“Never mistake a clear view for a short distance.” –Paul Saffo

A significant advantage of trend following is its ability to help investors manage emotions and behaviors by providing a clear, adaptable plan for any market scenario.

This systematic investing strategy aims to generate alpha through investment returns, but also to maintain discipline and consistency in the face of market fluctuations. In our view, trend following excels at managing market outliers — those rare, unpredictable events that can significantly impact performance. For example, NVIDA’s market cap has reached $2.6 trillion, $890 billion higher than all the companies in the S&P 500 Energy sector combined. Such unprecedented events underscore the need for a robust plan for navigating these exceptional occurrences.

Last month we discussed the tendency of markets to experience downturns and how trend following often takes a wait-and-see approach during small declines. April’s U.S. equity market declines were erased in May, as the market bounced back and set new all-time highs. This illustrates that trend following is less about predicting outcomes and more about maintaining a disciplined process. This investing approach enables decisive action without second-guessing, which we think is a significant advantage.

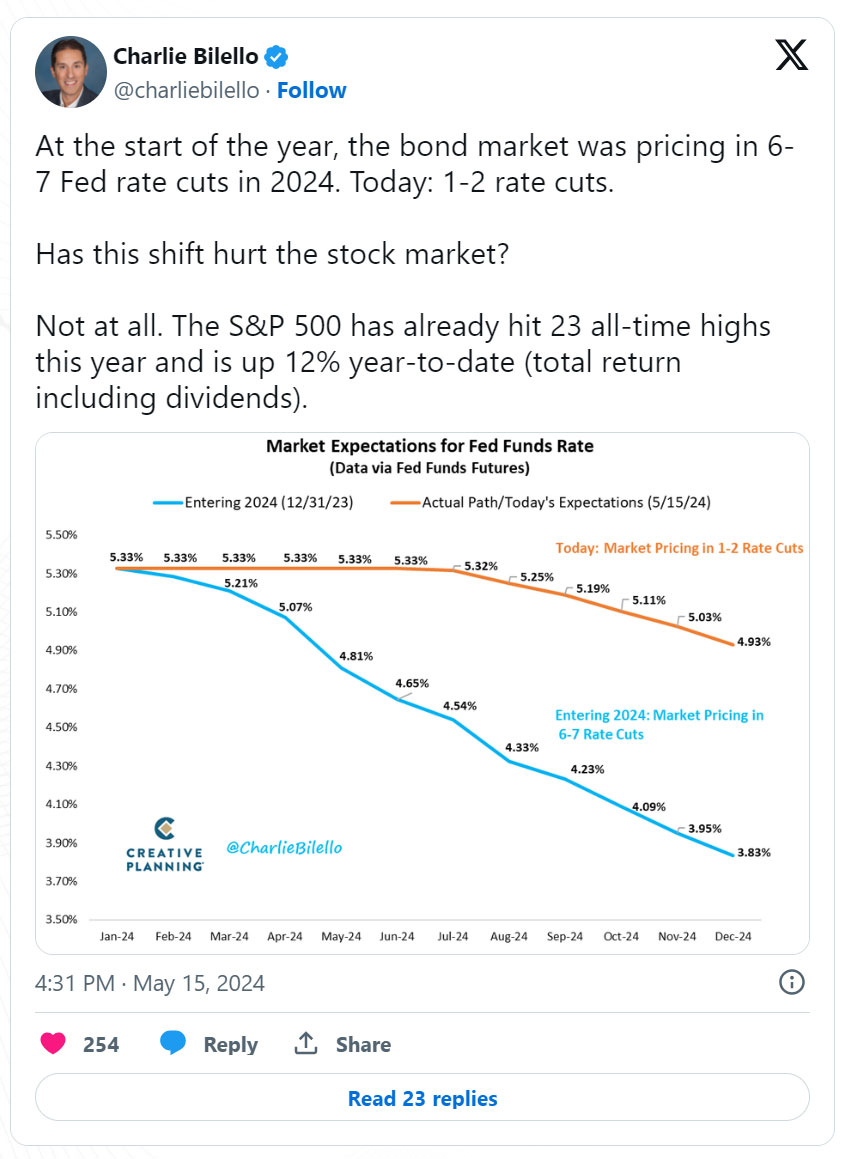

In this month’s Note, we discuss our continued wait-and-see approach in fixed income, which has been significantly affected by what’s been happening — or not happening — with interest rates. Despite predictions of cuts in 2024, higher rates have persisted.

But first, here’s a summary of our take on what transpired in the markets in May.

Asset-Level Overview

Equities & Real Estate

The S&P 500 Index rebounded in May after a dip in April, hitting new all-time highs. Growth and tech sectors led the charge, positioning the index for another year of double-digit returns by mid-year. Consequently, we’ll continue to overweight U.S. equities in our portfolios.

Internationally, despite long-term underperformance relative to U.S. equities, foreign markets, including emerging markets, held steady in the short term. We’ll maintain baseline allocations here as we enter June.

Real estate securities struggled at the month’s end, maintaining their downtrend. We’ll keep allocations to this sector at or near minimum levels, focusing instead on the stronger U.S. equities.

Fixed Income & Alternatives

Despite some economic indicators suggesting potential rate cuts in 2024, longer-term fixed income remains in a downtrend across all timeframes, and we’ll keep our allocations at a minimum. We’ll continue to favor short-duration instruments in our fixed income strategies.

In our alternatives bucket, we’ve increased our net long equity exposure while reducing our net long fixed income positions. This shift from a net short position seven months ago highlights the adaptability of our multi-asset trend-following approach. Our commodity investments remain diversified, with significant positions in metals like gold and aluminum, and we’re strategically hedging currency exposure, balancing shorts in currencies like the Swedish Krona and Brazilian Real with longs in the Korean Won and Chinese Renminbi.

Sourcing for this section: Barchart.com, S&P 500 Index ($SPX), 11/1/2023 to 5/28/2024; Morningstar.com, “Wall Street revamps 2024 S&P 500 targets after record-setting stock-market rally,” 5/25/2024; and Barchart.com, S&P 500 Index ($SPX), 1/1/2023 to 5/28/2024

3 Potential Catalysts for Trend Changes

1

Chinese Economics:

The recent announcement by President Joe Biden of new tariffs on approximately $18 billion worth of Chinese goods may seem minor economically but is symbolically significant, signaling a further decoupling of the Chinese and U.S. economies. This move, building on tariffs from the Trump era, suggests a deepening rift as Western nations attempt to loosen China’s grip on crucial raw materials needed for defense and green technologies. Despite these efforts, Chinese dominance in markets for metals like lithium, cobalt, and nickel is growing, with expanded operations and lower prices that outcompete American and European firms.

2

Kids are Expensive in America:

Recent surveys show a dip in financial confidence among American parents with children under 18. In 2023, only 64% felt they were doing financially alright, a decrease from 69% the previous year. This sentiment is notably more pessimistic compared to the general American population, where about three-quarters report feeling financially stable. A striking aspect of the survey highlighted that some families are spending nearly as much on childcare as they do on housing, stressing the financial burden of raising children in today’s economy.

3

World Needs More Children:

Globally, fertility rates are approaching a critical low, potentially dipping below the level necessary to sustain or grow the population. This universal decline spans various regions and demographic groups, irrespective of income, education, or employment. The implications are profound, affecting lifestyle, economic growth, and geopolitical dynamics. Post-pandemic, developed countries are experiencing acute labor shortages, a trend that could intensify as fewer young individuals enter the workforce, increasing the strain on healthcare and pension systems.

Sourcing for this section: The Wall Street Journal, “The U.S. Finally Has a Strategy to Compete With China. Will It Work?” 5/20/2024; The Wall Street Journal, “China Is Winning the Minerals War,” 5/21/2024; The Wall Street Journal, “Parents Are Feeling the Pain of Inflation and Child-Care Costs,” 5/21/2024; and The Wall Street Journal, “Suddenly There Aren’t Enough Babies. The Whole World Is Alarmed.” 5/13/2024

Rate Cuts: Patience is a Virtue

“If you fail to plan, you are planning to fail.” – Benjamin Franklin

At Strategic Advisory Partners, we often marvel at the power of trend following and sometimes find ourselves puzzled as to why it isn’t the go-to strategy for more investors. Our enthusiasm for this method is palpable, and we welcome every opportunity to discuss its merits—especially when it sparks those enlightening “AHA!” moments.

We understand that skepticism leads to questions, and we relish these conversations as they allow us to share insights into our approach. For instance, our strategy during the second quarter serves as a perfect illustration of trend following in action.

Reflecting on last month’s commentary, we discussed how market downturns, like the one we saw in April, test our resolve. Yet, the disciplined framework of trend following enabled us to maintain our course confidently amidst market highs and lows. True to form, the markets bounced back in May, hitting new highs and validating our steadfast approach.

Our strategy isn’t about making spur-of-the-moment decisions; it’s about unwavering commitment to a proven process. In May, our strategy required us to hold steady—effectively, to do nothing—which is sometimes the most challenging action to take.

We believe in simplifying investment strategies because we understand that our clients have complex lives with plenty to manage without worrying about intricate investment details.

The past months have showcased the benefits of trend following, not just in equities but across all asset classes. Particularly in fixed income, where the trajectory of interest rates significantly impacts returns, our approach has been invaluable. Despite widespread anticipation of rate cuts at the start of 2024, the reality has been quite the opposite. Yet, this has not swayed our strategy. We continue to focus on ultra-short duration instruments, which have consistently offered strength and higher yields amidst rate uncertainties.

The alpha we aim for isn’t just about the numbers. It’s also about helping our clients manage their emotions and behaviors—an often overlooked but critical aspect of financial health. We believe the best way to achieve this is by having a clear, concise plan that works in any market condition. This clarity is, perhaps, the most profound advantage of trend following.

We’re passionate about trend following because we see its benefits daily, not just in the data but in the peace of mind it offers our clients. Please feel free to reach out with any questions, no matter how big or small. We’re here to help you navigate these waters, armed with a plan that stands the test of time.

Sourcing for this section: Nasdaq.com, “The S&P 500 Nets First Best Quarter In Five Years,” 3/31/2024 and Morningstar.com, “Wall Street revamps 2024 S&P 500 targets after record-setting stock-market rally,” 5/25/2024

Important Disclosures

Strategic Advisory Partners is an investment advisor registered pursuant to the laws of the state of North Carolina. Our firm only conducts business in states where licensed, registered, or where an applicable exemption or exclusion is afforded. This material should not be considered a solicitation to buy or an offer to sell securities or financial services. The investment advisory services of Strategic Advisory Partners are not available in those states where our firm is not authorized or permitted by law to solicit or sell advisory services and products. Registration as an investment adviser does not imply any level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. For more information, please visit adviserinfo.sec.gov and search for our firm name.

Past performance is not indicative of future results. The material above has been provided for informational purposes only and is not intended as legal or investment advice or a recommendation of any particular security or strategy. The investment strategy and themes discussed herein may be unsuitable for investors depending on their specific investment objectives and financial situation.

Information obtained from third-party sources is believed to be reliable though its accuracy is not guaranteed.

Opinions expressed in this commentary reflect subjective judgments of the author based on conditions at the time of writing and are subject to change without notice. The above commentary is for informational purposes only. Not intended as legal or investment advice or a recommendation of any particular security or strategy.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission from Strategic Advisory Partners.

An index is an unmanaged portfolio of specific securities, the performance of which is often used as a benchmark in judging the relative performance of certain asset classes. Investors cannot invest directly in an index. An index does not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown.

S&P 500 Index: A widely used U.S. equity benchmark. It contains 500 U.S. stocks chosen for market size, liquidity, and industry group representation.

Get In Touch

3817 Lawndale Dr. Suite D1

Greensboro, NC 27410

(336) 790-2560

info@StrategicAdvisoryPartners.com