“A masterly retreat is in itself a victory.” –Norman Vincent Peale

At Strategic Advisory Partners, we pride ourselves on our ability to navigate the ever-changing investment landscape with a unique perspective – one that might, at first glance, seem a bit survival-focused. Phrases like “survive and advance” and “live to play another day” are part of our everyday vocabulary, not because we’re pessimistic, but because we’re committed to rationality and objectivity when it comes to managing risk.

As dedicated trend followers, we understand that measured losses are a natural part of our investment strategy. Our approach isn’t about ego or attempting to predict the unpredictable. We don’t engage in battles with the market or get lost in endless what-if scenarios. Instead, we remain steadfast in our pursuit of repeatable and consistent execution.

For us, trend following is not just a strategy; it’s a philosophy rooted in the concept of survivability. While we may encounter occasional minor setbacks, we firmly believe that this approach shields us from catastrophic losses. It’s about ensuring that we remain active participants in today’s financial landscape so that we can seize the opportunities that tomorrow holds.

In this month’s update, we’ll delve into our strategy for reducing equity risk as we approach October. We’ll also explore one of the key advantages of our systematic investment process: having an adaptable plan that evolves alongside the ever-shifting market dynamics. With our well-defined rules, we never find ourselves in a position of uncertainty. Yet, we acknowledge that following these rules is not always a straightforward task.

Here’s a summary of what transpired in the markets for September.

U.S. Equities

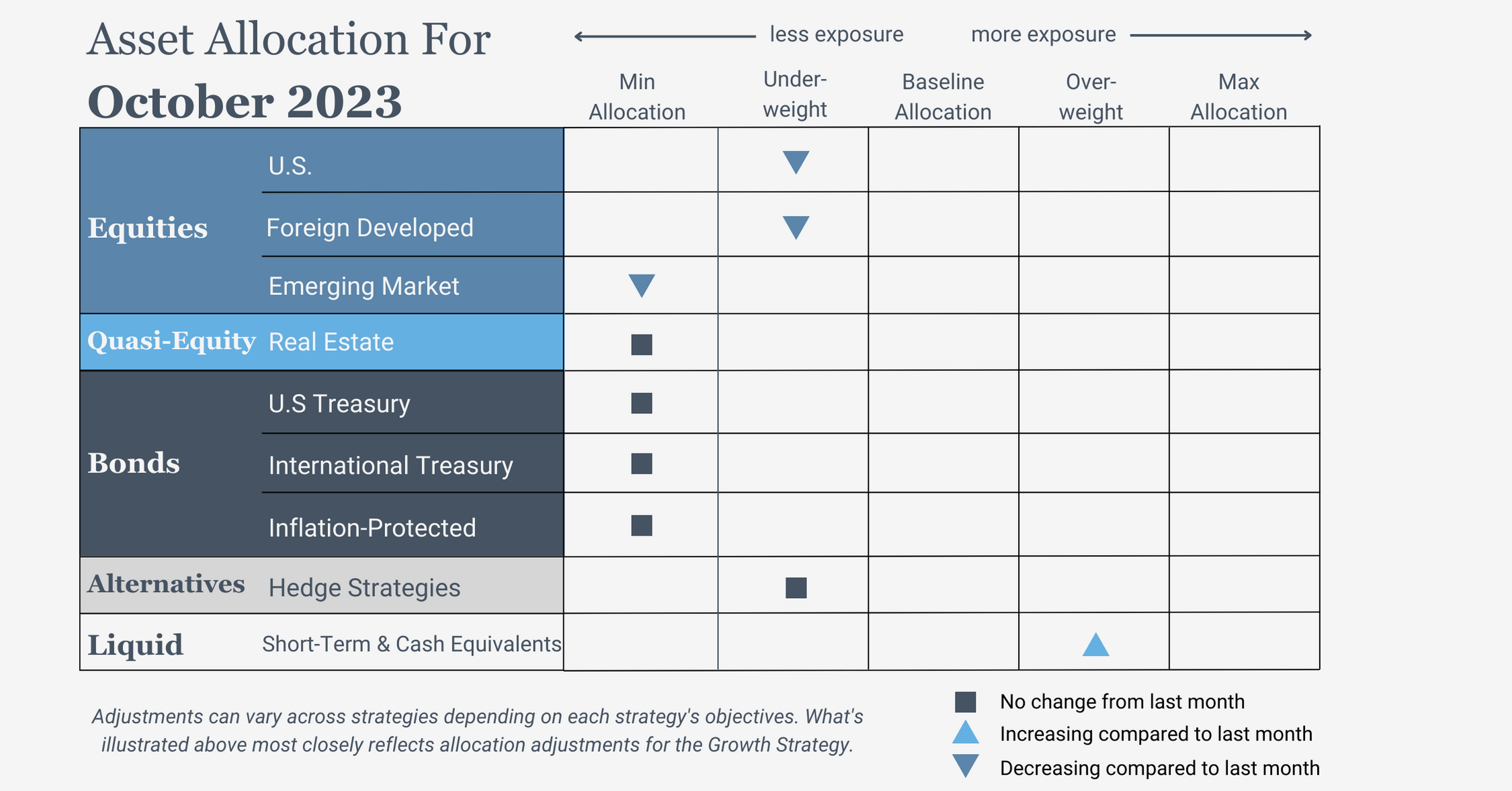

Exposure will decrease and move to underweight. The intermediate-term trend has turned negative, and a portion of the allocation will revert to Treasury bills. The long-term trend remains positive. Within the asset class, exposure will remain skewed toward growth and large caps, which are stronger than value, small caps, and mid caps.

Intl Equities

Exposure will decrease and remain underweight. Both foreign developed and emerging market equities continue to experience intermediate-term downtrends. For emerging markets, the long-term trend is now also negative.

Real Estate

Exposure will not change and is at its minimum allocation due to downtrends across both timeframes.

U.S. & Intl Treasuries

Exposure will not change and is at its minimum allocation due to downtrends across both timeframes.

Inflation-Protected Bonds

Exposure will not change and is at its minimum allocation due to persistent downtrends across both timeframes.

Short-Term Fixed Income

Exposure will increase, as it receives allocations from weaker assets across the spectrum.

Alternatives

Exposure will not change, as gold continues to couple an intermediate-term downtrend with a long-term uptrend.

Asset Level Overview

Equities & Real Estate

As we step into the final quarter of 2023, September saw a continuation of the equity story we witnessed in August. Major equity indexes experienced declines, with tech and growth sectors taking a notable hit. Year-to-date returns show a mixed picture: most equity indexes remain in positive territory, while value and dividend-oriented segments are trailing behind. In contrast, growth, tech, and large-cap indexes maintain their positive annual gains.

A recent two-month retracement has pushed various segments of U.S. equities into an intermediate-term downtrend. Although the long-term trends are still generally positive, this shift in intermediate-term dynamics prompts us to reduce exposure across our portfolios.

International equities have faced a somewhat more favorable situation in the last sixty days but have also seen declines. Due to their initial weaker position compared to U.S. equities, international markets have more swiftly entered downtrends. Emerging markets have returned to downtrends across both short and long timeframes; a trend that has been recurrent since late 2021. Foreign developed markets maintain a long-term uptrend for now, resulting in milder exposure reductions.

Real estate securities find themselves hovering near their 2022 and one-year lows. This is somewhat surprising, given the strong performance of certain equity segments in 2023. However, narratives surrounding inflation and interest rates have weighed on this asset class. Consequently, our portfolios will maintain their minimum exposure levels.

Fixed Income & Alternatives

The same forces affecting real estate have left their mark on fixed income. Across various duration segments, trends continue to be negative, and our allocations remain conservative. Ultra-short-term fixed-income instruments remain the favored beneficiary from an exposure perspective. They will not only maintain their prominent position in our portfolios but increase due to reallocating exposure from weaker equity assets.

Gold exposure will remain steady, with the intermediate-term trend staying in negative territory while the long-term trend remains positive.

Sourcing: Barchart.com, Nasdaq Composite ($NASX), 9/1/2023 to 9/28/2023; Barchart.com, Growth ETF Vanguard (VUG), 9/1/2023 to 9/28/2023; Barchart.com, Value ETF Vanguard (VTV), 1/1/2023 to 9/28/2023; Barchart.com, High Dividend Yield Vanguard ETF (VYM), 1/1/2023 to 9/28/2023; and Barchart.com, Real Estate Vanguard ETF (VNQ), 1/1/2022 to 9/28/2023

3 Potential Catalysts for Trend Changes

The Newest Shutdown Standoff:

U.S. House Speaker Kevin McCarthy punted on a potential government shutdown by funding a short-term bill that will keep the government running for the next 45 days or so. All eyes are now on the negotiations between the divided Congress in hope of avoiding a work stoppage. If the parties are unable to come to an agreement, we could see federal employees furloughed just in time for the holidays. Such an event would lead to the partial closure of federal agencies and the temporary suspension of pay for federal workers and active-duty military personnel.

Ramifications for the Fed:

The Federal Reserve is currently navigating the challenging task of curbing inflation while avoiding economic upheaval. An extended government shutdown could add an extra layer of complexity to this already delicate balancing act. If Congress fails to pass a funding measure before the next deadline, the shutdown could disrupt the regular release of critical economic data related to wages, employment, inflation, and output.

Sluggish Hiring and Legal Battles:

This year, the race to hire warehouse workers and package carriers for the holiday season is noticeably slower compared to the previous year. Companies in the logistics and fulfillment sector are maintaining a conservative hiring approach due to lingering concerns about consumer spending. In a separate development, Amazon finds itself in legal hot water as the Federal Trade Commission, along with 17 states, has filed a lawsuit against the e-commerce giant. The lawsuit alleges that Amazon unlawfully leverages monopoly power to artificially inflate prices, lock sellers into its platform, and undermine its competitors.

Having A Plan Is Excellent, But It Is No Panacea

This famous quote aptly illustrates the reality that while having a plan is undoubtedly valuable, it’s not a cure-all for the challenges of investing. At Strategic Advisory Partners, we emphasize that a plan, no matter how meticulously crafted, is only as effective as the conviction and discipline behind it.

In the world of investing, markets are in a constant state of flux, and even the most well-thought-out strategies can face tests. September provided a poignant example of this. In the previous month’s note, we discussed our risk handoff strategy and how it led to a shift in allocations from international equities to U.S. equities. While this strategy often proves rewarding as we seek stronger, positively trending markets, it’s essential to recognize that this isn’t always the case. The last thirty days of U.S. equity performance serve as a reminder of the challenges inherent in trend following.

These challenges are embraced because they’re an integral part of our investing strategy. We accept defined, measured losses for several reasons. One key reason is that when you deviate from a well-designed quantitative system, you risk significant deviations from the desired outcome. Small compromises can lead to cascading effects, jeopardizing the entire system.

Looking ahead to October, we maintain our commitment to our system and, accordingly, are reducing exposure to U.S. equities, despite their strong performance in 2023. This decision isn’t made lightly, but it is an essential part of our disciplined process.

Fortunately, our portfolios are well-positioned for October. Treasury bill rates have reached their highest levels since January 2001, and our equity exposure is strategically positioned to benefit from a potential reversal upward. If equity markets continue to decline, we anticipate that our portfolios will outperform. Conversely, if equities rally, we are well-prepared to capitalize on the opportunities in the final months of 2023.

Our plan, patience, and discipline are continuously tested, but our confidence in our approach remains unwavering.

Sourcing: Fred.stlouisfed.org, 3-Month Treasury Bill Secondary Market Rate, Discount Basis (DTB3), 9/26/2018 to 9/26/2023

Disclosures:

Strategic Advisory Partners is an investment advisor registered pursuant to the laws of the state of North Carolina. Our firm only conducts business in states where licensed, registered, or where an applicable exemption or exclusion is afforded. This material should not be considered a solicitation to buy or an offer to sell securities or financial services. The investment advisory services of Strategic Advisory Partners are not available in those states where our firm is not authorized or permitted by law to solicit or sell advisory services and products. Registration as an investment adviser does not imply any level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. For more information, please visit adviserinfo.sec.gov and search for our firm name.

Past performance is not indicative of future results. The material above has been provided for informational purposes only and is not intended as legal or investment advice or a recommendation of any particular security or strategy. The investment strategy and themes discussed herein may be unsuitable for investors depending on their specific investment objectives and financial situation.

Information obtained from third-party sources is believed to be reliable though its accuracy is not guaranteed.

Opinions expressed in this commentary reflect subjective judgments of the author based on conditions at the time of writing and are subject to change without notice.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission from Strategic Advisory Partners.

An index is an unmanaged portfolio of specific securities, the performance of which is often used as a benchmark in judging the relative performance of certain asset classes. Investors cannot invest directly in an index. An index does not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown.