned with our baseline strategy.

Sourcing for this section:

Barchart.com, S&P 500 Index ($SPX), 10/1/1928 to 3/25/2024; Barchart.com, Growth ETF Vanguard (VUG), 3/1/2024 to 3/25/2024; Barchart.com, Value ETF Vanguard (VTV), 3/1/2024 to 3/25/2024; Barchart.com, High Dividend Yield Vanguard ETF (VYM), 3/1/2024 to 3/25/2024; Barchart.com, Midcap ETF Vanguard (VO), 3/1/2024 to 3/25/2024; Barchart.com, Smallcap ETF Vanguard (VB), 3/1/2024 to 3/25/2024; Barchart.com, FTSE All-World Ex-US ETF Vanguard (VEU), 3/1/2024 to 3/25/2024; Barchart.com, 1-3 Month T-Bill Barclays Capital SPDR (BIL), 3/1/2024 to 3/25/2024; Barchart.com, 1-3 Year Treasury Bond Ishares ETF (SHY), 3/1/2024 to 3/25/2024; Barchart.com, 3-7 Year Treas Bond Ishares ETF (IEI), 3/1/2024 to 3/25/2024; Barchart.com, 20+ Year Treas Bond Ishares ETF (TLT), 3/1/2024 to 3/25/2024; and Barchart.com, Gold Trust Ishares (IAU), 3/1/2024 to 3/25/2024

3 Potential Catalysts for Trend Changes

1

Rate Cut or Hold’em?

As anticipated, the Federal Reserve maintained its stance on interest rates at its recent policy meeting. However, officials still foresee three rate cuts in 2024, despite firmer-than-expected inflation in the early months of the year. The central bank’s outlook for longer-term rates has been influenced by a stronger-than-expected growth environment, leading to adjustments in rate cut forecasts for 2025 and 2026. The expected “neutral” rate to sustain full-strength economic activity with steady inflation has been revised slightly upward to 2.6%.

2

Negative Rates:

The era of negative interest rates, spanning nearly 12 years globally, has come to a close. The Bank of Japan, the final participant in this experiment, has returned its key policy rate to at least zero. This experiment revealed that negative rates alone were insufficient to pull economies out of recession or raise inflation to central banks’ targets. Despite initial concerns, the banking systems remained resilient, even amid adverse effects such as currency depreciation and import price hikes.

3

Mortgage Maze:

Alterations in the mortgage-backed securities market could impact the trajectory of 30-year mortgage rates, potentially delaying declines even if the Federal Reserve implements rate cuts later in the year. Economists at Fannie Mae have adjusted their forecast for average 30-year fixed mortgage rates, expecting an average of 6.4% in Q4’24, up from their previous estimate of 5.9%. They also project an average rate of 6.2% in 2025

Sourcing for this section:

The Wall Street Journal, “Fed Officials Still See Three Interest-Rate Cuts This Year, Buoying Stocks,” 3/20/2024; The Wall Street Journal, “Stock Market Today, March 20, 2024: Indexes Close at Record Highs After Fed Holds Rates Steady,” 3/20/2024; The Wall Street Journal, “Global Era of Negative Interest Rates Ends as Japan Goes to Zero,” 3/19/2024; and The Wall Street Journal, “The New Normal for Mortgage Rates Will Be Higher Than Many Hope,” 3/22/2024

The S&P 500 Is Having a Top 15 Performance in Q1

“The present is the past rolled up for action, and the past is the present unrolled for understanding.” –Will Durant

We often say that data is our love language at Strategic Advisory Partners. Any time the market displays behavior we think might be interesting, we love to explore it. Sometimes that exploration results in something that truly is interesting, and sometimes it turns out to be nothing. Either way, the process of examining the data is endlessly fascinating for us.

Last year (2023) was a classic example of this. As the first half of the year closed on a tear, we wanted to see how it compared to other strong-performing first halfs, as well as how the year typically concluded under such circumstances. We found 2023 was indeed among the best starts in the S&P 500 Index. Moreover, following a top-10 performance during the first half of the year, the index always ended the year higher than its mid-year close, never lower. This study set the stage for an interesting real-time experiment throughout the remainder of 2023. The index declined and appeared on pace to finish lower until rallying in the last 60 days to end higher once again.

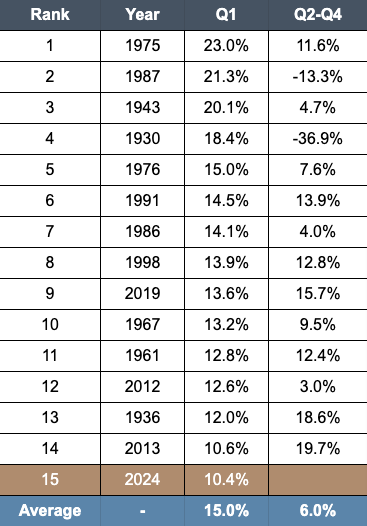

Fast forward to 2024. Another similarly strong start has our attention. Given the fast start for the year in equity markets, we were curious where this year’s first quarter ranks historically and what subsequent return it is associated with. To examine this, we went back in our data archives and pulled out S&P 500 Total Return data going back to 1928. This near-100-year sample gives us 96 first-quarter observations to analyze.

We found that out of 96 first quarters since 1928, 2024 is the 15th best, with a return of just over 10%. To get in the top 10, the index would have needed an additional 3% return. Breaking into the top 5 would have required an additional 5%. In case you’re wondering, the best first quarter since 1928 occurred in 1975 with the benchmark index returning a scorching 23%. The average return of this group is just over 15% and the overall average for Q1 is 2.5%.

Best Q1 Performance for the S&P 500

Source: ICE, S&P 500 TR, 10/1/1928 to 3/27/2024

So what happens from here? Well, if you are expecting an answer other than “we don’t know,” you must be new here.

It probably sounds like a broken record now, but as trend followers we believe the best predictor of what a market will do is what it is doing. So with trends up and our portfolios situated as described above, our expectation is for that to continue.

With that said, it can be useful to look at what has happened before, if for no other reason than to remind ourselves that anything can happen and we should prepare accordingly. For instance, the data shows that out of the top 14 (ignoring 2024) Q1s, only two finished the year lower, but boy were they biggies (1930 and 1987). With those two outliers included, the average April to December return among this top-14 group is 5.9%.

Except for 1930 and 1987, the market has generally shown consistent persistence after a strong first quarter. We suspect many would argue that enhanced market and regulatory controls instituted during the last several decades make the risk of another ’87-style crash very low. That’s probably correct, but we wouldn’t do anything different regardless.

The general conclusion is that good starts usually correlate with good finishes. The beauty of a systematic investing process is that it doesn’t matter ultimately. With prices trending higher and volatility remaining low, we think investors should enjoy these periods and stop worrying about what happens next. For clients who partner with Strategic Advisory Partners, we believe this is particularly true since our strategies stand ready to trigger action if prices dictate it.

Sourcing for this section:

GFD, SPDR S&P 500 ETF Trust (SPY), 2/1/1993 to 7/26/2023; and ICE, S&P 500 TR, 10/1/1928 to 3/25/2024

Important Disclosures

Strategic Advisory Partners is an investment advisor registered pursuant to the laws of the state of North Carolina. Our firm only conducts business in states where licensed, registered, or where an applicable exemption or exclusion is afforded. This material should not be considered a solicitation to buy or an offer to sell securities or financial services. The investment advisory services of Strategic Advisory Partners are not available in those states where our firm is not authorized or permitted by law to solicit or sell advisory services and products. Registration as an investment adviser does not imply any level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. For more information, please visit adviserinfo.sec.gov and search for our firm name.

Past performance is not indicative of future results. The material above has been provided for informational purposes only and is not intended as legal or investment advice or a recommendation of any particular security or strategy. The investment strategy and themes discussed herein may be unsuitable for investors depending on their specific investment objectives and financial situation.

Information obtained from third-party sources is believed to be reliable though its accuracy is not guaranteed.

Opinions expressed in this commentary reflect subjective judgments of the author based on conditions at the time of writing and are subject to change without notice. The above commentary is for informational purposes only. Not intended as legal or investment advice or a recommendation of any particular security or strategy.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission from Strategic Advisory Partners.

An index is an unmanaged portfolio of specific securities, the performance of which is often used as a benchmark in judging the relative performance of certain asset classes. Investors cannot invest directly in an index. An index does not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown.

S&P 500 Index: A widely used U.S. equity benchmark. It contains 500 U.S. stocks chosen for market size, liquidity, and industry group representation.

Get In Touch

3817 Lawndale Dr. Suite D1

Greensboro, NC 27410

(336) 790-2560

info@StrategicAdvisoryPartners.com