March 2025 Investment Update

Strategic Positioning: Capitalizing on International Strength

February demonstrated once again how quickly market sentiment can shift in today’s investment landscape. After starting the year in positive territory, we witnessed a notable pullback through the end of February, with major indices briefly dipping into negative territory for the year. However, a strong rally on the final trading day of the month helped markets regain positive ground.

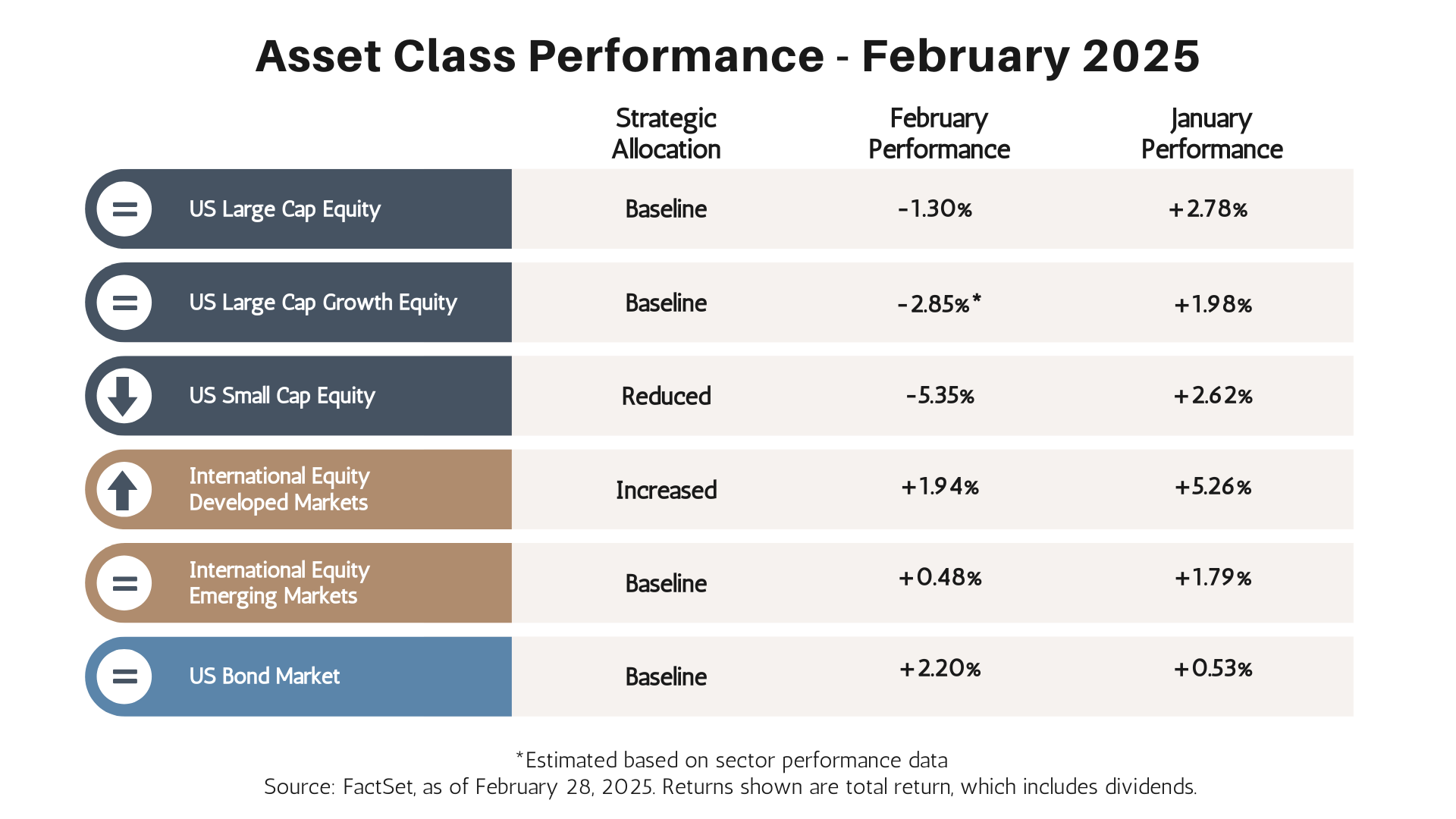

Asset Allocation Update

The volatility we observed last month was largely driven by weakness in the technology sector, particularly among the “Magnificent Seven” stocks (Meta, Apple, Google, Amazon, Microsoft, Tesla, and Nvidia) that have powered much of the market’s performance in recent years. Several factors contributed to this pullback:

- Concerns about potential tariff increases under the new administration

- Questions about Nvidia and whether there has been excess spending on computing power for AI applications

- Uncertainty around Chinese spending patterns on technology

- Broader questions about the sustainability of recent AI-driven growth

Despite these short-term fluctuations, our disciplined investment approach remains focused on identifying relative strength among asset classes and making targeted adjustments to enhance portfolio performance.

Our Positioning

At Strategic Advisory Partners, we’ve maintained our overall allocation to equities versus fixed income, but we’ve made strategic shifts within our equity exposure based on our analysis of market dynamics:

- Reduced Small Cap Exposure: We decreased our allocation to small-cap U.S. companies, which have shown persistent weakness.

- Increased International Exposure: We increased our weighting to international developed markets, which have demonstrated stronger relative performance than we’ve seen in quite some time.

These adjustments reflect our active management approach rather than making dramatic shifts in overall equity exposure. By reallocating capital toward areas of relative strength, we aim to generate alpha (returns above benchmark) while maintaining appropriate diversification.

Looking Forward

Our investment philosophy continues to be guided by identifying opportunities across different asset classes and market segments. Rather than making reactive, large-scale changes to allocation in response to short-term volatility, we prefer making measured adjustments that compound over time.

These incremental shifts in positioning, when executed consistently through full market cycles, have historically allowed us to outperform benchmarks while managing risk appropriately. We remain vigilant in monitoring market conditions and stand ready to make additional adjustments as opportunities present themselves.

As always, please reach out to your Strategic Advisory Partners advisor with any questions about your specific portfolio or financial plan.

Important Disclosures

This communication is for informational purposes only and does not constitute investment advice, a recommendation, or an offer to buy or sell any security. Strategic Advisory Partners (“SAP”) is a registered investment advisor. Registration does not imply a certain level of skill or training.

Past performance is not indicative of future results. No investment strategy, including trend following, can guarantee profits or protect against losses. Market indices mentioned are unmanaged and cannot be invested in directly. Index performance does not reflect transaction costs, fees, or expenses.

Forward-looking statements, including projections of market performance, earnings growth, Federal Reserve actions, and economic conditions, are based on various assumptions and beliefs that may not prove to be accurate. These statements should not be relied upon for making investment decisions.

Investment decisions should be based on an individual’s own goals, time horizon, and risk tolerance. Diversification and asset allocation do not ensure a profit or protect against loss.

This material has been prepared from sources believed to be reliable but is not guaranteed as to accuracy or completeness. This information may change at any time based on market or other conditions.

©2025 Strategic Advisory Partners. All rights reserved.