December 2023 Monthly Investment Update

What Investors Think Should Happen Versus What Is Actually Going On

“The plural of anecdote is not data.” – Roger Brinner

As systematic trend followers, we make decisions using price data. It appears to us that many in the investment world take a different approach, viewing markets through a lens of stories and anecdotes. In times like now, the second approach can present a communication challenge if current market dynamics don’t fit with the story that’s being told. Presently, there’s a notable sense of disbelief, as both stocks and bond prices are on an upward trend.

Investors often hold firm beliefs about market behavior derived from economic principles, historical trends, or personal experiences. When market movements contradict these beliefs – such as sustained market climbs despite signs of overvaluation or anticipated economic downturns – it triggers a sense of disbelief. This clash between expectations and market realities introduces noise, complicating decision-making and risk management.

Unlike conventional approaches, trend followers circumvent the tug-of-war between empirical market data and personal beliefs. Their objective stance empowers data to guide decisions. This data-driven approach is crucial for effectively navigating markets, particularly during volatile or irrational periods. It allows a focus on actual trends rather than being swayed by individual beliefs or prevailing market sentiments.

In this month’s update, we delve into the rollercoaster of investor sentiment mirrored in the S&P 500 movements this year. We also explore historical S&P 500 data, homing in on recovery timelines and offering perspective on the last 24 months.

But first, here’s a summary of our take on what transpired in the markets in November.

U.S. Equities

Exposure will increase and move to overweight. The intermediate-term trend is now positive, joining the long-term trend. Within the asset class, exposure will remain skewed toward growth and large caps, as value, mid, and small caps regain intermediate-term uptrends but maintain long-term downtrends.

Intl Equities

Exposure will increase but remain underweight. Both foreign developed and emerging market equities now have intermediate-term uptrends, with long-term trends remaining negative.

Real Estate

Exposure will increase but remain underweight as the intermediate-term trend changes to positive. The long-term trend continues to be negative.

U.S. & Intl Treasuries

Exposure will increase but remain underweight as the intermediate-term trend changes to positive. The long-term trend continues to be negative.

Inflation-Protected Bonds

Exposure will not change and is at its minimum allocation due to persistent downtrends across both timeframes.

Short-Term Fixed Income

Exposure will decrease, as it gives back a large portion of allocations to strengthening assets.

Alternatives

Exposure will not change, as trends in gold remain positive across both timeframes.

Asset Level Overview

Equities & Real Estate

November brought an optimistic start for U.S. equity markets, opening with a streak of positivity. The Vanguard Total Stock Market Index surged over 6% in seven days, closing the month near 9%. U.S. equities bounced impressively from October lows, rising over 10% after retesting the previous highs from Q2 2023.

This rally was swift and widespread, with nearly all equity segments participating, from small to large and foreign to domestic. Tech and growth led the charge, while dividend and value trailed comparatively. Even the previously underperforming real estate sector saw a positive shift.

These upward movements have reintroduced numerous intermediate-term uptrends in portfolios. Consequently, exposure to these segments has increased, especially for large caps, growth, and tech. While other segments have also risen, they remain slightly below their baseline allocations, awaiting more definitive moves.

Fixed Income & Alternatives

Fixed income also recovered in November. Continued news indicating a peak in rate hikes by the Fed resulted in more support for bond prices. The iShares Core U.S. Aggregate Bond ETF is on the verge of its first intermediate-term uptrend since May, which means instruments with duration, whether international or domestic, are looking at the first meaningful increases since the first quarter.

As a response, Strategic Advisory Partners portfolios aim to extend duration, capitalizing on these emerging uptrends in fixed income. If these moves fail, as they have previously during the last couple of years, then we will harvest losses and return to the short end of the yield curve. However, there is a reasonable expectation that the returns from longer-duration instruments will present promising opportunities for patient systematic investing strategies.

After a mid-month retest of its recent average price, gold increased during the latter half of November, maintaining its uptrend as we enter December. The result is that exposure will not change and remains at its baseline allocation.

Sourcing for this section:

Barchart.com, Vanguard Total Stock Market Index, 10/1/2023 to 11/28/2023; Barchart.com, Growth ETF Vanguard (VUG), 11/1/2023 to 11/28/2023; Barchart.com, S&P 500 Technology Sector SPDR (XLK), 11/1/2023 to 11/28/2023; Barchart.com, Value ETF Vanguard (VTV), 11/1/2023 to 11/28/2023; and Barchart.com, High Dividend Yield Vanguard ETF (VYM), 11/1/2023 to 11/28/2023

3 Potential Catalysts for Trend Changes

More Supply:

Federal Reserve Chair Jerome Powell’s recent remarks signaled an intriguing change. He noted that the economy’s speed limit, known as potential growth, seems to have temporarily increased due to higher inventories, a larger available workforce, and potentially enhanced worker productivity. While growth might have slowed down this quarter, it remains robust. Concurrently, inflation and wage growth have continued to slow.

Home No-Sales:

October witnessed a 4.1% decline in sales of previously owned homes compared to September, contributing to a 13-year low in overall home sales. Elevated home prices and increased mortgage rates have dissuaded many potential buyers. This decline in demand has been matched by a limited supply of homes for sale, as homeowners are hesitant to sell due to the high rates, leading to a continuous rise in home prices in various parts of the U.S.

Warning Signal:

Although economists have revised down their recession predictions and economic metrics like hiring, consumer spending, and output are positive, a key indicator remains concerning. The Conference Board’s Leading Economic Index (LEI) experienced a 0.8% decline in October, marking its 19th consecutive decrease. The LEI draws insights from various indicators like jobless claims, building permits, and interest-rate spread. The concern is that elevated inflation, higher interest rates, and a decline in consumer spending might briefly tip the U.S. economy into a recession.

Sourcing for this section:

The Wall Street Journal, “Home Sales Fell to a New 13-Year Low in October,” 11/21/2023 and The Conference Board, “LEI for the U.S. Declines Again in October,” 11/20/2023

What the Data Shows About Time to Recovery

“Without data, you’re just another person with an opinion.” –W. Edwards Deming

In last month’s note we highlighted the erratic shifts in investor sentiment encountered in 2023. As if on cue, the equity markets underwent yet another turnaround, ascending higher. As we write this note, the S&P 500 Index sits around 4550 and is nearing a new all-time high (ATH), off by just about 6% as we approach the end of 2023.

The S&P 500 last reached an intra-day high on January 4, 2022, at 4818.62. By April 2022, it surpassed correction territory, facing a 10% decline, and the bear market designation, having dropped by 20% by June 2022. In October 2022, it hit the trough of the move (so far), falling more than 27% from the January high.

Since then, more than a year has passed, with more than 30% regained. Reflecting on this year and contemplating 2024, we delved into past market corrections to analyze the duration of the S&P 500’s recoveries. We aimed to extract insights from this data to shape our mindset for 2024.

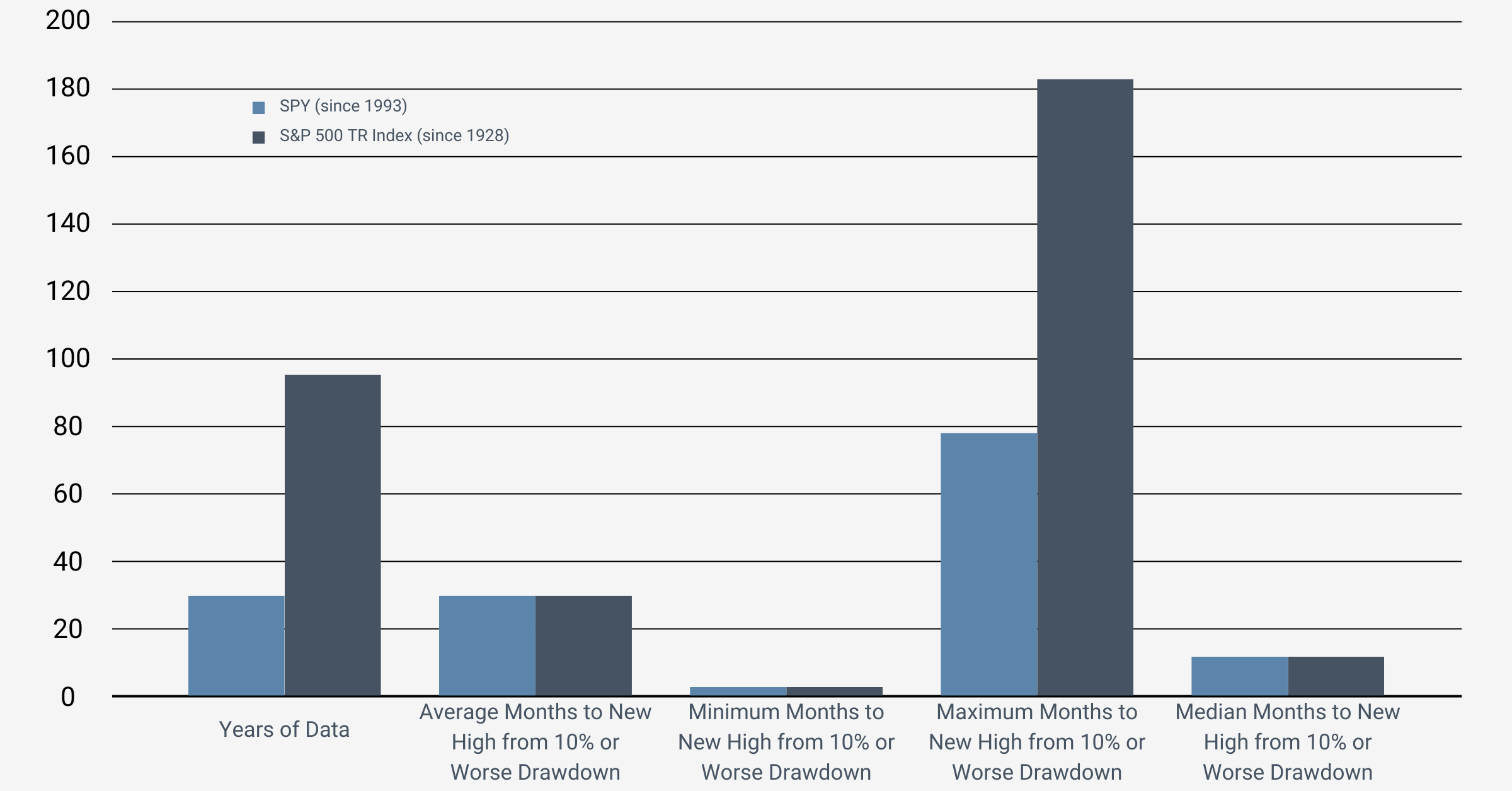

Using the SPY ETF since its inception in 1993, we found that the average months from 10% drawdown to new all-time highs is approximately 28 months. With only six instances of this occurring since 1993, the sample size is likely too small for robust conclusions. To gain a more comprehensive understanding, we looked further back, spanning nearly 100 years of S&P 500 Index data, where we found a similar average recovery time of 28 months.

Source: ICE, 2/1/1993 to 11/1/2023 and GFD, 10/1/1928 to 11/1/2023

Predictably, extended bear markets in the 1920s, 1930s, and 2000s skewed the distribution and pushed the average upwards. Hence, we turned our attention to the median recovery time, which stood at 12 months across the almost 100-year data set. Essentially, the S&P 500 has historically taken around a year to fully recover from drawdowns of 10% or more.

As we end November, the S&P 500 Index has lingered underwater for 20 months. In comparison to historical data, we’ve surpassed the typical (median) recovery time and are nearing the positively skewed average. Although predictions about what unfolds next are uncertain, statistically, there is a case to stay invested in equity markets, anticipating the end of the current bear market and the emergence of a new bull market.

For us, this is not about predicting what could happen. Rather, we want to point out the potential value of a systematic investing process. In what has been an unfriendly environment for some trend-based systems since October 2022, our strategies have generated returns consistent with most investors’ long-term goals while staying within our strict risk-management guidelines. Our strategies are increasing equity exposure at a time when equity markets could be readying for a new all-time high.

Disclosures:

Strategic Advisory Partners is an investment advisor registered pursuant to the laws of the state of North Carolina. Our firm only conducts business in states where licensed, registered, or where an applicable exemption or exclusion is afforded. This material should not be considered a solicitation to buy or an offer to sell securities or financial services. The investment advisory services of Strategic Advisory Partners are not available in those states where our firm is not authorized or permitted by law to solicit or sell advisory services and products. Registration as an investment adviser does not imply any level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. For more information, please visit adviserinfo.sec.gov and search for our firm name.

Past performance is not indicative of future results. The material above has been provided for informational purposes only and is not intended as legal or investment advice or a recommendation of any particular security or strategy. The investment strategy and themes discussed herein may be unsuitable for investors depending on their specific investment objectives and financial situation.

Information obtained from third-party sources is believed to be reliable though its accuracy is not guaranteed.

Opinions expressed in this commentary reflect subjective judgments of the author based on conditions at the time of writing and are subject to change without notice.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission from Strategic Advisory Partners.

An index is an unmanaged portfolio of specific securities, the performance of which is often used as a benchmark in judging the relative performance of certain asset classes. Investors cannot invest directly in an index. An index does not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown.