“Those who have knowledge, don’t predict. Those who predict, don’t have knowledge.” –Lao Tzu

Our team finds joy in challenging commonly accepted investing beliefs because we believe that thinking outside the box leads to better outcomes for our clients. Let’s talk about one belief that we find quite unhelpful: the obsession with prediction. It’s fascinating how predictions often miss the mark, and we can’t resist pointing out some glaring examples.

As we look at the current state of the market, it’s worth noting that the S&P 500 is nearing its all-time high and has shown strong performance in the first half of the year. Interestingly, many so-called market experts predicted a decline in the S&P 500 for this year. It’s the first time since at least 1999 that the aggregate prediction has been negative. Yet, here we are, on track to have one of the best starts to the year since 1990.

We don’t want to make predictions ourselves, as that would go against our principles. However, we want to highlight the potential drawbacks of blindly following the advice of so-called experts. Our latest Monthly Note dives into more 2023 predictions and how they’ve fared so far. We also explore the relationship between stock prices and anticipated news, as well as the impact of certain stocks driving the overall indexes this year.

But before we delve into all of that, here’s a summary of what transpired in the markets in June. Let’s keep challenging conventional wisdom and seeking the best path forward for your investments. (1)

Markets.businessinsider.com, “3 reasons why the stock market could hit a record high by the end of the year,” 6/21/2023; Bloomberg.com, “Wall Street Turns Bearish on Stocks After Bad Year,” 12/1/2022; and ICE, S&P 500 Index, 1/1/1990 to 6/29/2023

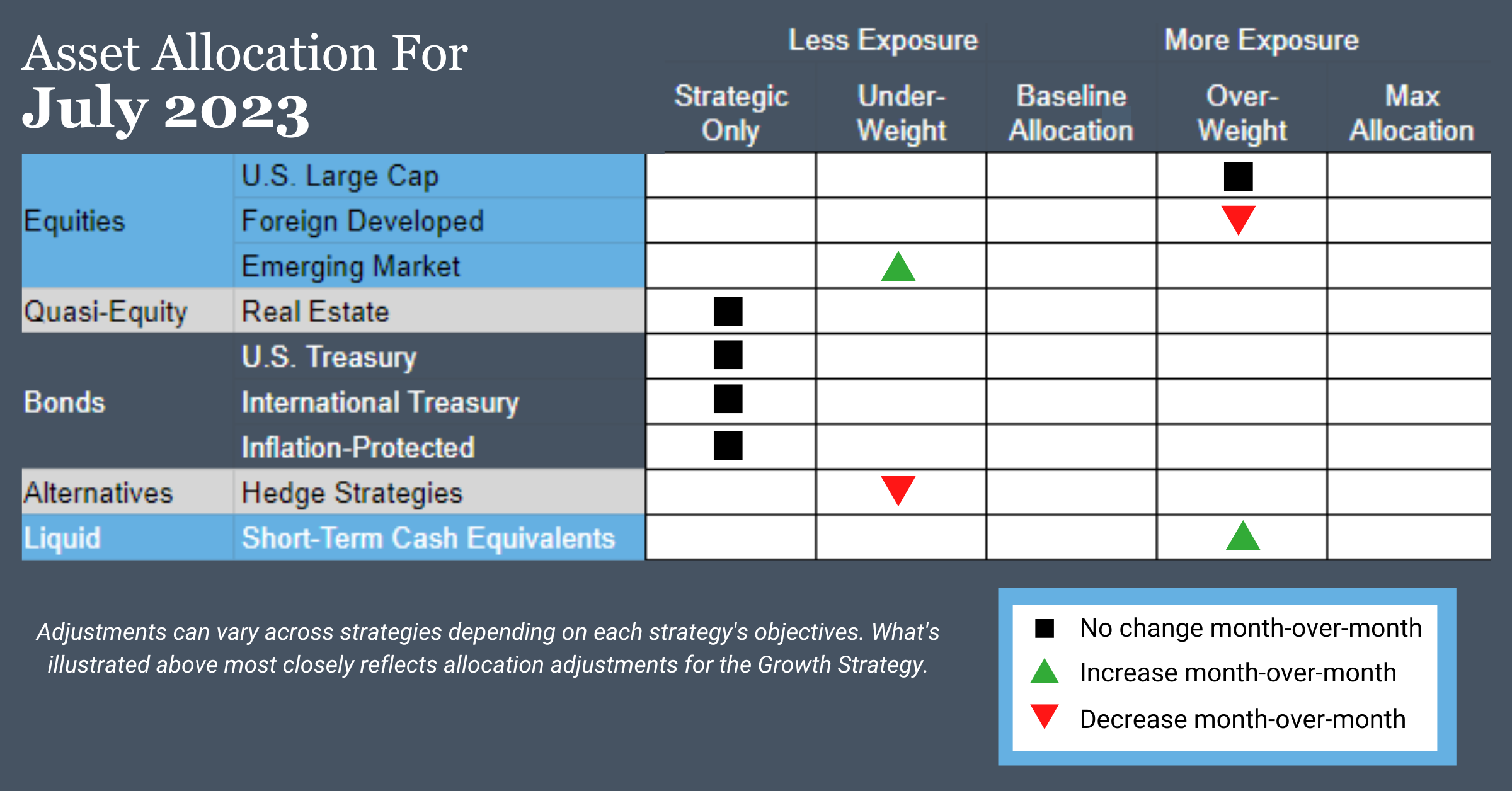

U.S. Equities

Exposure will not change. Both the intermediate-term and long-term timeframes remain in uptrends, and the asset class will continue to be overweight due to taking on exposure from weaker real estate earlier this year. Within the asset class, exposure remains skewed toward growth and large caps, which are stronger than value, small caps, and mid-caps.

Intl Equities

Overall exposure will not change. Foreign-developed equities continue to experience uptrends across both timeframes but will give a portion of their overweight exposure back to emerging markets, which are now experiencing an intermediate-term uptrend.

Real Estate

Exposure will not change, as there are downtrends across both timeframes.

U.S. & Intl Treasuries

Exposure will not change and remains underweight. Both U.S. and international bonds have downtrends across both timeframes.

Inflation-Protected Bonds

Exposure will not change and is at its minimum allocation due to downtrends across both timeframes.

Short-Term Fixed Income

Exposure will increase due to receiving exposure from gold. Short-term fixed income also continues to hold allocations previously received from weaker U.S., international, and inflation-protected bonds.

Alternatives

Exposure will decrease due to the emergence of an intermediate-term downtrend. The vacated exposure will be handed-off to short-term fixed income.

Asset Level Overview

Equities & Real Estate

Equities and real estate, which have been showing some interesting trends lately. In recent asset-level overviews, we’ve noticed the tight ranges of equities with higher lows, and this month is no different. June saw broad gains in equity markets, with both leading U.S. and foreign developed markets experiencing solid breakouts and strengthening their previous uptrends.

While technology and growth stocks continue to lead the way, we’re seeing almost all segments join the party. Value and dividend stocks, which had been lagging behind in 2023, are now showing intermediate-term uptrends. Additionally, small- and mid-cap stocks are creating uptrends across shorter timeframes, adding to the positive sentiment.

Foreign-developed equities are also making noteworthy progress, making a new one-year high and remaining firmly entrenched in uptrend territory. Even emerging markets, which had faced some challenges earlier in the year, are regaining strength and allowing us to allocate exposure that had been temporarily reduced.

It’s important to remember that we can’t predict the future, but for those bullish on the market, there is hope that previously weaker assets will catch up to their stronger counterparts, creating additional returns on the equity side.

On the other hand, real estate securities continue to experience downtrends across both timeframes. As a result, our portfolios will maintain their minimum allocation to this asset class.

Fixed Income & Alternatives

Shifting our focus to fixed income and alternatives, where we’ve seen some notable trends. Unfortunately, fixed income of almost any duration remained weak, with U.S., inflation-protected, and international bonds all in downtrends. As a result, our portfolios will maintain their minimum allocations to fixed income.

Adding to the challenge is the fact that yields remain lower compared to their very short-term counterparts. However, there is a silver lining. Treasuries with less than a year duration continue to offer favorable yields compared to recent history. For example, a six-month Treasury is currently providing an approximate 5.5% yield. Consequently, the primary source of bond exposure in our portfolios will come from this segment.

In terms of alternatives, gold retraced further in June and is now experiencing a downtrend over the intermediate-term timeframe. As a result, our portfolios will be underweight in gold.

Barchart.com, Nasdaq Composite ($NASX), 1/1/2023 to 6/29/2023; Barchart.com, Growth ETF Vanguard (VUG), 1/1/2023 to 6/29/2023; Barchart.com, Value ETF Vanguard (VTV), 1/1/2023 to 6/29/2023; Barchart.com, High Dividend Yield Vanguard ETF (VYM), 1/1/2023 to 6/29/2023; Barchart.com, FTSE Developed Markets Vanguard (VEA), 7/1/2022 to 6/29/2023; and Ycharts.com, 6 Month Treasury Rate (I:6MTCMR), 6/29/2023

3 Potential Catalysts for Trend Changes

Student Loans:

The recent Supreme Court decision blocked the Biden administration’s plan to eliminate federal student debt, affecting millions of borrowers. This plan would have wiped out an estimated $430 billion in loans. Approximately 24.3 million borrowers, accounting for 53% of the total, owe less than $20,000 and would have had their debts erased.

Summer Relief:

Good news for wallets: natural gas prices have significantly dropped compared to last year. Starting the summer at less than half the price, currently around $2.70, it means lower electricity bills for many households when they turn up their air conditioners. This relief also eases cost pressures for industrial companies, including makers of chemicals, cat litter, fertilizer, paper, wallboard, and steel.

Home Prices Lower, But Mortgages Still Expensive:

Home prices have experienced their first year-over-year decline in 11 years. However, higher mortgage rates have made home purchasing more expensive for buyers. The rapid increase in mortgage rates in 2022 resulted in a slowdown in home sales as buyers stepped back from the market. Moreover, higher mortgage rates have made homeowners hesitant to sell, leading to a reduction in housing supply.

The Wall Street Journal, “Who Could Be Left Behind in the Supreme Court’s Student-Loan Ruling, in Six Charts,” 6/29/2023; The Wall Street Journal, “Cheaper Natural-Gas Prices in Store This Summer,” 6/28/2023; Tradingview.com, Natural Gas Futures, 1M, NYMEX” 1/1/2022 to 6/30/2023; and The Wall Street Journal, “U.S. Home Prices Posted First Annual Decline Since 2012 in April,” 6/27/2023

Imagine If Meteorologists Were Accurate 8% of the Time

- We’ll still be in a bear market by year’s end

- The U.S. will fall into a recession in 2023

- The interest rate yield curve will reverse its inversion during the second half of the year

- The U.S. inflation rate ends the year far below expectations

- Healthcare will be the top-performing sector in 2023

- Gold-mining stocks will be among the best-performing industries

- Energy stocks will struggle following a strong year

- Apple will fall below $100

- Toyota will close out 2023 as the world’s largest automaker by market cap

- China stocks will vastly outperform U.S. stocks

- U.S. home prices fall as much as 20%

- A financial crisis will unfold

–Sean Williams, The Motley Fool, 1/8/2023

The good news about making 12 predictions about the markets is that one of them is bound to be correct, right? In this case, energy stocks have indeed struggled (#7) year to date, so with half of the year left, that’s a pace of 8% accuracy. (Also, imagine if meteorologists were only 8% accurate.)

At the end of March, we had a bit of fun making a case for both a bull or bear run in equity markets. In the bull case, we wrote the following:

The fact that material bank issues have done little to alter this pattern of higher lows is arguably the strongest bull case of all. Investors are largely seeing this for what it is – a few banks paying the price for reckless decisions. Sadly, these types of situations have always existed and will likely continue.

There’s a solid argument to make about markets having already priced in all the bear scenarios. With the worst seeming to be behind us in regard to inflation, rate hikes, and banking issues, the markets may be slowly weeding out the remaining bears. In the absence of selling, the markets naturally tend to climb. If we’re about to climb, you want to be on board or get on board.

In last month’s update, we highlighted that only a handful of stocks were driving the major equity indexes higher. In our view, a bifurcation like this isn’t that uncommon. We find that, in time, the leaders tend to fall back to earth or the others start to catch up. Based on June’s performance thus far, it appears the latter is the case.

Price Predicts News

Embracing the power of price, we recognize its ability to guide our investment approach. Our focus on trend-following and simplicity enables us to navigate market trends with confidence and agility.

Rather than relying on subjective opinions or predictions, we let the market’s price movements speak for themselves. By following the trends, we identify opportunities and make informed investment decisions, regardless of the underlying “why.”

As the market confirms trends, we witness the headlines catching up. This approach has allowed us to capture the current uptrend in U.S. stocks, positioning our portfolios for success.

Contrary to widespread recession predictions for 2023, the strong economy has pushed those forecasts to 2024, with little indication of rate cuts. Those who played it safe based on expert opinions may have missed out on significant gains.

We are committed to a process that adapts to market dynamics, providing our clients with a reliable and informed investment strategy.

Stay tuned for more insights and updates on our investment approach in our upcoming Monthly Market Recap.

Fool.com, “12 Stock Market Predictions for 2023,” 1/8/2023 and Cnbc.com, “Forget rate hikes, these analysts are predicting interest rate cuts next year,” 7/1/2022

Disclosures:

Strategic Advisory Partners is an investment advisor registered pursuant to the laws of the state of North Carolina. Our firm only conducts business in states where licensed, registered, or where an applicable exemption or exclusion is afforded. This material should not be considered a solicitation to buy or an offer to sell securities or financial services. The investment advisory services of Strategic Advisory Partners are not available in those states where our firm is not authorized or permitted by law to solicit or sell advisory services and products. Registration as an investment adviser does not imply any level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. For more information, please visit adviserinfo.sec.gov and search for our firm name.

Past performance is not indicative of future results. The material above has been provided for informational purposes only and is not intended as legal or investment advice or a recommendation of any particular security or strategy. The investment strategy and themes discussed herein may be unsuitable for investors depending on their specific investment objectives and financial situation.

Opinions expressed in this commentary reflect subjective judgments of the author based on conditions at the time of writing and are subject to change without notice.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission from Strategic Advisory Partners.