January 2023

Monthly Investment Update

Even When Traveling Through a Storm, Some Paths Are More Pleasant Than Others

“It can be very expensive to try to convince the markets you are right.” –Ed Seykota

We can’t control the market. This should be self-evident, but it doesn’t always feel that way. How many times are you convinced that the market will do X, only to have it do Y? The cost of this inherent flaw in our DNA is not just to our egos; future financial well-being is also at stake. Many people did not expect the market environment we saw in 2022.

As a systematic investing firm, Strategic Advisory Partners and our investment process have no expectations. In fact, our only expectation is that our process will be executed with intense discipline and focus.

This doesn’t mean that we like bear markets. The reality is that our team, as humans, are just as prone to emotional biases about the market as anyone. Fortunately, our systematic investment process is not.

In this monthly note, we discuss our systematic investing process in the context of 2022’s market environment. While the short-term destination is out of our hands, we think we have more control over the long-term outcome and the ride to get there. In our estimation, utilizing a rules-based process provides investors with a more pleasant experience and path.

Here’s a summary of what transpired in the markets in December.

U.S. Equities

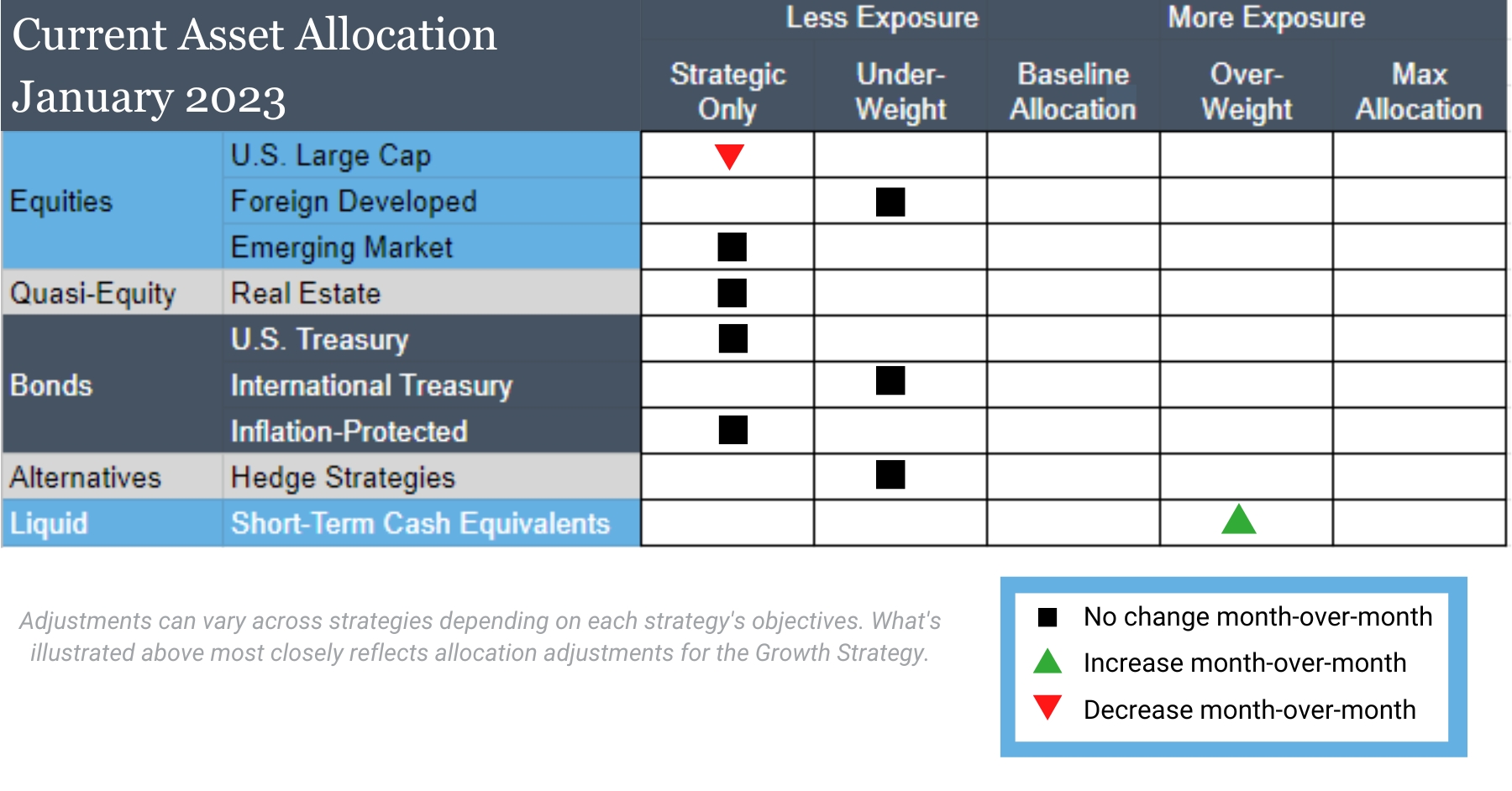

Exposure will decrease as the intermediate-term timeframe reverts to a downtrend. The long-term timeframe remains in a downtrend.

Inflation-Protected Bonds

Exposure will not change and is at its minimum allocation due to downtrends across both timeframes.

Intl Equities

Exposure will not change, as foreign developed continues to experience an intermediate-term uptrend; their long-term trend remains negative. Emerging markets remain in downtrends across both timeframes.

Alternatives

Exposure will not change, as gold continues to have an intermediate-term uptrend but the long-term timeframe remains in a downtrend.

U.S. & Intl Treasuries

Exposure will not change, as international Treasuries maintain their intermediate-term uptrend; their long-term trend remains negative. Both timeframes for U.S. Treasuries remain negative.

Real Estate

Exposure will not change from its minimum allocation, as both the intermediate- and long-term timeframes remain in downtrends.

Short-Term Fixed Income

Exposure will increase, as it takes on exposure from U.S. equities.

Asset Level Overview

Equities & Real Estate

The promise of a prolonged Santa Claus rally was dashed after November’s strong close resulted in yet another failed high in December. The December decline is enough to send U.S. equities back into a downtrend in the intermediate timeframe, joining the long-term downtrend. Our portfolios will move further underweight in response.

International equities also declined in December, but developed markets managed to maintain their intermediate-term uptrend. Exposure in our portfolios will not change.

After flirting with a trend change, emerging markets continued to experience downtrends, which means our portfolios will remain at or near their minimum allocation.

Our portfolios hold minimum allocations to real estate securities, as they continue to be weaker than their equity counterparts both domestically and internationally. Until some light is visible at the end of the rate hike tunnel, it will be a challenge for this asset class to produce meaningful positive attribution.

Fixed Income & Alternatives

Many bond instruments briefly produced their first uptrends in 2022 over relatively shorter timeframes. However, that quickly faded with declines forcing downtrends as we ended the year. International bonds continue to maintain an intermediate-term uptrend but will remain underweight in the portfolios given their long-term downtrend.

Gold maintains its steady climb from early November lows and is at its highest level since around summertime. Last month we increased exposure due to the emergence of an intermediate-term uptrend. If the trend continues, gold is on pace for a long-term uptrend at some point in January. For now, exposure remains unchanged and underweight but is poised to increase further.

3 Potential Catalysts for Trend Changes

Declining Population Growth:

America’s population grew 0.4% this year, per Census Bureau figures released this month. The latest data shows a continuing trend of historically slow growth, which adds pressure to a tight labor market.

The U.S. added 1.3 million people in the year that ended July 1 for a total population of 333.3 million. That includes 245,000 more births than deaths, a surplus that has long supplied much of the nation’s growth.

The other component is net migration, which measures people moving in and out of the country. This figure grew by 1 million. Long-term economic growth is heavily dependent on population growth.

Declining Spending:

Consumer spending and business demand softened late this year, while inflation eased, indicating a slowing U.S. economy. Personal spending increased 0.1% in November from the prior month, which is a significant pullback from the 0.9% increase in October. Households increased spending on services while decreasing on goods. The spending was flat when adjusted for inflation.

Declining Home Sales:

Existing-home sales in the U.S. slid in November for a 10th straight month. The latest data extends a record streak of declines. Sales of previously owned homes declined 7.7% in November from the prior month, which is a 35.4% decline from a year prior. This streak of declines is the longest on record in data that goes back to 1999. The Federal Reserve has raised rates seven times this year to combat high inflation by slowing spending, hiring, and investment. As a result, mortgage rates have climbed to above 7% in early November from 3.1% at the end of 2021.

If Trend Following Is So Great, Why Doesn’t Everyone Do It?

Regardless of their merits, all investment processes have imperfections and, at times, challenge the conviction of their investors and creators. Acknowledging that reality is part of the journey to successful implementation.

The most common question we receive when sharing our investment strategy is “If it’s so great, why doesn’t everyone do it?”

Let’s start with these two facts:

1. You cannot time the market.

2. You cannot predict the future.

Understanding this, we must acknowledge that investing with emotional bias will have negative long-term consequences on returns.

Having a systematic approach that can fundamentally remove emotion and rely on irrefutable data will then, by its very nature, improve long-term results. With clear rules and actions around inflection points, the guesswork of “when,” “how,” and “how much” is eliminated from the investment philosophy. Rigorous backtesting can confirm outcomes and assure the investor that future performance can likely be duplicated.

Our style of systematic investing can, at times, challenge your discipline. 2022 might be a good example:

- Closing 2021 at all-time highs in U.S. equities meant maximum exposure for our strategies entering the new year.

- When markets subsequently declined, our strategies participated in stage 1 of that decline before cutting exposure.

- From the middle of the first quarter until the fourth quarter, the strategies spent their time protecting capital and outperforming their respective benchmarks.

- The fourth quarter brought a rally from lows in October, followed by another decline in December. This meant our strategies went from being fully defensive to having marginally higher equity exposure during the quarter. The end result is that calendar year absolute returns generally exceed benchmarks but not by the margins seen at the Q3 lows in equities.

A skeptic might look at the 2022 performance print and ask, “What’s the big deal about trend following?”

Looking at one snapshot in time, they might have an argument. But that’s a little like judging a painting that is still in progress.

A more granular view of 2022 reveals that a trend-following process, even one with a long bias like ours, spent much of the year outperforming benchmarks – and by significant margins at times. Consider the following graph, which displays the rolling 3-month total equity exposure for the Tactical Balanced Strategy against its baseline allocation.

Tactical Balanced Strategy

Rolling Equity Exposure vs. Baseline Allocation

![chart[24] - Read-Only](https://strategicadvisorypartners.com/wp-content/uploads/2023/01/chart24-Read-Only-pdf.jpg)

Source: Strategic Advisory Partners, 1/1/2022 to 12/31/2022

Once downtrends emerged as a result of January, the strategy steadily reduced equity exposure and spent almost the year well below its baseline allocation.

Even in a year when the destination wasn’t great (i.e., negative returns), the ride was much better for investors than a traditional approach.

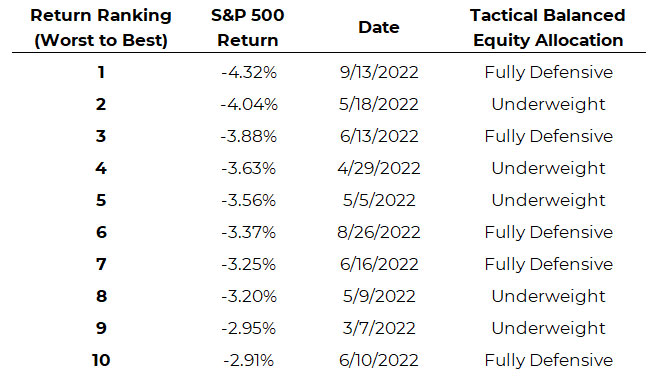

The data below demonstrates “the ride” in terms of the relative equity exposure of the Tactical Balanced Strategy during the S&P 500’s worst 10 performance days of 2022.

Tactical Balanced Strategy

Positioning During S&P 500’s Worst 10 Days of 2022

Source: ICE and Strategic Advisory Partners, 1/3/2022 to 12/28/2022

History shows the worst days in equities tend to occur after downtrends emerge. 2022 was no exception. As we’d expect in these conditions, the 10 worst days coincided with our strategies being underweight equity exposure or fully defensive.

Underweight and defensive positioning helped lower the volatility and drawdown levels in our portfolios, and there was the added benefit that we were able to communicate plans and actions to our clients at every turn. We believe the ability to take decisive action and communicate the rationale clearly is a tremendous benefit of our approach because it can put clients at more ease than simply repeating the mantra of, “Hang in there! The market always comes back!”

This approach reinforces what matters most to us at Strategic Advisory Partners: serving our clients. Without you, we wouldn’t get to do what we enjoy the most. We are invigorated and excited about what 2023 has in store. We will continue to execute our strategies and look for innovative ways to serve our clients well.

Disclosures:

Strategic Advisory Partners is an investment advisor registered pursuant to the laws of the state of North Carolina. Our firm only conducts business in states where licensed, registered, or where an applicable exemption or exclusion is afforded. This material should not be considered a solicitation to buy or an offer to sell securities or financial services. The investment advisory services of Strategic Advisory Partners are not available in those states where our firm is not authorized or permitted by law to solicit or sell advisory services and products. Registration as an investment adviser does not imply any level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. For more information, please visit adviserinfo.sec.gov and search for our firm name.

Past performance is not indicative of future results. The material above has been provided for informational purposes only and is not intended as legal or investment advice or a recommendation of any particular security or strategy. The investment strategy and themes discussed herein may be unsuitable for investors depending on their specific investment objectives and financial situation.

Opinions expressed in this commentary reflect subjective judgments of the author based on conditions at the time of writing and are subject to change without notice.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission from Strategic Advisory Partners.