Building on a Record-Setting Year

As we begin 2025 following a remarkable year in markets, we’re pleased to share our latest investment insights and portfolio updates. At Strategic Advisory Partners, we understand that informed investors make better decisions. This month’s update highlights both the impressive achievements of 2024 and our strategic outlook for navigating opportunities ahead.

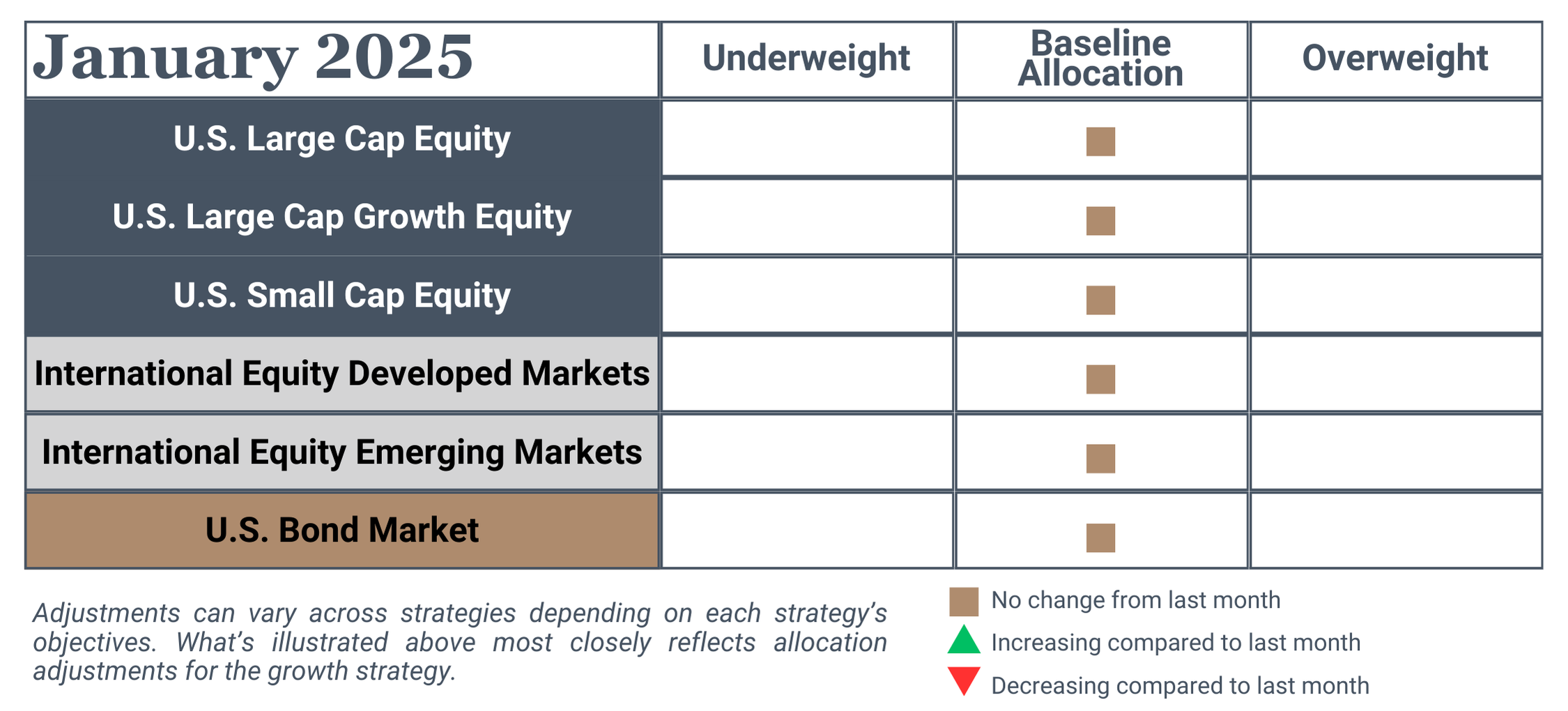

Asset Allocation Update

Our unchanged portfolio allocations demonstrate our commitment to disciplined investing. While markets frequently tempt investors to make reactive changes, our trend-following strategy focuses on meaningful shifts rather than calendar-driven adjustments. This approach helped protect and grow client wealth through 2024’s various market phases.

2024 Market Review: Understanding the Gains

In a year marked by record highs and notable shifts in monetary policy, investors witnessed remarkable resilience across financial markets. Despite early concerns about recession and persistent inflation, markets demonstrated extraordinary strength, particularly in the final quarter following significant political changes and signs of easing inflation.

Last year’s impressive market performance directly impacted our clients’ portfolios:

The S&P 500’s 24% gain and 57 record highs reflect the strength of high-quality U.S. companies in your portfolios

The Nasdaq’s 30% surge highlights the continued importance of technology innovation and growth

The broadening rally beyond the Magnificent Seven companies validates our diversified approach

Most importantly, these gains occurred despite significant headwinds including election uncertainty, inflation concerns, and geopolitical tensions – demonstrating the resilience of well-structured portfolios.

Looking Ahead: Why 2025’s Outlook Matters

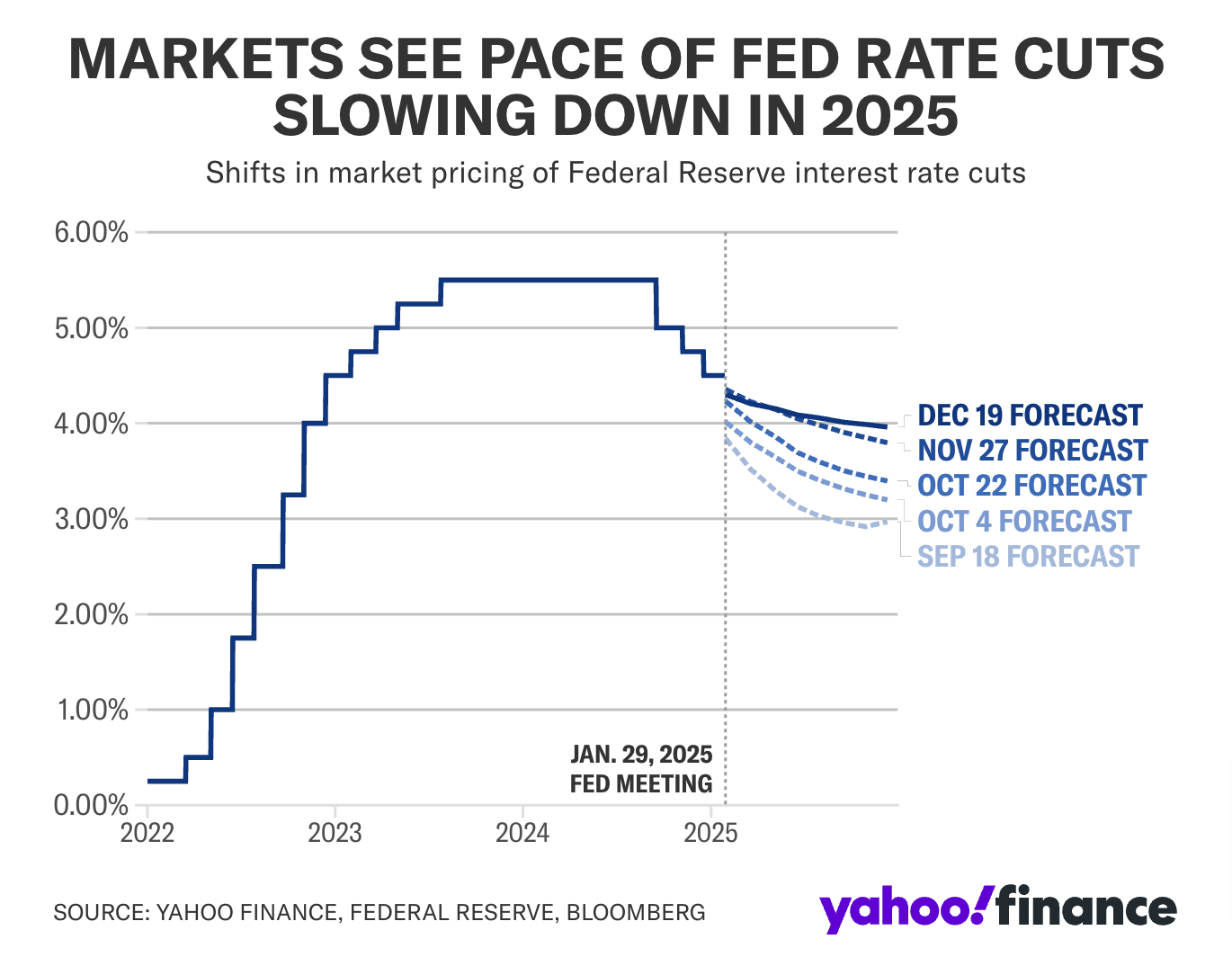

As we navigate the early days of 2025, several compelling dynamics are shaping the investment landscape. With the Fed’s pivot to rate cuts, strong corporate earnings projections, and a resilient economy, markets appear well-positioned. However, monitoring inflation trends and policy implementation from the new administration remains crucial for strategic positioning.

Several key factors will influence your investment success this year:

Projected 15% earnings growth suggests companies are adapting well to higher rates and inflation

The Fed’s planned rate cuts could benefit both stocks and bonds in balanced portfolios

Wall Street’s optimistic targets (median S&P 500 target of 6,600) align with our positive long-term outlook

Our trend-following strategy remains positioned to capitalize on these opportunities while maintaining risk management as a top priority. By staying disciplined rather than chasing short-term movements, we aim to deliver consistent long-term results that support your financial goals.

Important Disclosures

This communication is for informational purposes only and does not constitute investment advice, a recommendation, or an offer to buy or sell any security. Strategic Advisory Partners (“SAP”) is a registered investment advisor. Registration does not imply a certain level of skill or training.

Past performance is not indicative of future results. No investment strategy, including trend following, can guarantee profits or protect against losses. Market indices mentioned are unmanaged and cannot be invested in directly. Index performance does not reflect transaction costs, fees, or expenses.

Forward-looking statements, including projections of market performance, earnings growth, Federal Reserve actions, and economic conditions, are based on various assumptions and beliefs that may not prove to be accurate. These statements should not be relied upon for making investment decisions.

Investment decisions should be based on an individual’s own goals, time horizon, and risk tolerance. Diversification and asset allocation do not ensure a profit or protect against loss.

This material has been prepared from sources believed to be reliable but is not guaranteed as to accuracy or completeness. This information may change at any time based on market or other conditions.

©2025 Strategic Advisory Partners. All rights reserved.