May 2025 Investment Update

Maintaining a Disciplined Approach Amidst Market Fluctuations

April witnessed a mixed performance across major U.S. stock indices. While there was a late-month rally, the overall trend highlighted the volatility our CIO noted. It’s important to remember that periods of rapid market increases can occur even within broader, longer-term market declines. This underscores the need for a consistent and disciplined investment strategy, particularly in the current environment characterized by heightened sensitivity to news and increased overall market risk.

Asset Allocation Update

Our CIO, Chris Harris, notes that the current market landscape is one where even minor news events can trigger significant market reactions. This heightened sensitivity reflects a period of greater uncertainty, which, in the realm of investments, translates directly to higher risk.

For the month of April 2025:

- The Dow Jones Industrial Average experienced a decline of approximately 3.2% for the month. Despite a seven-day winning streak to close out April, this wasn’t enough to bring the index into positive territory for the month. (Source: Investopedia, April 30, 2025)

- The S&P 500 also finished April in negative territory, with a loss of around 0.8%. Similar to the Dow, a late-month rally wasn’t sufficient to overcome earlier declines. (Source: Investopedia, April 30, 2025)

- The Nasdaq Composite, however, managed to eke out a gain of approximately 0.9% in April, snapping a previous two-month losing streak thanks to a late-session surge. (Source: Investopedia, April 30, 2025)

These figures illustrate the volatility within the market during April, with some indices showing losses despite a late recovery, reinforcing the importance of a long-term perspective.

Our Ongoing Strategy

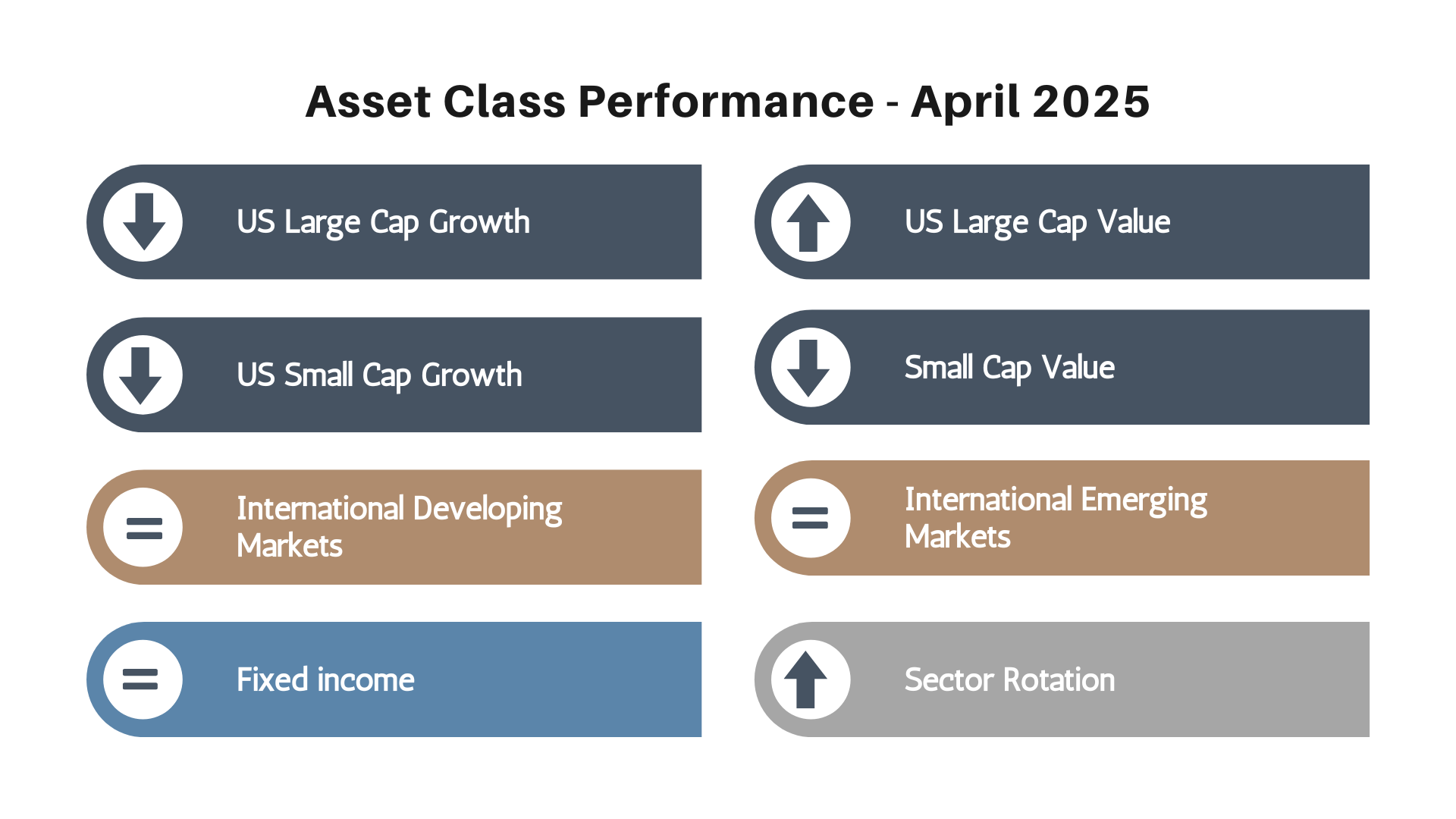

Our approach remains rooted in a systematic and unemotional evaluation of market indicators. As a reminder of the adjustments made in the previous month:

- Rebalanced Large US Stock Holdings: We previously shifted our focus within large-cap U.S. equities towards value positions, aligning with research suggesting their potential outperformance during periods of rising interest rates and inflation concerns.

- Reduced Small US Stock Holdings and Rebalanced to Dividend-Yielding Stocks: We decreased our allocation to small-cap U.S. companies and reallocated a portion to dividend-yielding stocks, seeking enhanced downside protection and potential income in a more volatile market.

- Maintained International Stock and Bond Holdings: Our allocations to international stocks and bonds remain unchanged as we continue to monitor global developments.

- No Large-Cap Growth Holdings: We maintain our stance of avoiding large-cap growth holdings, consistent with research indicating potential underperformance in the current economic phase.

Looking Ahead

The mixed performance in the stock market observed in April, with the Dow and S&P 500 showing losses while the Nasdaq gained, underscores the elevated volatility and risk highlighted by our CIO. Extended market downturns frequently include short-lived rallies, which can be emotionally misleading for investors.

Therefore, our focus remains steadfast on adhering to our established investment system. We will continue to closely monitor key indicators and make adjustments to portfolios as warranted by our disciplined process, not by short-term market fluctuations or emotional responses to daily market activity.

Following a consistent system is crucial during periods of heightened risk. It prevents emotional decision-making that can often lead to suboptimal investment outcomes. Our commitment is to navigate this environment with a measured and strategic approach, prioritizing the long-term financial well-being of our clients.

As always, we encourage you to reach out to your advisor with any questions or to discuss your individual portfolio and financial plan.

Sources:

Nasdaq.com, “Nasdaq First Quarter 2025 Recap” – May 1, 2025

Investopedia, “Markets News, April 30, 2025: S&P 500, Dow Extend Winning Streaks as Stocks Rebound From Post-GDP Report Lows; Indexes Still Post April Losses” – April 30, 2025

Reuters, “Late rally propels Dow, S&P 500 to slight gains” – April 30, 2025

Important Disclosures

This communication is for informational purposes only and does not constitute investment advice, a recommendation, or an offer to buy or sell any security. Strategic Advisory Partners (“SAP”) is a registered investment advisor. Registration does not imply a certain level of skill or training.

Past performance is not indicative of future results. No investment strategy, including trend following, can guarantee profits or protect against losses. Market indices mentioned are unmanaged and cannot be invested in directly. Index performance does not reflect transaction costs, fees, or expenses.

Forward-looking statements, including projections of market performance, earnings growth, Federal Reserve actions, and economic conditions, are based on various assumptions and beliefs that may not prove to be accurate. These statements should not be relied upon for making investment decisions.

Investment decisions should be based on an individual’s own goals, time horizon, and risk tolerance. Diversification and asset allocation do not ensure a profit or protect against loss.

This material has been prepared from sources believed to be reliable but is not guaranteed as to accuracy or completeness. This information may change at any time based on market or other conditions.

©2025 Strategic Advisory Partners. All rights reserved.