July 2024 Asset Allocation Update

What Does This All Mean?

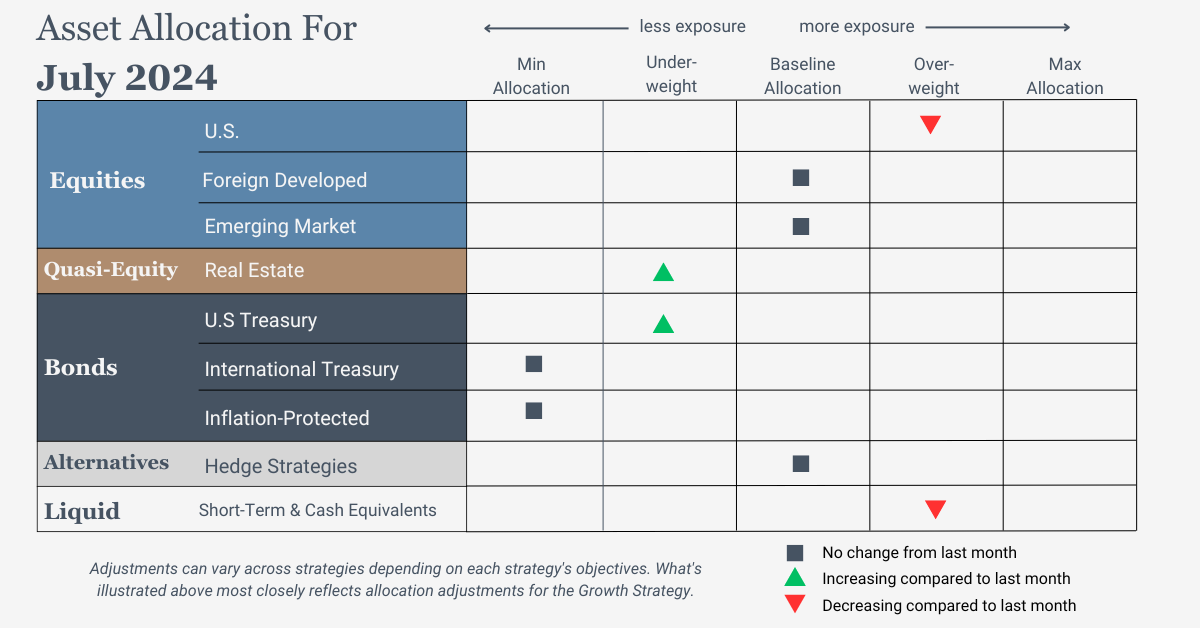

U.S. Equities

We will slightly reduce exposure while maintaining an overweight position. Positive trends across all timeframes support its status as the strongest equity asset class. The minor adjustment in allocation aims to reintroduce exposure to real estate, which has shown notable strength.

International Equities

Exposure will not change and will stay at the baseline allocation. Trends are positive across all timeframes.

Real Estate

Exposure will increase marginally but continue to be underweight as the intermediate-term trend shifts to positive.

U.S. & International Treasuries

Exposure will increase slightly but remain underweight as trends improve.

Inflation-Protected Bonds

Exposure will not change and will remain at its minimum.

Alternatives

Our exposure will be maintained using a multi-asset alternative ETF. Presently, the allocation favors long positions in equities, short positions in fixed income, and a modest short position in commodities. In currency markets, we are positioned with a net short stance on the U.S. Dollar, while holding long positions in both the British Pound and Swiss Franc against other major global currencies.

Short-Term Fixed Income

Exposure will decrease slightly as some of the allocation is returned to modestly strengthening U.S. Treasuries.

Get In Touch

3817 Lawndale Dr. Suite D1

Greensboro, NC 27410

(336) 790-2560

info@StrategicAdvisoryPartners.com