November 2022 Monthly Investment Update

Under the Surface of a Bear Market Rally

“…learn enough from history to bear reality patiently, and to respect one another’s delusions.” –Will Durant

There have been a lot of talks this year about uncertainty. Specifically, about how markets hate it. We think it’s beneficial for all investors to remember that the market is comprised of market participants (i.e., people), and it is actually us humans who hate uncertainty. Psychology even defines certainty as an emotional state, not an intellectual one.

In our view, it is a wasted effort to attempt to create certainty, especially in the short run, around outcomes. We can create certainty of process and this is our goal at Strategic Advisory Partners. The irony is that by focusing on the process, you may ultimately improve outcomes. Focusing on the process may not be as emotionally satisfying in the short term, but the long-term results are likely to be improved and more consistent.

In this month’s note, we provide context to the longer-term trend in equities through the lens of our systematic investment process. At the end of the day, our strategies can add tremendous value.

Here’s a summary of what transpired in the markets in October.

U.S. Equities

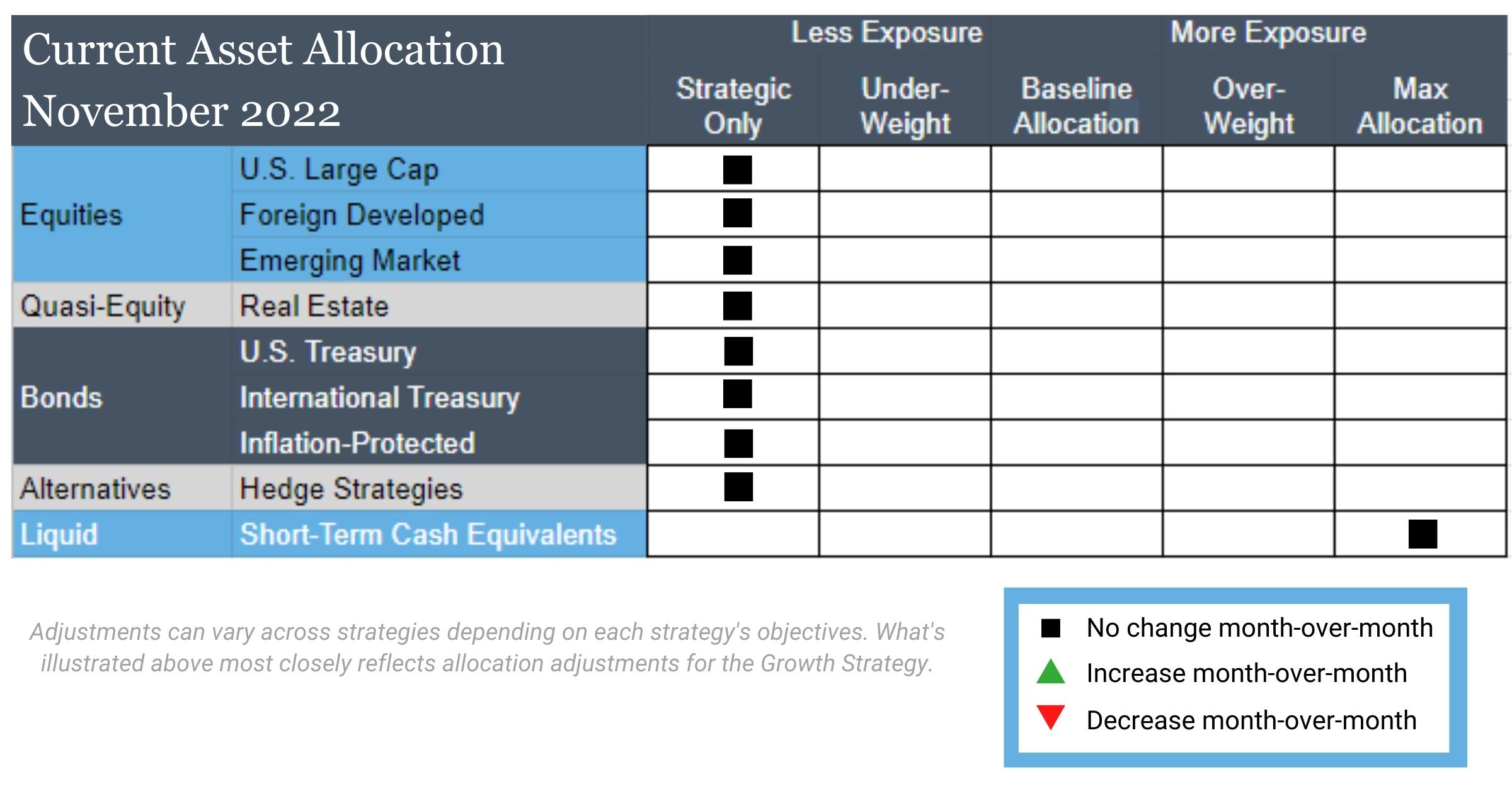

Exposure will not change from its minimum allocation, as both the intermediate- and long-term timeframes remain in downtrends.

Inflation-Protected Bonds

Exposure will not change and is at its minimum due to downtrends across both timeframes.

Intl Equities

Exposure will not change from its minimum allocation, as both foreign developed and emerging markets remain in downtrends across both timeframes.

Alternatives

Exposure will not change and is at its minimum allocation due to downtrends across both timeframes.

U.S. & Intl Treasuries

Exposure will not change and is at its minimum allocation due to downtrends across both timeframes.

Real Estate

Exposure will not change from its minimum allocation, as both the intermediate- and long-term timeframes remain in downtrends.

Short-Term Fixed Income

Exposure will not change, as it is already at its max allocation due to previously taking on exposure from equities, real estate, alternatives, and longer-duration fixed income.

Asset Level Overview

Equities & Real Estate

After making a new annual low early in the month, U.S. equities posted positive returns in October, led by the energy and industrial sectors. However, with the exception of the energy sector, all equity sectors in the U.S. remain entrenched in downtrends. As a result, all our portfolios will continue to have minimal exposure at the asset class level. Within strategies and products that incorporate single stocks, exposure will increase, particularly within U.S. small- and mid-caps.

Looking internationally, developed economies experienced rising equity prices in October. Conversely, emerging markets are on pace to experience yet another down month, led by weakness in Chinese stocks, which are closing the month near 15-year lows. Overall, our portfolios continue to be minimally exposed to international stocks and will do so until conditions improve.

Real estate securities managed to eke out a small gain on the month, but conditions continue to be difficult. As inflation continues to run historically high, correspondingly higher interest rates have had a considerable negative effect on U.S. and global real estate. Our portfolios remain at their minimum exposure to this asset class.

Fixed Income & Alternatives

What can you say about fixed income, except that things are UGLY? While some pockets, such as inflation-protected and global bonds stopped dropping, for now, U.S. bonds are on pace for another down month. This asset class seems intent on challenging stocks for worst-performing, which surprised many investors given its historically low-volatility characteristics. Our portfolios remain at minimum exposure across all areas of fixed income except ultra-short duration.

Gold specifically, and commodities more broadly, continued to drift sideways to lower with the obvious exception being energy. While less weak than other assets, gold has not done enough to warrant uptrends. All portfolios remain at their minimum allocation.

3 Potential Catalysts for Trend Changes

Rinse, Repeat

The Federal Reserve is set to increase the baseline interest rate by 0.75% for the fourth time at their Nov. 1-2 meeting. According to the Wall Street Journal, officials plan to discuss whether to slow the pace of rate increases in the future. Some members of the Federal Reserve are wary that they may be pushing the economy too far, which could tip the United States into a recession, depending on your definition of “recession”…

Elevator Down

The housing market continues to trend down. Rising mortgage rates and concerns about recession have caused buyers to scale back, sending home sales and prices down from their atmospheric levels. The S&P CoreLogic Case-Shiller National Home Price Index fell 1.1% in August from July, the biggest decline since 2011.

Bigger Deductions!

One positive side effect of rampant inflation is that the IRS is raising tax brackets and standard deductions by 7%. The standard deduction will climb to $27,700 for married couples and $13,850 for individuals, allowing taxpayers to shield more of their earnings from higher income taxes. The threshold for the estate tax also jumped to $12.92 million for 2023.

Under the Surface of a Bear Market Rally

“We must all suffer one of two pains: the pain of discipline or the pain of regret.” –Jim Rohn

Right on cue from last month’s Note, U.S. stocks produced a noticeable bear market rally in October. On the surface, this was a reprieve from the steady drumbeat of declining prices experienced so far in 2022.

It takes only a cursory look beneath the surface to realize that little has changed over the last 30 days. From a fundamental perspective:

- Inflation data continues to come in higher than expected.

- Rates continue to rise as a result.

- Russia continues to wage war with Ukraine.

- Oil prices remain relatively high with plenty of support for even higher prices.

- Oh, and throw in the uncertainty of a coming election in the U.S.

You have plenty of ingredients for continued weakness in capital markets.

Our systematic investing approach, which takes a quantitative look at price trends, reinforces the unfavorable economic and political climate. Our trend signals turned down before the fundamental data reflected the dire conditions. Since the end of January, we have been generally underweight equities. We have been at our minimum allocations since the end of April.

Despite the increases in October, major indexes, year-to-date continue to repeat the same patterns of new lows followed by lower highs. Until this cycle is broken, our research and systematic investing rules tell us that moving equity exposure back to our baseline allocations is simply too much risk for the potential reward.

When you are exposed to falling asset prices and have no plan for how to respond, years like 2022 can be agonizing. That’s typical of bear markets.

Our strategies are different because they follow repeatable rules for making allocation decisions, and we are able to clearly communicate the how and why behind our positioning. Now and for future environments. This is important because sometimes investors incorrectly project future performance based on what they feel right now. If they see one of our strategies down double digits, they might infer a certain level of negative performance for the future. Most of our risk-managed asset allocation and single stock strategies are beating their appropriate benchmarks year-to-date by several hundred basis points.

It is important for our clients to understand that even though we fell by a certain amount in January, it doesn’t mean that’s how we are positioned now. The beauty of systematic investing, powered by trend following, is that our positioning can change quickly depending on market conditions. Since we’re transparent about our process and positioning, you can verify we’re walking the walk for yourself: just ask to see how different our positioning for January 2022 was compared to where we’ll be in November, and we’ll happily show you.

We can’t predict if declines will continue. Historical data makes us believe that a portfolio with low equity exposure and mostly allocated to ultra-short-term bonds, as we have now, will experience only a fraction of the decline if markets close 2022 in the same manner they have acted all year. We are content with our allocations because we know that, just like we quickly reduced exposure earlier this year, we will increase it if things suddenly improve. Not only does this keep us positioned well but also gives us great peace of mind.

We view one of the most impactful elements of our investment process to be its repeatable, consistent infrastructure. An analogy we often use is that we want to operate like a utility. For example, electricity makes our lives better in countless ways, and we only stop to think about it when it’s missing. That is how we want our investment process to work in terms of ubiquitous risk management: it should deliver a few negative outlier events or times when the lights don’t turn on. We also want our service model to operate like a utility for our client partners: dependable, consistent, and trustworthy.

Disclosures:

Strategic Advisory Partners is an investment advisor registered pursuant to the laws of the state of North Carolina. Our firm only conducts business in states where licensed, registered, or where an applicable exemption or exclusion is afforded. This material should not be considered a solicitation to buy or an offer to sell securities or financial services. The investment advisory services of Strategic Advisory Partners are not available in those states where our firm is not authorized or permitted by law to solicit or sell advisory services and products. Registration as an investment adviser does not imply any level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. For more information, please visit adviserinfo.sec.gov and search for our firm name.

Past performance is not indicative of future results. The material above has been provided for informational purposes only and is not intended as legal or investment advice or a recommendation of any particular security or strategy. The investment strategy and themes discussed herein may be unsuitable for investors depending on their specific investment objectives and financial situation.

Opinions expressed in this commentary reflect subjective judgments of the author based on conditions at the time of writing and are subject to change without notice.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission from Strategic Advisory Partners.