December 2022 Monthly Investment Update

Which Is Better: Consistently Good or Occasionally Great?

“The first rule of compounding: Never interrupt it unnecessarily.”

–Charlie Munger

Compounding. It’s in virtually everything we do. It’s a word that generally everyone knows but the power and significance get lost on many.

Whether you’re trying to lose weight, training for a marathon, learning a new language, or achieve a financial goal, harnessing the power of compounding is critical because each small decision has large implications on the outcome.

To Munger’s point above, there are two ways to interrupt compounding: allowing small losses to turn into big losses and not allowing small profits to turn into big profits. Yes, this is trend following 101, but simple, daily decisions made with the intention of preventing either of those scenarios can have massive future implications on long-term compounding.

In this month’s note, we discuss compounding through the lens of being consistently good versus occasionally great. Our goal is to be consistently good because maintaining discipline at every turn and delivering a reliable process leads to predictable, long-term results.

Here’s a summary of what transpired in the markets in November.

U.S. Equities

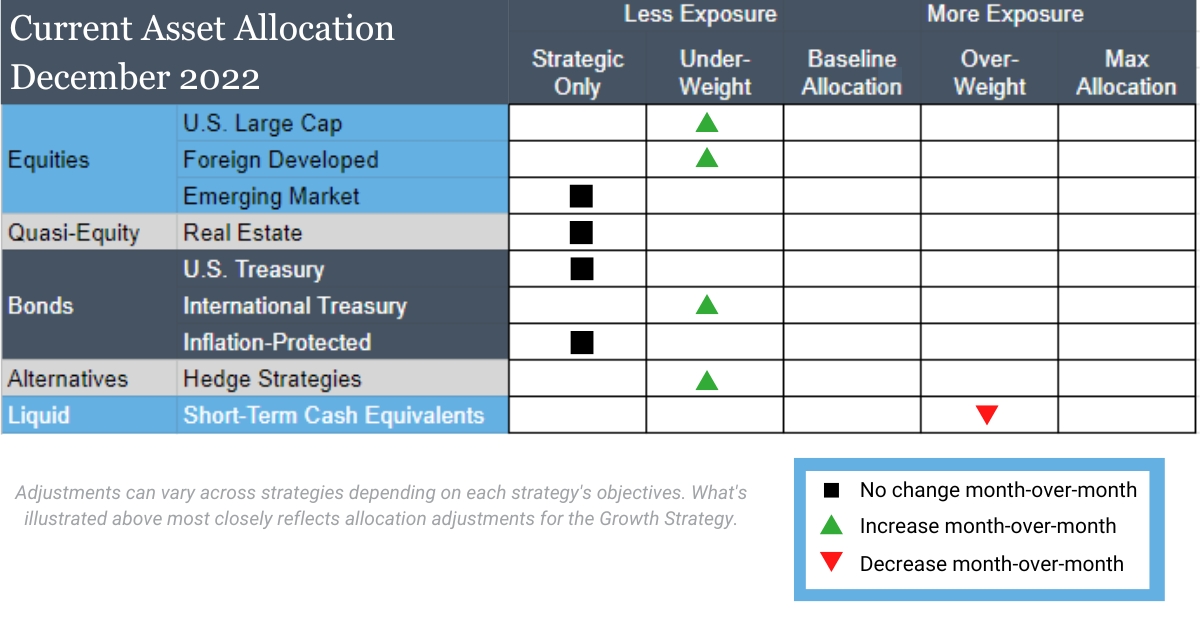

Exposure will increase as the intermediate-term timeframe moves into an uptrend. The long-term timeframe remains in a downtrend.

Inflation-Protected Bonds

Exposure will not change and is at its minimum due to downtrends across both timeframes.

Intl Equities

Exposure will increase from its minimum allocation, as foreign developed experiences an intermediate-term uptrend; their long-term trend remains negative. Emerging markets remain in downtrends across both timeframes.

Alternatives

Exposure will increase, as gold now has an intermediate-term uptrend. The long-term timeframe continues to be in a downtrend.

U.S. & Intl Treasuries

Exposure will increase, as international Treasuries experience an intermediate-term uptrend; their long-term trend remains negative. Both timeframes for U.S. Treasuries remains negative as well.

Real Estate

Exposure will not change from its minimum allocation, as both the intermediate- and long-term timeframes remain in downtrends.

Short-Term Fixed Income

Exposure will decrease, as it gives back exposure to strengthening trends in U.S. equities, international equities, international Treasuries, and gold.

Asset Level Overview

Equities & Real Estate

The recent increase in U.S. equity prices since the last low is enough to create an intermediate-term uptrend. It will be the first time since March that we’ve seen positive trends at month-end. As a result, all our portfolios will experience an increase in exposure. U.S. equities haven’t been able to break the trendline of lower highs in 2022. Until that occurs it is difficult to call the current rally significant.

International equities, particularly in developed markets, have also increased since their last low. The increase is significant enough to create an intermediate-term uptrend. On a longer-term basis, when juxtaposed with U.S. equities, this is a considerable development for foreign equities. The same cannot be said for emerging markets, as they continue to experience downtrends. Overall, our exposure to international equities has increase but only to developed markets.

While real estate securities experienced gains in November, they are not enough to generate an uptrend. Consequently, our portfolios remain at their minimum exposure to this asset class. Until some light is visible at the end of the rate hike tunnel, it will be a challenge for real estate to produce meaningful alpha.

Fixed Income & Alternatives

Let’s face it, fixed income assets have been a dumpster fire for all of 2022. That said, there were some interesting developments in November from a trend perspective. International bonds are on pace to experience their first end-of-month intermediate-term uptrend in almost a year. All U.S. bond segments remain in downtrends across both timeframes but are close to producing uptrends.

While 2022 has undoubtedly been a disappointing year for gold, given the tailwinds of inflation and war, it did manage to close the month with an intermediate-term uptrend. Our portfolios will increase exposure. Some work needs to be done to create a long-term uptrend, but after making a new low earlier in November, recent progress is promising.

3 Potential Catalysts for Trend Changes

Slowing Down:

After an aggressive path of rate increases this year, Federal Reserve officials are starting to consider how the economy is reacting to more restrictive monetary policy. The Fed has raised rates by 0.75% at each of the last four meetings in an attempt to markedly slow down inflation. The Fed is now signaling that they will only raise 0.50% at the next meeting and may lower it to the more traditional 0.25% raises after that.

Flying Inverted:

Yields on longer-term U.S. Treasuries have fallen even further below short-term bonds. The difference is greater than at any time in decades, a sign that investors think the Federal Reserve is close to slowing or pausing rate hikes. An inverted yield curve is often the market’s way of indicating that a recession is looming.

The Well Is Dry:

The huge pile of cash and deposit savings that consumers built up during the COVID-19 pandemic is shrinking. Economists expect it will run out before the end of next year. Government stimulus and reduced spending opportunities allowed households to accumulate a large amount of excess savings, of which between $1.2 trillion and $1.8 trillion remain. This savings buffer has helped Americans keep spending elevated despite historically high inflation and rapidly rising interest rates. As the savings dwindle, signs of financial distress could reappear, such as rising default rates on loans.

Consistently Good > Occasionally Great

“It’s more important to be consistently good than occasionally great.”

–Jeff Cunningham, marathon/distance running coach

If you’re like us, being healthy is becoming more important as you get older. Monitoring diet closely, strength training, and running have all become normal routines for folks here at SAP. As these lifestyles are being incorporated, we cannot help but notice the parallels between health/fitness and our systematic investing process for managing our risk-managed portfolios.

The quote above could just as easily represent the core tenets of a systematic, trend-following investment strategy as it does distance running:

- Understanding the goal and key constraints

- Focusing on the process rather than short-term outcomes

- Realizing that over time things should play out in our favor if we stay consistent

This is what our investment process is all about.

Perhaps the primary obstacle to being consistently good is ego. In distance running, there is a temptation to go faster than is appropriate for a training session. In investing, there is a desire to make a prediction about how something will increase in value in order to appear smart or prescient. (Read More: There’s No Such Thing As a Runner’s High in Investing)

The worst thing that can happen for the ego is these predictions come true, which can encourage the investor to continue making projections about things that are unknowable. For all those times when the ego’s gamble pays off, there’s often at least one loser that more than offsets the gain. But the losses are rarely talked about as transparently as the gains, which creates a distorted perception of reality.

Our research indicates it is better to avoid these predictions and instead follow systematic investing rules to stay focused on process.

The incredible thing about being consistently good is that if you can manage it for a long enough period, you often accomplish something truly great. Consistently beating a benchmark in a way that is behaviorally- and tax-friendly for clients allows them to maximize their financial potential.

So, as we enter the final month of 2022, we continue to do: focus on what we can control, show up, and follow the process.

Disclosures:

Strategic Advisory Partners is an investment advisor registered pursuant to the laws of the state of North Carolina. Our firm only conducts business in states where licensed, registered, or where an applicable exemption or exclusion is afforded. This material should not be considered a solicitation to buy or an offer to sell securities or financial services. The investment advisory services of Strategic Advisory Partners are not available in those states where our firm is not authorized or permitted by law to solicit or sell advisory services and products. Registration as an investment adviser does not imply any level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. For more information, please visit adviserinfo.sec.gov and search for our firm name.

Past performance is not indicative of future results. The material above has been provided for informational purposes only and is not intended as legal or investment advice or a recommendation of any particular security or strategy. The investment strategy and themes discussed herein may be unsuitable for investors depending on their specific investment objectives and financial situation.

Opinions expressed in this commentary reflect subjective judgments of the author based on conditions at the time of writing and are subject to change without notice.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission from Strategic Advisory Partners.