“History never repeats itself. Man always does.” –Voltaire

As a proponent of systematic investing, we often talk about the dangers of overfitting rules to past market behavior. This is a process known as “curve fitting.” We think it’s dangerous for many reasons, including the notion that past market movements are not likely to repeat themselves in the future. As Mark Twain said, “History doesn’t repeat itself, but it often rhymes.”

In our view, human nature is the primary factor that leads to the future rhyming with the past. A person’s reaction to rising or falling market prices is about the only variable that can be consistently predicted. Fear, greed, envy, and a host of other emotions are embedded in our DNA and provide for very predictable behavior.

Contrary to common belief, investment professionals are not immune to this behavior. This is why we employ a systematic investment process. We are not immune to emotion – but the system we use is.

In this monthly note, we discuss the value of having a systematic investing process in the context of return chasing. Buying last year’s winners is an all-too-common thread in the investment world, as well as a behavior rooted in human nature. It is our belief that a better approach is to employ a set of simple rules that circumvent these potentially harmful behaviors.

But first, here’s what transpired in the markets in April.

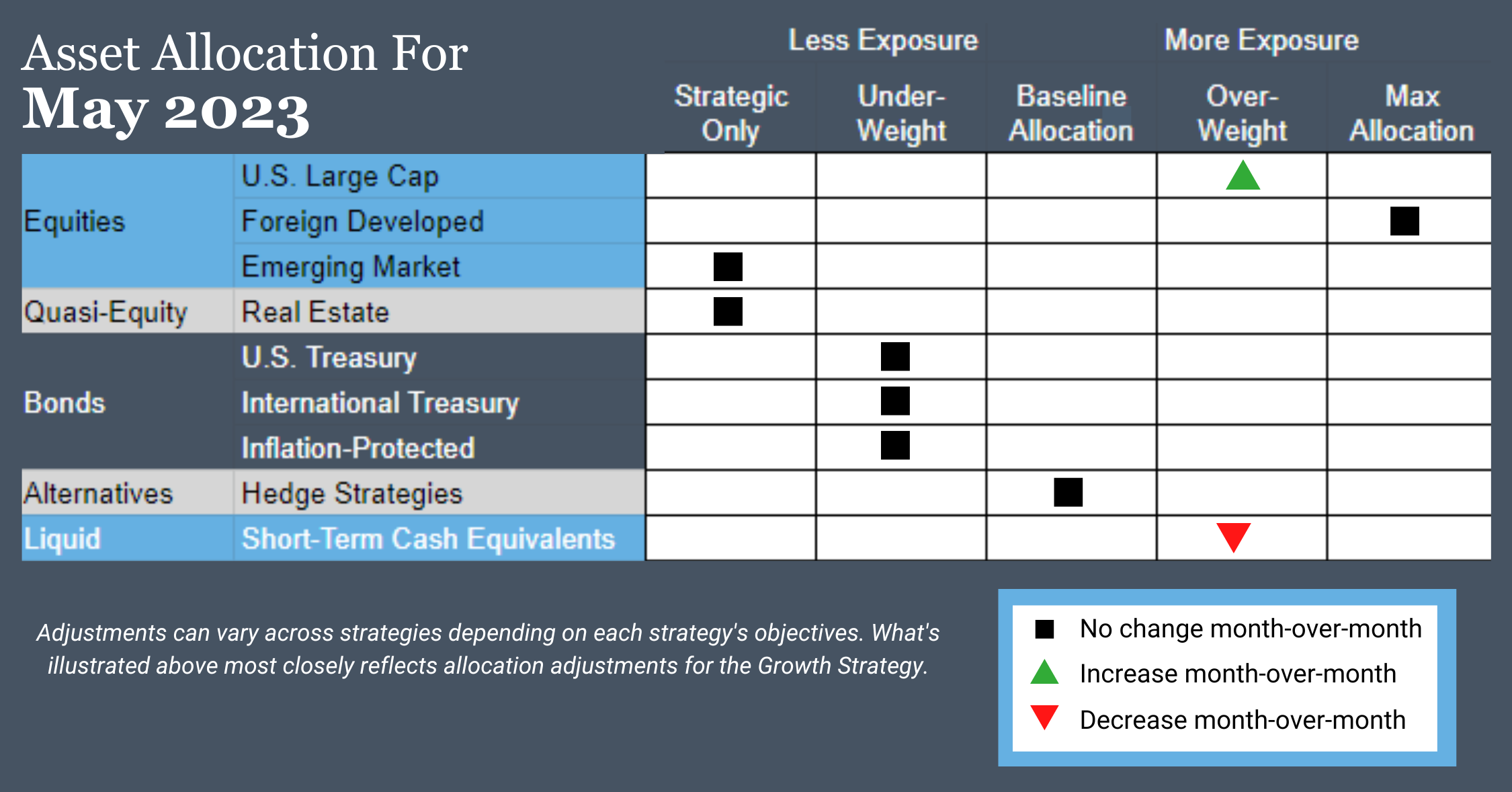

U.S. Equities

Overall exposure will increase. The long-term timeframe joins the intermediate-term timeframe in an uptrend for the first time since early 2022. The asset class is overweight due to previously taking on exposure from weakening real estate and additional exposure now coming from short-term bonds. Exposure remains skewed toward large caps due to downtrends across both timeframes for small and mid.

Intl Equities

Exposure will not change. Foreign developed equities continue to experience uptrends across both timeframes, while emerging market equities continue to have downtrends.

Real Estate

Exposure will not change, with downtrends across both timeframes.

U.S. & Intl Treasuries

Exposure will be unchanged and remain underweight. Intermediate-term trends continue to be positive, while the long-term trends remain negative.

Inflation-Protected Bonds

Exposure will be unchanged and remain underweight. The intermediate-term trend is positive, while the long-term trend remains negative.

Short-Term Fixed Income

Exposure will decrease, as allocations are returned to strengthening U.S. equities.

Alternatives

Exposure will not change. The baseline allocation for gold is also our highest limit, so we are already at the maximum allocation as the asset class continues to experience uptrends over both timeframes.

Asset Level Overview

Equities & Real Estate

After closing March with a three-day rally that caused the S&P 500 Index to climb 3.25%, April’s price activity was tame by comparison. The S&P closed slightly positive. In fact, the S&P 500 held a range within 100 points throughout April, which is a fraction of the distance it has traveled in the prior twelve months. The S&P 500’s range in April, as a percentage of the open, is the sixth lowest since 1993.

Parsing out U.S. equity markets:

- Dividend payers and value stocks were the leaders in April after lagging significantly in the first quarter. Value and dividend stocks continue to hover near their 2022 close, even with the positive monthly performance.

- Growth stocks, along with small and mid-caps, finished negative for April. For growth, this is merely a dent in what has been a bit of a recovery year after 2022’s disastrous performance. Mid and small-caps continue to perform more in line with value and dividend stocks.

For U.S. equities, higher lows in prices and low volatility have resulted in uptrends for the broader market, which means our portfolios will increase exposure. Portfolios will actually go overweight, as this asset class picks up exposure from weaker real estate securities.

Foreign-developed equities are on pace again to lead global equity markets for the month in positive territory. Our portfolios have been overweight since January in response to this strength and will continue to be in May. On the flip side, emerging markets have reverted back into downtrend status after briefly hitting an intermediate-term uptrend. Our portfolios remain at their minimum allocation as a result.

Real estate securities continue to experience downtrends across both timeframes. As a result, all our portfolios remain at their minimum allocation. As mentioned above, this exposure has been handed off to stronger U.S. equities.

Fixed Income & Alternatives

Very little has changed in the world of fixed income since our last update. The middle of the yield curve continues to be strongest from a price perspective, with bonds in duration from three years to 20 years posting intermediate-term uptrends. Treasuries in duration from one year to three years, as well as those above 20 years, continue to experience downtrends across all timeframes. Exposure in our portfolios is underweight, reflective of the weakness, and will not change in May.

Gold’s price moved very little in April but remains in uptrends. It has been one of the leading asset classes for 2023 and thus will continue to be at its maximum exposure in our portfolios (1).

3 Potential Catalysts for Trend Changes

GDP Report:

U.S. economic growth decelerated to a 1.1% annual rate in the first quarter. It marks the second declining quarter in a row, as inflation and seasonally adjusted growth was 2.6% in the fourth quarter of 2022 and 3.2% in the third quarter. Projections from The Wall Street Journal for the remainder of the year are flat to slightly negative.

Home Prices:

The latest data shows that home prices rose in February from the prior month, breaking a seven-month streak, as buyers began to compete again for homes for sale. After rising to 20-year highs last fall, mortgage rates declined in December and earlier this year, which brought home buyers back into the market. The number of homes for sale also remained unusually low, keeping the buyers’ market competitive in parts of the country.

Declining Confidence:

Possible signals of a looming recession can be found in the April report from The Conference Board. The report showed consumer confidence declined in March, Americans’ assessment of current business and labor market conditions improved, and consumers’ expectations for the coming months dropped (2).

Why ‘Keep It Simple’ Resonates Deeply

In our update last month, we outlined both a bull case and a bear case for what lies ahead in the markets.

The point of doing so was to illustrate the folly in making investment decisions based on predicting market behavior. As our clients know, we are avid supporters of designing and implementing systematic investing processes for adapting portfolios in a predetermined way. We think this gives clients the best chance of meeting their goals over 10, 20, 30, or 50-year windows, regardless of what transpires in their lives (and the markets).

The markets never perfectly repeat past behavior. However, our research indicates to us that there’s enough of a pattern that a rules-based, systematic framework can help with navigation.

Markets generally fall into one of these periods of trend:

1. Up

2. Down

3. Sideways

Different rules applied within these periods will result in different performing profiles in terms of return, volatility, and correlation in comparison to a benchmark, such as the S&P 500. One set of rules is not necessarily better than another, and any form of repeatable trend following is better than none.

The systematic investing rules used in our portfolios aim to capture as much upside as possible. We apply the investing process to a broadly diversified portfolio, and we take into consideration tax consequences and downside risk.

A systematic investing process with predetermined rules for each of the previously-mentioned trend environments will usually do part of the work that’s needed to help manage emotions during turbulent times. But we – this includes you – aren’t immune to reacting to market conditions with feelings of fear, greed, envy, and a host of other emotions because it is embedded in all of our DNA.

We see how these predictable human emotions and behaviors are at play throughout the industry. It is almost comical how even financial professionals will fixate on previous performance, constantly chasing the recently best-performing asset rather than sticking with a tried-and-true process.

It appears that we have a stalemate between the bulls and the bears at the moment. Equities (and bonds for that matter) have yet to seriously retest lows from 2022, but as mentioned above, are not threatening new highs either. There seems to be an underlying desire from investors to push the market higher; they are just looking for a reason to buy. Economic data and subsequent Federal Reserve commentary continue to stand in the way.

Some could argue that directionless markets are the Achilles heel for trend-following strategies, but we want to highlight two areas that show why systematic portfolio management via trend-following still shines.

The last three years are a prime example:

- Growth and tech: Our strategies have been challenged at various times by the latest hot asset class. A recent example is how growth and tech-oriented factors were top performers at the end of 2021 (their last peak), only to become among the worst performers in 2022.

- Commodities: We have also seen firms eschew commodities for years, only to buy them at their peak in 2022.

- Crypto: And don’t even get us started on crypto assets. It was almost an everyday occurrence in 2021 for someone to ask us about adding crypto to our portfolios or how they could benefit from it. Now, when it is arguably a better investment, almost NO ONE is talking about it.

These examples remind us why the acronym KISS (Keep It Simple, Stupid) resonates deeply. Years of working with market data yield a few universal truths, as we see them:

- Almost all of a given market’s return is produced when it is in an uptrend (we know this sounds obvious, but it conflicts with commonly held sacred cows like “the best 10 days rule”).

- Bad things tend to happen when you hold a market that is in an extended downtrend – note we didn’t say “any downtrend,” we said “extended downtrend” because not all declines are created equal.

These ideas and the underlying rules that support them are why we:

- will continue to increase large-cap U.S. equity exposure for May.

- are keeping high exposure in foreign developed equities, but low allocations in emerging markets and real estate.

- have had almost no exposure to long-duration fixed income for almost two years, but have kept high exposure to relatively ultra-short-duration assets.

- are at maximum allocation for gold.

What we’re building and executing is not flashy. It will not receive high praise in the mainstream. We will probably not be asked to join a speaking circuit. We’re OK with all of that because our goal is to provide a foundation for serving clients, as well as the type of white glove service that almost NO ONE else is providing.

We can’t guarantee performance but we can vow to follow our systematic investing process with discipline and to provide service marked by its intensity and responsiveness.

Our mantra remains: Control what you can and seek to maximize the reward per risk on what you can’t (3).

Sourcing for section (1):

Barchart.com, S&P 500 Index, 3/29/2023 to 4/27/2023; GFD, S&P 500 Index, 1/1/1993 to 4/25/2023, calculation is high for month minus low for month divided by open price for the month; Barchart.com, High Dividend Yield Vanguard ETF (VYM), 1/1/2022 to 4/25/2023; Barchart.com, Value ETF Vanguard (VTV), 1/1/2022 to 4/25/2023; Barchart.com, Growth ETF Vanguard (VUG), 1/1/2022 to 4/25/2023; Barchart.com, Midcap ETF Vanguard (VO), 1/1/2022 to 4/25/2023; Barchart.com, Smallcap ETF Vanguard (VB), 1/1/2022 to 4/25/2023; Barchart.com, FTSE All-World Ex-US ETF Vanguard (VEU), 4/1/2022 to 4/25/2023; and Barchart.com, Gold Trust Ishares (IAU), 1/1/2023 to 4/25/2023

Sourcing for section (2):

The Wall Street Journal, “GDP Report Shows Economic Growth Slowed in First Quarter, 4/27/2023; The Wall Street Journal, “Home Prices Rose in February for First Time Since June,” 4/25/2023; and The Conference Board, “US Consumer Confidence,” 4/25/2023

Sourcing for section (3):

Barchart.com, Growth ETF Vanguard (VUG), 6/30/2021 to 4/25/2023; Barchart.com, Nasdaq QQQ Invesco ETF (QQQ), 6/30/2021 to 4/25/2023; Barchart.com, S&P GSCI Commodity-Indexed Ishares ETF (GSG), 1/1/2020 to 4/25/2023

Disclosures:

Strategic Advisory Partners is an investment advisor registered pursuant to the laws of the state of North Carolina. Our firm only conducts business in states where licensed, registered, or where an applicable exemption or exclusion is afforded. This material should not be considered a solicitation to buy or an offer to sell securities or financial services. The investment advisory services of Strategic Advisory Partners are not available in those states where our firm is not authorized or permitted by law to solicit or sell advisory services and products. Registration as an investment adviser does not imply any level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. For more information, please visit adviserinfo.sec.gov and search for our firm name.

Past performance is not indicative of future results. The material above has been provided for informational purposes only and is not intended as legal or investment advice or a recommendation of any particular security or strategy. The investment strategy and themes discussed herein may be unsuitable for investors depending on their specific investment objectives and financial situation.

Opinions expressed in this commentary reflect subjective judgments of the author based on conditions at the time of writing and are subject to change without notice.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission from Strategic Advisory Partners.