November 2023 Monthly Note

Using History As A Guide, Without Being Married to the Past“The only way to make sense out of change is to plunge into it, move with it, and join the dance.” –Alan Watts

As we’ve chatted with our clients over the past month, one thing stands out: folks are feeling more cautious lately. Negative headlines and market ups and downs can do that. These moments of uncertainty are quite common when the markets get a bit tricky. It’s precisely during these times that we find comfort in our core principles: adaptability, following trends, and sticking to the plan.

At Strategic Advisory Partners, we’re proud of our adaptability. Markets are like a rollercoaster – always changing. Our strategies are built to change with them. While the specific rules we follow don’t shift much, it’s their flexibility that makes them special. We’re big fans of trend following. It’s not just a preference; it’s a deliberate choice. We firmly believe that trends often show the way forward. By riding those trends, we stay in tune with the market’s flow, helping us navigate through all the noise and uncertainty.

Discipline is our secret sauce. It’s what keeps us on track, no matter what’s happening in the markets. Our disciplined approach means we stay rock-solid when things get tough, always sticking to our client commitments and investment principles.

In this month’s investment update, we dive into the nuts and bolts of our systematic investment strategy, shining a light on its core components. We genuinely believe that the timeless principles driving our strategies, when executed with utmost discipline, lead to better outcomes for our investors.

But before we jump into that, let’s talk about what transpired in the markets in October.

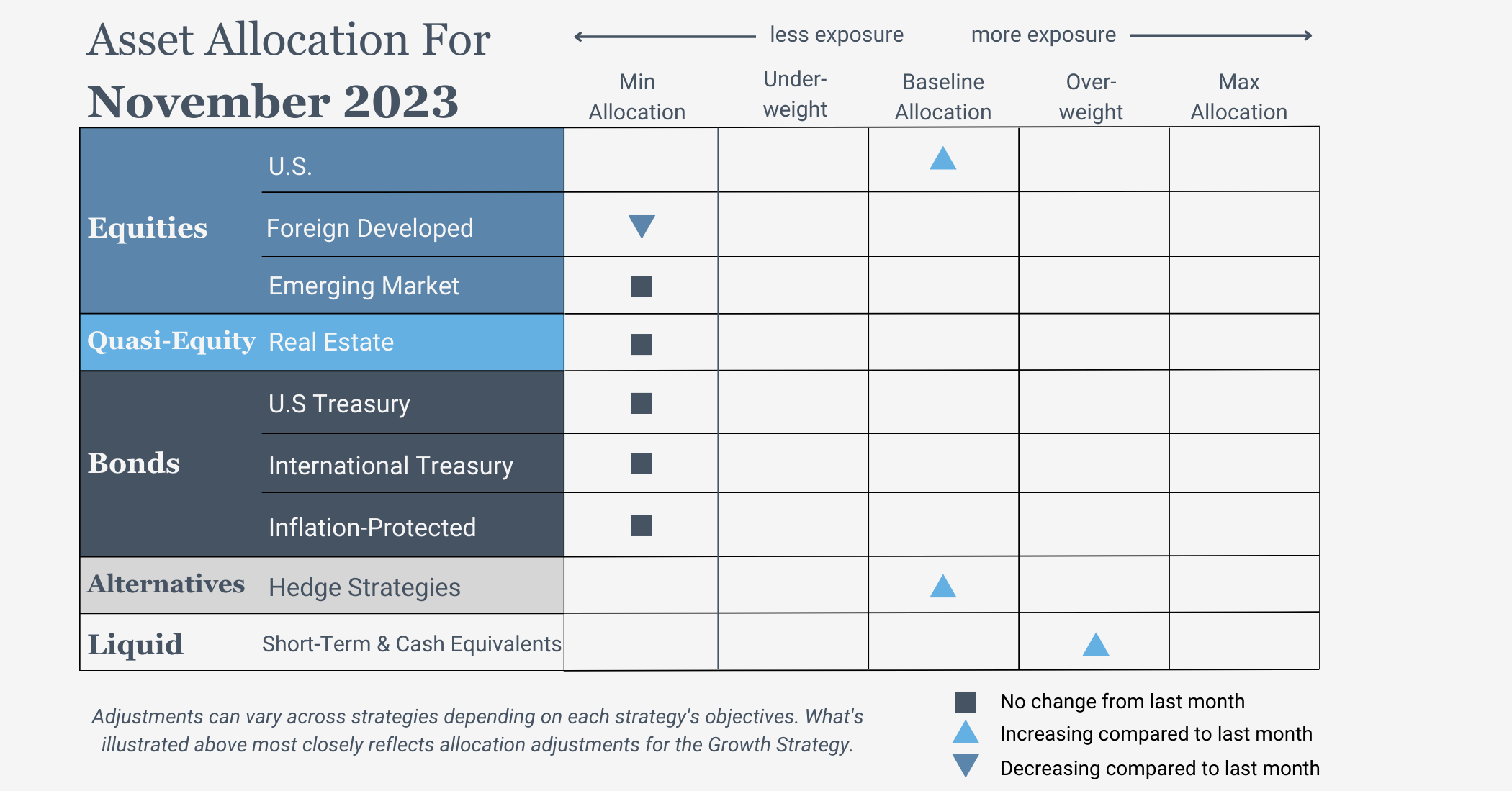

U.S. Equities

Exposure will increase slightly and move to baseline allocation. The intermediate-term trend remains negative, but the long-term trend is positive. As a result, U.S. equities will pick up exposure from weakening international equities. Within the asset class, exposure will remain skewed toward growth and large caps, with almost all other segments in downtrends across both timeframes.

Intl Equities

Exposure will decrease and move to its minimum allocation. Both foreign developed and emerging market equities now have downtrends across both timeframes.

Real Estate

Exposure will not change and is at its minimum allocation due to downtrends across both timeframes.

U.S. & Intl Treasuries

Exposure will not change and is at its minimum allocation due to downtrends across both timeframes.

Inflation-Protected Bonds

Exposure will not change and is at its minimum allocation due to persistent downtrends across both timeframes.

Short-Term Fixed Income

Exposure will increase, as it receives allocations from weaker assets.

Alternatives

Exposure will increase, as gold pushes back into an intermediate-term uptrend to coincide with the long-term uptrend.

Asset Level Overview

Equities & Real Estate

October unfolded with an initial uptick in equity indexes, only to swiftly retrace to levels reminiscent of May. As we bid farewell to this tumultuous month, it’s evident that there were a few bright spots in the equity landscape. Consequently, our portfolios have witnessed a growing prevalence of downtrends and a reduction in exposure. The one exception remains U.S.-large-cap equities, which persist in their long-term uptrend. This translates into a minor uptick in U.S. exposure, reverting to its baseline allocation. The increased exposure will come from weaker international equities, which now reside in downtrends across all timeframes.

It’s crucial to emphasize that November assumes significance in shaping the composition of our portfolios as we approach the close of 2023. If equity prices persist at these levels or undergo further declines, it is increasingly probable that our portfolios will have minimal allocations to equities entering December. Conversely, a November rally would likely maintain exposure at levels akin to our current stance for December, potentially setting the stage for an increase as we enter the new year.

Shifting the focus to real estate securities, October ushered in a decline that saw prices revisiting pre-pandemic levels. While this asset class may hold future potential, the prevailing trend remains firmly entrenched in a downward direction. Consequently, our approach continues to favor real estate only at the strategic minimums.

Fixed Income & Alternatives

A meme recently made its rounds in our office that accurately describes the state of the fixed income markets. In the first panel, a man proudly states that he uses bonds to offset the risk of his stock portfolio. In the second panel, we see a drastic change in his expression as he wonders to himself, “But what offsets the risk of my bond portfolio?”

We have the luxury of being amused by this since our allocations to fixed income of any material duration has been at or near its minimum for almost two years now. Others have not been so lucky. With bond markets continuing to make new lows in this downtrend, we are a long way from adding back on exposure. As a result, our portfolios will continue to benefit from higher yields and lower risk associated with ultra-short-term instruments

On the gold front, exposure will increase. Both intermediate- and long-term trends took a bullish turn in October. Presumably influenced by the escalating Middle East conflicts, gold experienced an uptick, though it has plateaued in recent days, still residing below its 2023 high achieved in the second quarter.

Sourcing for this section:

Barchart.com, Real Estate Vanguard ETF (VNQ), 1/1/2020 to 10/29/2023 and Barchart.com, Gold Trust Ishares (IAU), 1/1/2023 to 10/29/2023

3 Potential Catalysts for Trend Changes

Increasing Costs:

In recent weeks, the U.S. bond market has experienced a significant selloff, resulting in the 10-year U.S. Treasury note yield surging to 5%—a level unseen in 16 years. This upward movement in yields, which occurs when bond prices decline, began gaining momentum in January 2022 when concerns about potential Federal Reserve interest rate hikes to combat inflation emerged.

The recent acceleration of this selloff has been chiefly driven by an expansion in the term premium. This term premium represents the extra compensation investors require for holding longer-dated investments. Economists speculate that this increase might be worth two or three Fed rate hikes.

Government Spending:

Federal Reserve officials acknowledge that elevated long-term bond yields significantly influence their economic forecasts and decisions regarding interest rates. They also say the ballooning federal deficit is a reason yields are rising. Yet, they either cannot or will not explicitly state that political leaders should address this deficit issue.

Citizen Spending:

The U.S. economy witnessed a robust surge in growth during the summer, fueled by consumers who engaged in spending at an unprecedented pace. In the third quarter, GDP expanded at a remarkable seasonally-adjusted annual rate of 4.9%, surpassing the pace set in the second quarter by more than double. However, this economic vigor is met with caution as Americans experienced a 1.0% drop in after-tax, inflation-adjusted income during the third quarter, following a significant increase in the first half of the year. Additionally, savings as a share of income declined in the third quarter. A slowdown in consumer spending would weigh on overall growth because it accounts for the majority of U.S. economic output.

Sourcing for this section:

The Wall Street Journal, “Bond Rout Drives 10-Year Treasury Yield to 5%,” 10/23/2023 and The Wall Street Journal, “U.S. Economy Grew a Strong 4.9%, Driven by Consumer Spree That May Not Last,” 10/26/2023

Simplicity & Consistency

With just two more monthly updates remaining in 2023, we find ourselves reflecting on what has been a year marked by notable shifts in investor sentiment. It is worth noting that even we, as believers in systematic asset management, are not immune to human tendencies such as recency bias, and our perspective may also be shaped by recent events.

However, it is hard to recall a year that has experienced such pronounced swings in sentiment:

- From the fear at the beginning of 2023, driven by memories of 2022’s inflation and interest rate-driven market declines.

- To optimism in the middle of the year, fueled by hopes of declining or stabilizing interest rates and a rally in artificial intelligence and technology.

- Then back to fear, prompted by the looming threat of conflict in the Middle East.

In essence, these shifts can be viewed as variations of fear. Fear of loss replaced by fear of missing out (FOMO), only to return to fear of loss.

Investors develop and evolve their beliefs about markets and money as they grow and mature. These beliefs are often shaped by their environment, which includes family, friends, co-workers, and media exposure.

The challenge lies in filtering out the noise and adhering to a plan, highlighting the vital role of financial advisors. Just as exceptional athletes like Michael Jordan benefit from great coaches like Phil Jackson to win championships, investors often require guidance.

The elegance of systematic trend following lies in its simplicity and consistency. We consider it one of the most adaptable strategies available. It’s a rules-based approach that relies solely on price data as input, engineered for the long term.

Simplicity & Consistency

What is a robust strategy?

The way we define it is one that can stand the test of time. Over many different scenarios, it may never be the best strategy, but it will be skewed toward almost always providing a favorable outcome consistent with a reasonable goal. Based on our research, it will rarely have a negative outcome over a timeframe that matters to achieving the intended goal, and if it does have a negative outcome, it will likely still be better than the alternative.

How is a robust strategy built?

Again, in our opinion, the best way to build a robust strategy is to do it over as much time/data as possible and with as few variables as possible. Using historical data to build a strategy is kind of like what Winston Churchill said about representative democracies: it’s the worst form, except for all the others. The most valuable feature of historical price data is that it gives a window into investor sentiment and behavior in reaction to various events, which in our opinion is really what drives markets. Look no further than 2023.

Having few variables is important because of a statistical concept called degrees of freedom. Degrees of freedom are the maximum number of logically independent variables used to calculate a statistical relationship (i.e., cause and effect). In a large sample, more variables mean more ability to find a significant relationship among the different possibilities. However, in a smaller sample, more variables can increase the ability of randomness to disrupt the model moving forward.

In financial markets, it is difficult to know whether a sample is large enough, so in our opinion, it is better to err on the side of fewer variables. In the end, we are simply modeling investor behavior and incorporating rules to react as it changes. That’s how we build a strategy for the long term.

While a systematic trend-following strategy uses historical price data, it is not married to the past to the same degree as a human-based decision-making process. Think about it this way: a typical investor will make decisions based on all their experience, or at least the moments they recall in a more or less biased way. This can be individual moments, years, or even decades, depending on the individual. Now compare that to the typical trend-following process or even the one we use.

While our rules are developed over many decades, even hundreds of years of data, they never look at more than the last 200 trading days to make decisions in real-time. This means that we are reacting to what is happening at the moment. Not only is the influence of past data minimized, it is outright ignored. In our opinion, this is the best way to build and then execute a robust strategy that can constantly adapt to what is happening in the markets. This is always important but has never been more so than in 2023.

Disclosures:

Strategic Advisory Partners is an investment advisor registered pursuant to the laws of the state of North Carolina. Our firm only conducts business in states where licensed, registered, or where an applicable exemption or exclusion is afforded. This material should not be considered a solicitation to buy or an offer to sell securities or financial services. The investment advisory services of Strategic Advisory Partners are not available in those states where our firm is not authorized or permitted by law to solicit or sell advisory services and products. Registration as an investment adviser does not imply any level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. For more information, please visit adviserinfo.sec.gov and search for our firm name.

Past performance is not indicative of future results. The material above has been provided for informational purposes only and is not intended as legal or investment advice or a recommendation of any particular security or strategy. The investment strategy and themes discussed herein may be unsuitable for investors depending on their specific investment objectives and financial situation.

Information obtained from third-party sources is believed to be reliable though its accuracy is not guaranteed.

Opinions expressed in this commentary reflect subjective judgments of the author based on conditions at the time of writing and are subject to change without notice.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission from Strategic Advisory Partners.

An index is an unmanaged portfolio of specific securities, the performance of which is often used as a benchmark in judging the relative performance of certain asset classes. Investors cannot invest directly in an index. An index does not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown.