“Everything should be as simple as it can be, but not simpler” –Albert Einstein

We believe in keeping things simple and easy to understand. Recent changes in certain parts of the stock market have sparked discussions about whether there might be a ‘tech bubble.’ The real concern of a ‘tech bubble’ is not that investors will continue to capture gains as the bubble expands, but that they won’t know when, or how, to reduce exposure when the bubble deflates.

In this case, we are concerned about a handful of stocks that are leading this current market upward, but it applies to all asset classes in the same way. This reminds us of the importance of making the right decisions in investing. There are two types of mistakes investors can make: taking action when they shouldn’t (Type 1 error) and not taking action when they should (Type 2 error). Our approach, called trend following, aims to cut losses and maximize gains. We’d rather accept a small loss than miss out on a good opportunity. This month, we’ll talk about missed opportunities in investing and why having a systematic investment strategy, like ours, is important for reaching your financial goals.

But first, here’s a summary of our take on what transpired in the markets in February.

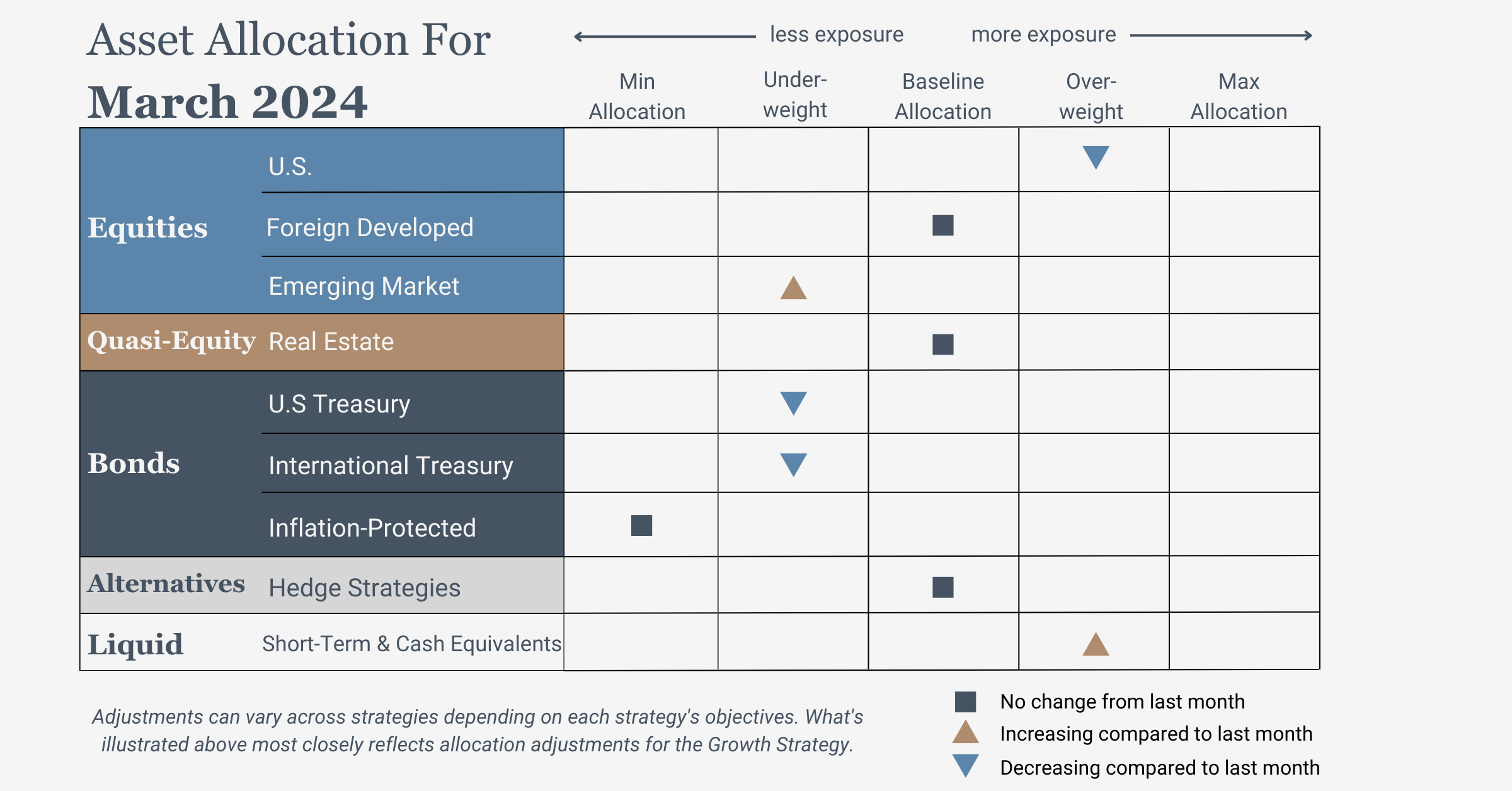

U.S. Equities

Exposure will decrease and remain overweight. Trends over all timeframes are positive, and a small portion of exposure will be returned to emerging markets. Within U.S. equities, exposure will remain skewed toward growth and large caps. Value, mid, and small caps have retained uptrends over all timeframes but remain relatively weaker.

Intl Equities

Exposure will increase and remain underweight overall. Foreign developed will not change from last month, but emerging market equities have regained uptrends across both timeframes.

Real Estate

Exposure will not change and will be at its baseline allocation, with uptrends across both timeframes.

U.S. & Intl Treasuries

Exposure will decrease and move to underweight as the intermediate-term trend has turned negative. The long-term trends remain positive.

Inflation-Protected Bonds

Exposure will not change due to the relative weakness of the asset class versus nominal Treasuries.

Alternatives

Exposure will not change. The baseline allocation for gold is also our highest limit, so we are already at the maximum allocation as trends in gold remain positive across both timeframes.

Short-Term Fixed Income

Exposure will increase and move to overweight as it takes on exposure vacated by longer-duration fixed income instruments.

Asset Level Overview

Equities & Real Estate

In February, the S&P 500 Index continued its strong performance, driven by leading technology and communications companies, pushing equity asset classes into positive territory. The index hit a new all-time high and crossed the 5,000 mark for the first time since the beginning of 2022. However, some segments like value and dividend stocks lagged behind.

Strategic Advisory Partners portfolios will slightly reduce exposure to U.S. equities in March, favoring previously weaker international equities. Foreign equities, although positive, underperformed U.S. large-cap stocks. Emerging market equities, especially in China, faced challenges, leading to reduced allocations in portfolios. Real estate stabilized in February after a decline in January, remaining in negative territory for the year despite flat returns. However, the overall upward trend in the real estate asset class persists.

Fixed Income & Alternatives

Last month, while many equity segments reached or approached new all-time highs, fixed income investments saw a decline as expectations for interest rate cuts shifted. Short-term bonds remained robust, but longer-term bonds weakened.

Our portfolios will adapt by favoring higher-yielding, short-term bonds over longer ones. Although gold prices are predicted to decrease in February, positive trends persist. Consequently, our portfolios will maintain their current exposure to gold without any changes.

Sourcing for this section:

ICE, S&P 500, 1/1/2021 to 1/29/2024; Barchart.com, S&P 500 Index ($SPX), 2/1/2024 to 2/28/2024; Barchart.com, Real Estate Vanguard ETF (VNQ), 1/1/2024 to 2/28/2024; Barchart.com, Nasdaq QQQ Invesco ETF (QQQ), 1/1/2004 to 2/28/2024; Barchart.com, Dow Jones Composite Average ($DOWC), 1/1/2004 to 2/28/2024; and Barchart.com, S&P 100 Ishares ETF (OEF), 1/1/2004 to 2/28/2024

3 Potential Catalysts for Trend Changes

Economic Pause:

The U.S. economic growth paused in January after brisk growth at the end of 2023. Retail sales declined by 0.8% from December, surpassing initial expectations for the downturn. Federal Reserve data revealed a 0.1% drop in January industrial production, contrary to positive forecasts. While technical factors may have exaggerated the weakness, a pullback by consumers could spell a weaker outlook for growth this year, especially since consumers account for about two-thirds of economic activity.

Food Inflation:

Americans are facing the highest food prices since the era of George H.W. Bush and the release of the Super Nintendo. Despite a general easing of inflation in recent years, food expenses continue to climb. Restaurant prices surged by 5.1% compared to January 2023, while grocery costs increased by 1.2% during the same period.

Future Cuts:

Interest-rate futures indicate a greater than 50% chance that the Federal Reserve will commence rate cuts at the June meeting. Investors anticipate multiple rate cuts by December, with at least a quarter-percentage point reduction per cut. Vanguard’s Global Chief Economist, Joe Davis, said recent data suggests current interest rates aren’t providing as much of a drag on the economy as Fed officials have thought.

Maximizing Gains with Trend Following

Trend following is often seen as a way to protect against market downturns, but its potential to capture market highs is equally vital. Our focus this month shifts to exploring this aspect of trend following and its role in investment success.

Unlocking Market Opportunities

Many investors are familiar with using trend following to safeguard against market risks. However, its ability to seize upward trends often goes unnoticed. We’ve found that our clients understand the importance of exiting weak markets to manage risks but may overlook trend following’s capacity to capitalize on market highs consistently.

For instance, let’s consider NVIDIA (ticker: NVDA). We’ve heard countless stories of investors who sold the stock after making good returns, only to miss out on further gains. By employing a basic trend-following strategy, investors could have:

- Avoided NVDA during its decline in 2022

- Bought NVDA early in 2023 when it showed positive momentum

- Held onto NVDA until the trend reversed

Trend followers don’t exit the market based on predictions or gut feelings. Instead, they rely on objective criteria, exiting only when the trend shifts, allowing them to maximize gains.

Exploring Missed Opportunities

Human nature tends to focus on the mistakes we’ve made rather than the opportunities we’ve missed. This oversight, known as opportunity cost, can lead to biased decision-making and missed investment prospects. For instance, investors often let past losses prevent them from reinvesting, only to see significant market gains later.

Why do we ignore missed opportunities? It’s often because the potential outcomes are unclear, requiring effort and self-reflection. However, embracing a systematic approach like trend following helps eliminate biases and develop plans to navigate various market scenarios.

Striving for Consistency

Prioritizing consistency over perfection is key to investment success. While trends may not always unfold as expected, a systematic approach allows investors to adapt and stay on course. We believe in crafting strategies designed to withstand market fluctuations and achieve long-term investment goals.

We’re grateful to work with clients who embrace these concepts and trust in our trend-following approach. While our approach may not suit everyone, we take pride in serving those who value reliability and long-term success.

Disclosures:

Strategic Advisory Partners is an investment advisor registered pursuant to the laws of the state of North Carolina. Our firm only conducts business in states where licensed, registered, or where an applicable exemption or exclusion is afforded. This material should not be considered a solicitation to buy or an offer to sell securities or financial services. The investment advisory services of Strategic Advisory Partners are not available in those states where our firm is not authorized or permitted by law to solicit or sell advisory services and products. Registration as an investment adviser does not imply any level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. For more information, please visit adviserinfo.sec.gov and search for our firm name.

Past performance is not indicative of future results. The material above has been provided for informational purposes only and is not intended as legal or investment advice or a recommendation of any particular security or strategy. The investment strategy and themes discussed herein may be unsuitable for investors depending on their specific investment objectives and financial situation.

Information obtained from third-party sources is believed to be reliable though its accuracy is not guaranteed.

Opinions expressed in this commentary reflect subjective judgments of the author based on conditions at the time of writing and are subject to change without notice.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission from Strategic Advisory Partners.

An index is an unmanaged portfolio of specific securities, the performance of which is often used as a benchmark in judging the relative performance of certain asset classes. Investors cannot invest directly in an index. An index does not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown.