August 2022 Monthly Investment Update

Inaction is a Form of Action

“Books serve to show a man that those original thoughts of his aren’t very new after all.”

― Abraham Lincoln

Over the past several months, we have consistently been asked if 2022 is unique in market history.

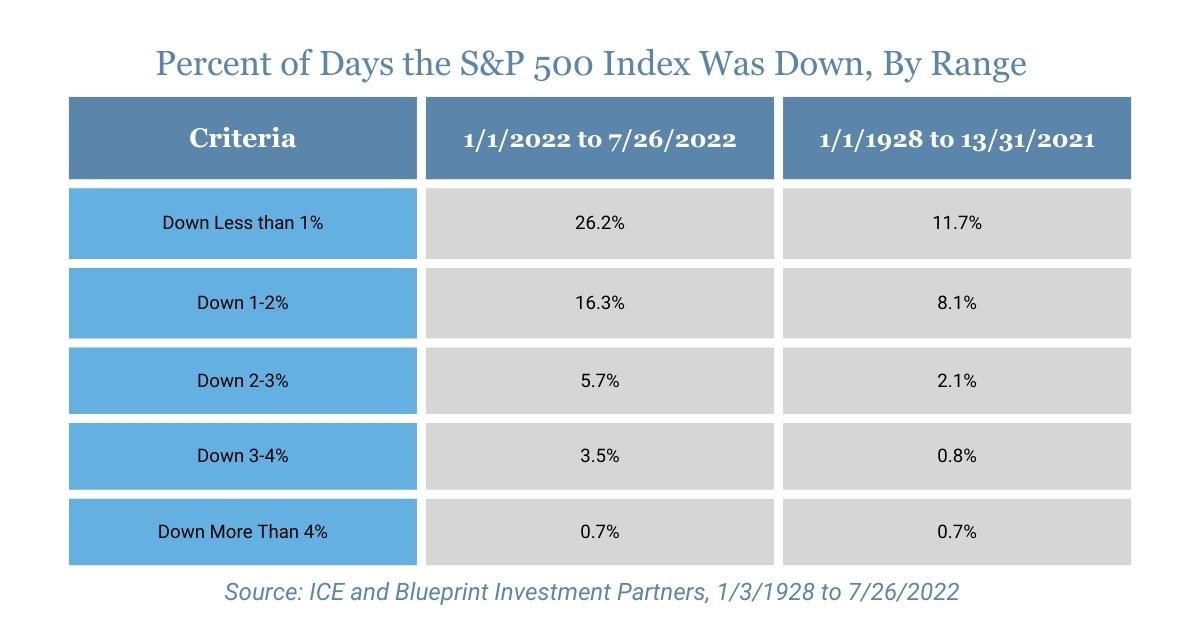

As a systematic investing manager, we rest on data. So, we looked at the percentage and magnitude of negative days so far this year to at least get started down the path to answering this question. Below is a table showing the percentage of days the S&P 500 was negative within certain ranges so far in 2022 and during the prior 94 years of data.

As the data illustrates, we can say that 2022 has been unique in terms of its downside volatility, as measured by the portion of days with performance down 1% or worse. In fact, the percentage of days thus far that performed worse than -2% is more than double the historical average.

In this month’s Note, we continue to make the case for patience relative to increasing equity exposure. In our view, the historical cost of investing when an asset is in downtrends outweighs the benefit over the long run. We describe our current defensive positioning and discuss how, for us, inaction equates to taking an offensive posture.

But first, here’s a summary of our take on what transpired in the markets in July.

U.S. Equities

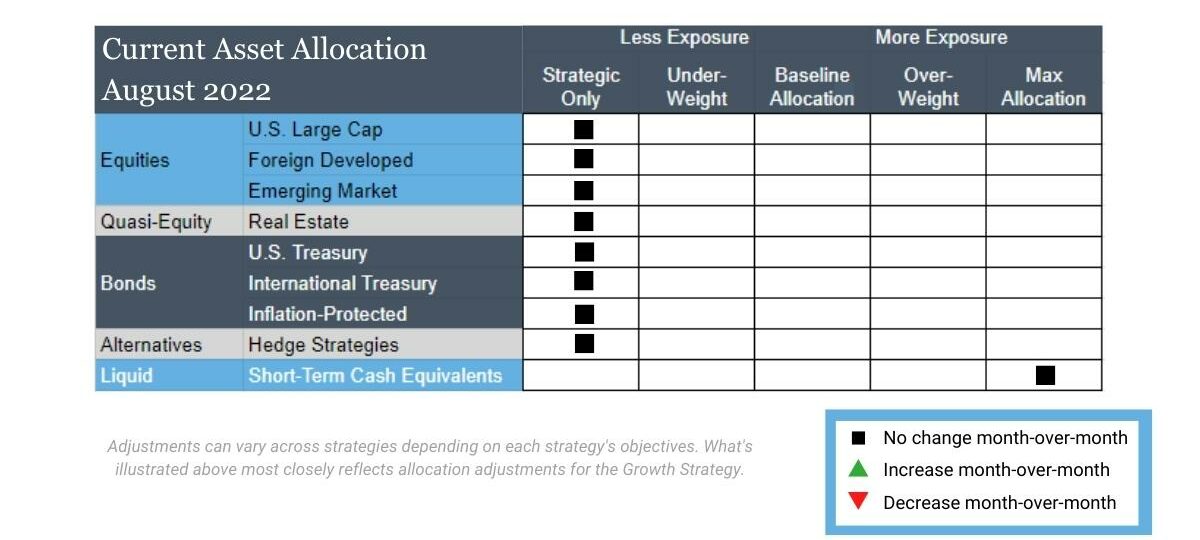

Exposure will not change from its minimum allocation, as both the intermediate- and long-term timeframes remain in downtrends.

Inflation-Protected Bonds

Exposure will not change and is at its minimum due to downtrends across both timeframes.

Intl Equities

Exposure will not change from its minimum allocation, as both foreign developed and emerging markets remain in downtrends across both timeframes.

Alternatives

Exposure will not change and is at its minimum allocation due to downtrends across both timeframes.

U.S. & Intl Treasuries

Exposure will not change and is at its minimum allocation due to downtrends across both timeframes.

Real Estate

Exposure will not change from its minimum allocation, as both the intermediate- and long-term timeframes remain in downtrends.

Short-Term Fixed Income

Exposure will not change, as it is already at its max allocation due to previously taking on exposure from equities, real estate, alternatives, and longer-duration fixed income.

Asset Level Overview

Equities & Real Estate

In July, the decline in U.S. equity markets paused. The S&P 500 managed a modest gain and, perhaps more importantly, avoided a new low for only the third month in 2022. As the month concludes, U.S. stocks are on pace for their best monthly showing of the year. Growth stocks, which have been the most battered, were a top-performing domestic equity class in July. That said, all segments and classes remain entrenched in downtrends. As a result, all our portfolios remain at their minimum allocations.

Emerging markets held up slightly better than domestic equities during the declines in June, but international equities (both emerging and foreign developed) performed worse than their U.S. counterparts in July. In fact, both developed and emerging markets experienced new 2022 lows, further reinforcing the current downtrends. A minimal rebound to close the month helped but has done nothing to change the current picture. Not surprisingly then, all our portfolios remain at their minimum allocations to international stocks.

Like U.S. equities, real estate stocks stabilized temporarily in July, producing positive returns. Despite borrowing costs being almost double what they were a year ago, the supply of housing and other real estate remains tight, which continues to support high prices. While the pause in declining returns is favorable for investors, it is not enough to produce uptrends. Thus, all our portfolios remain minimally allocated to this segment.

Fixed Income & Alternatives

While hardly cause for celebration, certain segments of the fixed income spectrum are moving closer to approaching their longer-term averages. When things have been as bad as they have for this asset class, any evidence of improvement is welcome. In fact, as July comes to a close, the U.S. Aggregate Bond Index represented by AGG, is trading above its 50-day exponential average for the first time in 2022. While these moves are necessary to establish uptrends, they are not sufficient thus far. As a result, all our portfolios remain at their minimum allocation to fixed income.

Last month we noted the paradox of seeing gold move into downtrends across all timeframes despite so many factors that would seemingly support positive returns. Not surprisingly, the establishment of downtrends led to accelerating declines in July, as gold posted new two-year lows. All portfolios will continue to be at their minimum allocation, accordingly.

3 Potential Catalysts for Trend Changes

Economy Slowing:

New applications for unemployment benefits reached their highest point since late last year, a sign the tight labor market is slowly loosening. Initial jobless claims, a proxy for layoffs, rose to a seasonally adjusted 251,000 in the week that ended July 16, up from 244,000 the week prior, according to a report from the Labor Department. These levels are above the 2019 pre-pandemic weekly average of 218,000, when the labor market was also strong, and the figures are the highest since last November.

Housing Slowing:

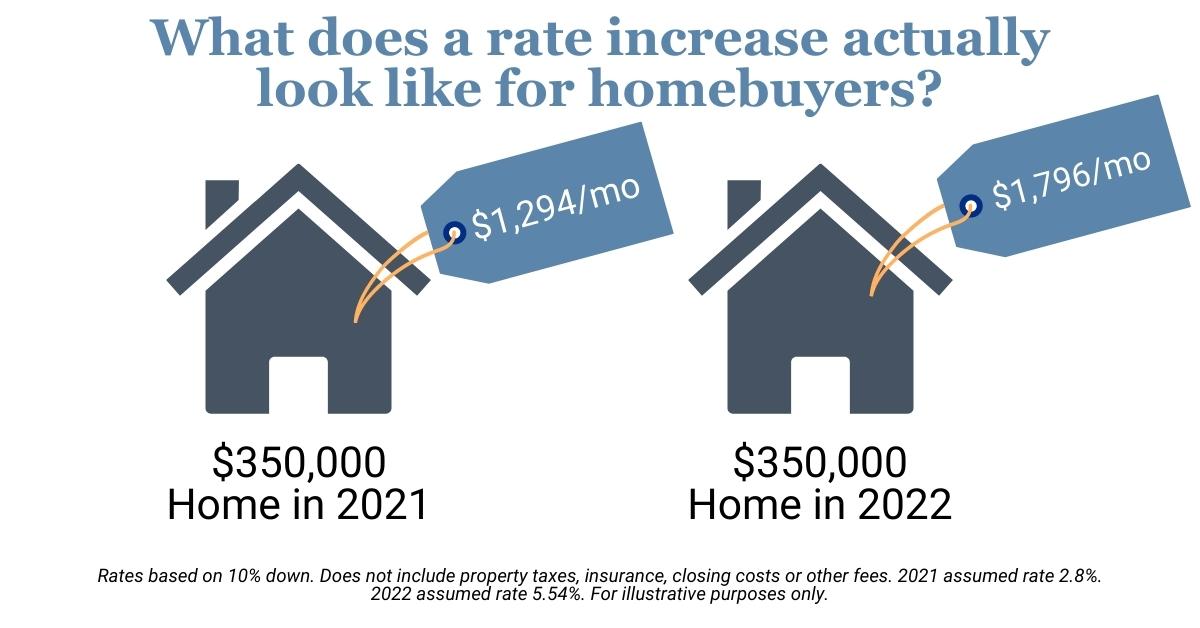

Mortgage rates continue to climb, with the average rate on a 30-year fixed-rate up to 5.54%, as reported by mortgage-finance giant Freddie Mac. That is up from 5.51%, which was reported earlier this month, but below the 13-year high of 5.81% recorded in June. A year ago, rates were around 2.8%. The U.S. housing market has slowed significantly after two record years. Refinance activity was 80% lower and purchase activity was 19% lower than the same week last year.

Inflation Slowing:

There is more data suggesting that price pressures are easing, and June’s 9.1% increase in consumer prices could be the peak. However, even if inflation does decrease with the next report, economists expect a slow pace of decline. Gasoline prices have fallen around 10% from their mid-June high point, wheat futures prices have fallen by 37% since mid-May, and corn futures prices are down 27% from mid-June. “It’s a step in the right direction, but ultimately, even if June is the peak, we’re still looking at an environment where inflation is too hot,” says Sarah House, senior economist at Wells Fargo, who expects fourth-quarter inflation to be 7.5% to 7.8%. “So peak or not, inflation is going to remain painful through the end of the year.”

Dog Days of Investing

“Move not unless you see an advantage; use not your troops unless there is something to be gained; fight not unless the position is critical”

—Sun Tzu, “The Art of War”

We are officially in the dog days of summer here in the U.S. with hot, humid conditions sweeping most of the country. If you’re like us, you have started to dream of those crisp fall mornings. Perhaps it’s fitting then that we also happen to be in what we would consider to be the dog days of trend following.

Allow us to explain.

The beauty of systematic investing is that if you are doing it correctly there is no need for angst about your next move with portfolios. All of that is resolved in the building phase, which for us was almost 20 years ago now. Once you have a robust process, you simply follow the rules and focus all your energy on execution and longer-term enhancements.

If you are a systematic investor who also happens to take defensive positions when equities are declining globally, like 2022, then there comes a point when you have made all the moves you can. From there, you wait.

As we close July and enter August, that is precisely where we sit. We’re waiting.

Much like the repetition of muggy summer days, mostly sitting out of the market and watching as it moves sideways or even rallies before making new lows starts to feel a little mundane. Even for a firm like ours, that prides itself on downside protection, it is much more fun to watch account values increase than sit and wait. Avoiding losses while markets are falling mathematically has the same impact on your rate of compounding as outperforming to the upside, but it certainly doesn’t feel as fun and exciting.

This takes us to the selected quote (above) for this month’s Note, as well as our recent blog about the side effects of investing during downtrends. Put plainly, the historical cost of investing when stocks are in downtrends outweighs the benefit, in our opinion. It’s kind of like what my parents used to say, “Nothing good happens if you are out past midnight.” We think the same thing can be said for investing in downtrending assets.

In times like this, we’re also reminded of the ever-present question related to trend following: If it’s so great, why doesn’t everyone do it? We think the answer is tied to how much discipline and patience it takes to always follow the data. For non-trend-followers, the allure of trying to pick a bottom is very strong, not just because of what it can do to account value if their guess is correct but also because of how it strokes the ego. But the reality is this: sometimes during bear markets, the better bet is to wait out counter-trend rallies. Take the bursting of the tech bubble as an example. The Nasdaq experienced a more than 70% decline from peak to trough, but it also had rallies of 40%, 28%, 41%, 50%, and 36%. Given the ultimate decline, peak to trough, it paid to largely sit on the sidelines despite these massive bear market rallies. How nearly impossible of a task it would have been to perfectly time each of those rallies while avoiding the subsequent declines, we think this example highlights why patience is prudent.

As we approach August, there are some names in our single stock strategies that appear close to switching to uptrends. If they do so before July closes, we will begin to participate in these stocks. However, for the most part, our best action at this time is inaction. Patience is indeed a virtue during bear markets.

It is also worth noting that we take heart in the fact that things can change quickly. It typically takes only 30 or so days for our more responsive rules to engage, which would soon have us participating in any burgeoning uptrends. Our longer-term rules are of course less responsive, but that allows for trends to “prove themselves.”

In conclusion, we hope our clients are enjoying their summers, spending extra time with family, and resting in the process we have created. We continue to vigilantly monitor our systems and stand ready to engage when conditions are favorable. For now, however, we wait.

Disclosures:

Strategic Advisory Partners is an investment advisor registered pursuant to the laws of the state of North Carolina. Our firm only conducts business in states where licensed, registered, or where an applicable exemption or exclusion is afforded. This material should not be considered a solicitation to buy or an offer to sell securities or financial services. The investment advisory services of Strategic Advisory Partners are not available in those states where our firm is not authorized or permitted by law to solicit or sell advisory services and products. Registration as an investment adviser does not imply any level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. For more information, please visit adviserinfo.sec.gov and search for our firm name.

Past performance is not indicative of future results. The material above has been provided for informational purposes only and is not intended as legal or investment advice or a recommendation of any particular security or strategy. The investment strategy and themes discussed herein may be unsuitable for investors depending on their specific investment objectives and financial situation.

Opinions expressed in this commentary reflect subjective judgments of the author based on conditions at the time of writing and are subject to change without notice.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission from Strategic Advisory Partners.