“We know that we don’t know.” –Larry Hite

In our perspective, the unsung hero of systematic investing lies in its ability to allow successful strategies to continue working without bias towards predictions or emotions.

A systematic investment process is specifically designed to achieve this. Our aim is to maximize compounding rates and maintain consistently high returns.

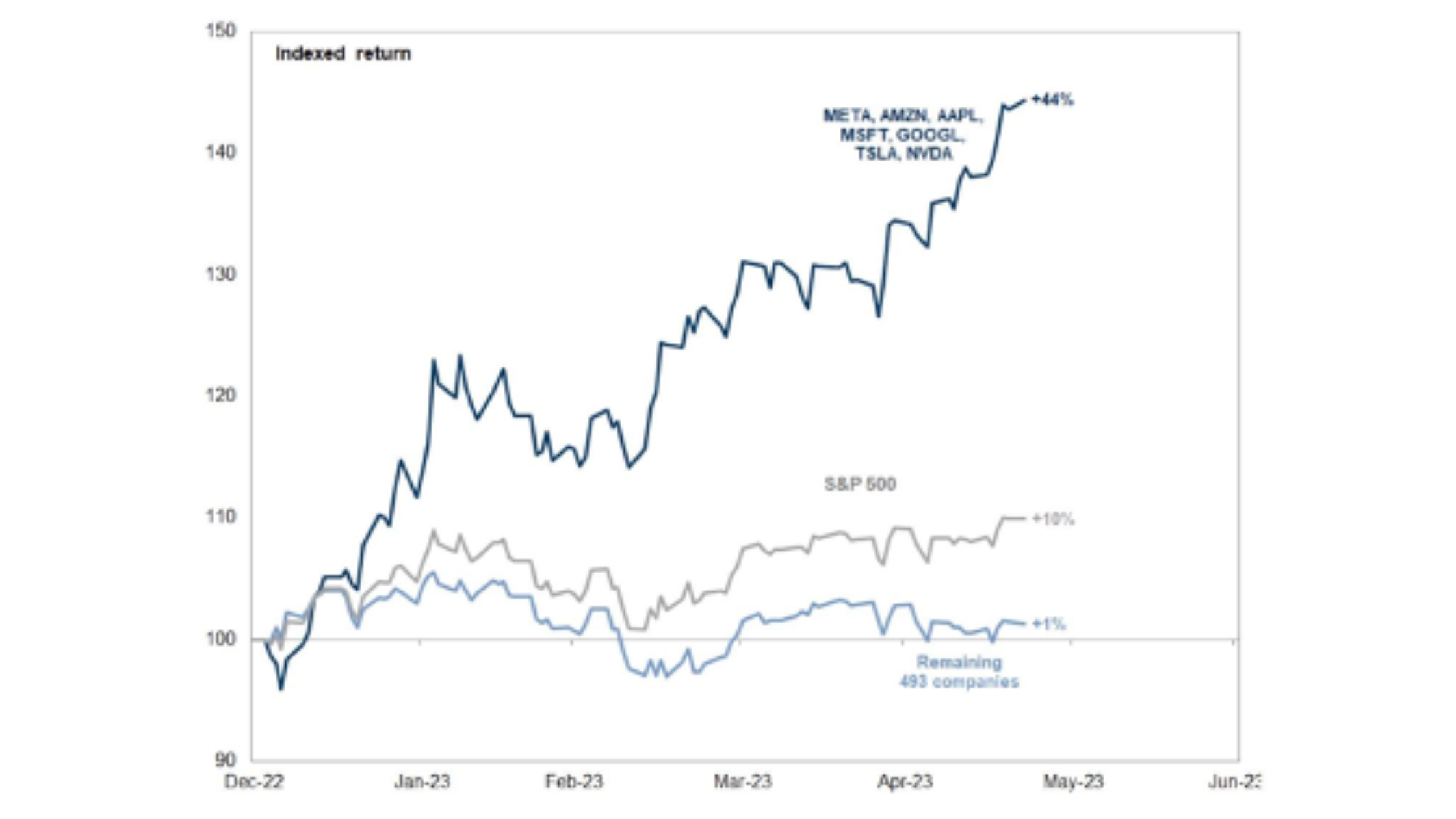

In a year like 2023, this aspect of trend following becomes particularly crucial. Thus far, a few outliers have influenced the major stock indices, while most stocks have experienced stagnation. This divergence can be observed by comparing the performance of equal-weighted and market-cap-weighted S&P 500 indices (1).

In this month’s Investment Update, we delve into how our systematic investment strategies have adapted to the market conditions witnessed thus far in the year. We recognize that trend-following strategies are not flawless, nor are they intended to be. However, based on our experience, they generally position you with a higher probability of capitalizing on what is working, regardless of the prevailing market environment.

We invite you to read our Investment Update to gain insights into how systematic investing can provide an advantage in capturing market trends and optimizing investment outcomes. Stay informed and make the most of what the markets offer.

U.S. Equities

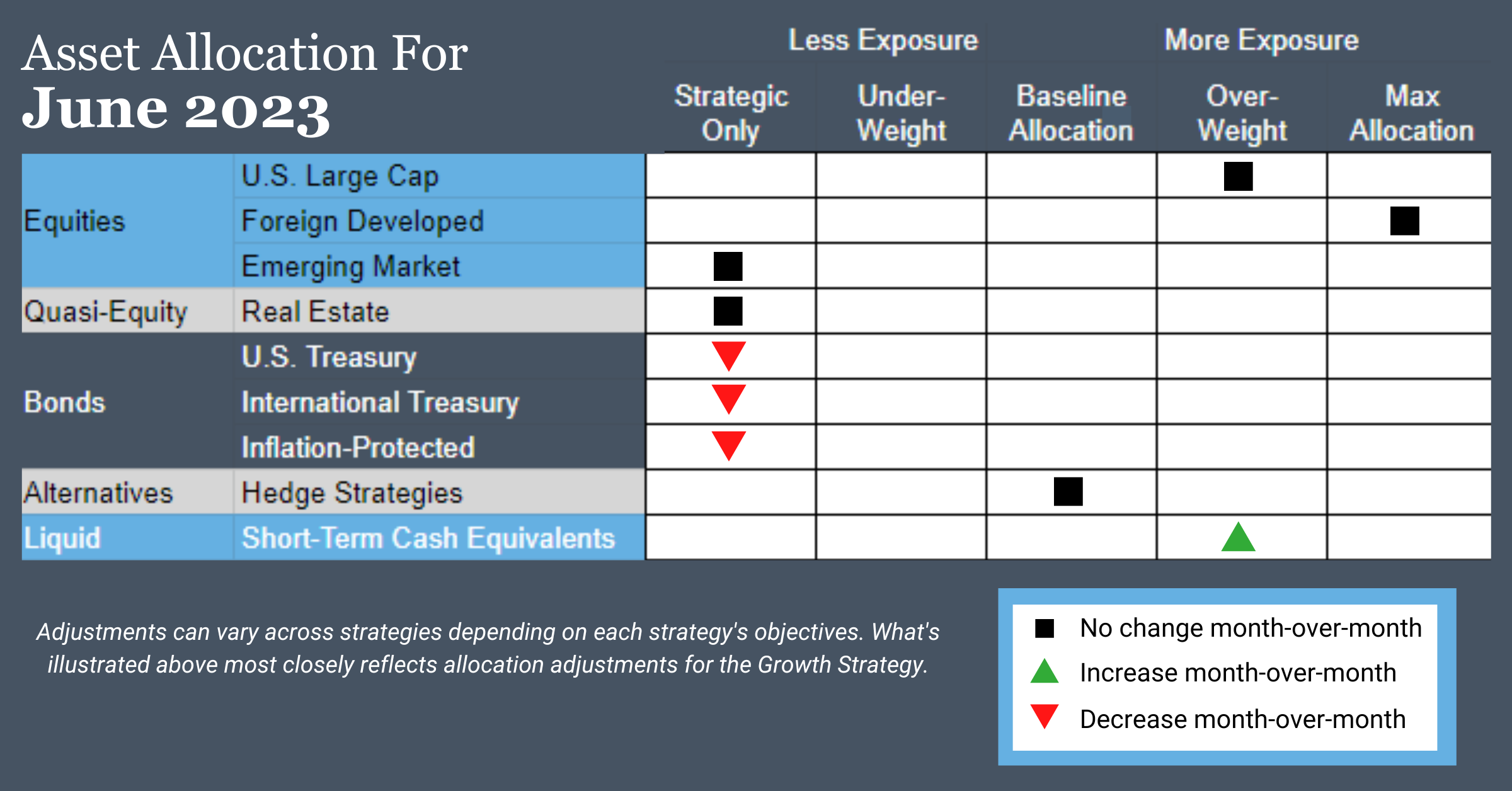

Exposure will not change. Both the intermediate-term and long-term timeframes remain in uptrends, and the asset class continues to be overweight due to taking on exposure from weaker real estate earlier this year. Within the asset class, exposure remains skewed toward growth and large caps, which are stronger than value, small-caps, and mid-caps.

Intl Equities

Exposure will not change. Foreign-developed equities continue to experience uptrends across both timeframes while emerging market equities continue to have downtrends.

Real Estate

Exposure will not change, with downtrends across both timeframes.

U.S. & Intl Treasuries

Exposure will decrease and remain underweight. Both U.S. and international bonds now have downtrends across both timeframes.

Inflation-Protected Bonds

Exposure will decrease to its minimum as the intermediate-term trend joins the long-term trend in negative territory.

Short-Term Fixed Income

Exposure will increase, as it receives allocations from weaker U.S., international, and inflation-protected bonds.

Alternatives

Exposure will not change. The baseline allocation for gold is also our highest limit, so we are already at the maximum allocation as the asset class continues to experience uptrends over both timeframes.

Asset Level Overview

Equities & Real Estate

Last month, we discussed the narrow trading range in U.S. markets, which was one of the tightest ranges we’ve seen in the past 30 years. In May, the S&P 500 Index briefly reached a new year-to-date high before quickly returning to the range that has characterized most of 2023.

Looking at U.S. equities as a whole, we continue to observe positive trends. Larger technology companies and growth-oriented stocks remain the strongest performers across all timeframes, while value, mid-caps, and small-caps show downtrends.

For June, we anticipate similar results to May, with an overweight exposure to U.S. equities, particularly in large caps, technology, and growth sectors.

In terms of foreign-developed equities, May did not witness a new high for the year, but prices traded near the upper range of 2023. Uptrends persist for now, leading us to maintain maximum exposure to these markets. However, emerging markets remain in downtrends across both short and long-term periods, resulting in minimal exposure.

Real estate securities continue to experience downtrends, and as a result, our systematic investing portfolios remain allocated at their minimum level.

Fixed Income & Alternatives

In terms of fixed-income investments, May did not favor any significant duration. Across various timeframes, ranging from long-term (20+ years) to short-term (1-3 years), prices either shifted back into downtrends or showed signs of moving in that direction. This trend was observed not only in domestic fixed income but also in international and inflation-protected bonds. Certain segments, such as 20+ years Treasuries, even approached their lowest levels of 2023.

On the positive side, yields remained relatively favorable compared to recent history. Treasury bonds with durations of less than a year provided yields surpassing 4%. However, high inflation eroded some of these benefits. As a result, our systematic investing portfolios reflect an underweight exposure to bonds with durations over 1 year and an overweight exposure to shorter-term bonds.

Gold experienced a retracement in May but continues to maintain uptrends. It has been one of the leading asset classes in 2023 and will continue to have maximum exposure within our systematic investing portfolios.

As always, we closely monitor market conditions and trends to inform our investment strategies. These adjustments in our portfolios aim to align with the prevailing dynamics and optimize outcomes for our clients (2).

3 Potential Catalysts for Trend Changes

Housing Prices:

The national median existing-home price fell in April from a year prior. It was the steepest year-over-year price decline since January 2012. A steep rise in mortgage rates since the start of 2022 has made home purchasing less affordable to most buyers and brought down demand. Another issue is a shortage of inventory, which is limiting options for future home-buyers.

Financial Well-Being:

Results of a fall 2022 survey by the Federal Reserve were released in May and indicated that Americans have significantly less confidence in their financial well-being, as high inflation eroded earnings and savings. The survey found that rising prices left more families in an economically precarious place, despite households being able to benefit from a strong labor market. Adults reporting being worse off financially in 2022 than a year earlier climbed to 35%, which was the highest on record going back to 2014.

Less School, More Money:

More high-school graduates are skipping college and going straight into blue-collar jobs. The college enrollment rate for recent U.S. high-school graduates, ages 16 to 24, declined to 62% last year from 66.2% in 2019. College enrollment has declined by about 15% in the past decade. Meanwhile, the unemployment rate for teenage workers, ages 16 to 19, fell to a 70-year low of 9.2% last month, which is fueling larger pay increases (3).

The S&P 7 Versus The S&P 493

Having the best player on the basketball court often increases your chances of winning. This has been evident throughout our lifetime, with standout players like Kareem and Magic for the Lakers, Bird for the Celtics, MJ (the best of all time… just sayin’) for the Bulls, as well as Shaq, Kobe, and LeBron.

While there have been exceptions, and arguments can be made, from the Bad Boy Pistons to the early 2000s Pistons, and the Raptors in recent years, we can still see another example of a team with arguably the best player, like two-time MVP Nikola Jokic, contending for a title this year.

As the NBA Finals approach in June, we can draw an interesting parallel to the current market situation. If you have the “best” stocks in your portfolio, you are likely having a successful year and making progress toward your goals. On the other hand, if you don’t, it may be time to reassess your strategy, similar to NBA general managers who missed the playoffs or were eliminated.

Just like in basketball, having the right players (or stocks) can greatly impact your performance. Stay informed, make wise choices, and work towards achieving your financial objectives.

The S&P is having a fairly good year, but that is being almost entirely driven by just a few stocks.

Source: Twitter.com, @Growth_Value_, 5/26/2023

We think the above is an amazing graphic display of the power of leaning into the best-performing names. Just seven names in a portfolio of 500 stocks have returned 44%, with the remaining returning 1%.

Now, before you beat yourself up for not owning one or more of the best seven, you should remember that even Cathie Wood sold NVDA in January.

The takeaway is this: If you are relying on your intuition or research skills and not a systematic investing process for determining which stocks to own, then you are doing yourself a disservice.

We are fond of saying, “If it isn’t repeatable, it isn’t useful,” and that, “Consistently good beats occasionally great.” Our systematic investing approach for owning funds, stocks, and bonds is based on those principles. Our trend-following process isn’t perfect and can’t make guarantees, but in our experience, we think it improves the odds of owning strong stocks like The S&P 7 and minimizing exposure to some of The S&P 493.

Our systematic investing portfolios have owned many, but not all, of The S&P 7 for most of 2023.

Tesla, for example, has generated most of its 2023 return while in a deep downtrend due to taking a beating in 2022. We ignored most of the first portion of 2023’s increase and just recently started dipping our toes back in. During the stock’s decline in 2022, we were generally out of Tesla, which is an equally important point to note, in our view.

Do The Ordinary Better Than Anyone Else

Chuck Noll, the coach who led the Pittsburgh Steelers to four Super Bowl victories, once shared a profound insight: “Champions are champions not because they do anything extraordinary, but because they do the ordinary things better than anyone else.” We believe this principle applies to systematic investing.

A systematic investing approach is not about doing something extraordinary or relying on a magical solution. It’s a straightforward and repeatable process that can be easily understood. However, in our opinion, it is the most suitable approach for achieving long-term financial goals. It provides a higher probability of benefiting from favorable market movements while also avoiding significant downturns.

By focusing on consistent execution and diligently following the process, systematic investing increases the likelihood of success over the long run. It emphasizes the importance of doing ordinary things exceptionally well, rather than relying on unpredictable strategies or attempting to time the market.

When it comes to investing, simplicity, discipline, and a long-term perspective often yield the best results. Embracing a systematic investing process can provide you with a reliable framework for navigating the markets and working towards your financial objectives (4).

Sourcing for section (1):

Yardeni Research, Inc., “Performance 2023 S&P 500 Sectors and Industries,” 5/23/2023; Barchart.com, S&P 500 EW Invesco ETF (RSP), 5/30/2023; and Barchart.com, S&P 500 EW Invesco ETF (RSP), 5/30/2023

Sourcing for section (2):

Barchart.com, S&P 500 Index ($SPX); 1/1/2023 to 5/24/2023; Barchart.com, Nasdaq QQQ Invesco ETF (QQQ), 1/1/2023 to 5/25/2023; Barchart.com, Growth ETF Vanguard (VUG), 1/12023 to 5/25/2023; Barchart.com; FTSE Developed Markets Vanguard (VEA), 1/1/2023 to 5/26/2023; Barchart.com, 20+ Year Treas Bond Ishares ETF (TLT), 1/1/2023 to 5/24/2023; Morningstar.com, SPDR® Blmbg 1-3 Mth T-Bill ETF, 5/26/2023; and Barchart.com, Gold Trust Ishares (IAU), 1/1/2023 to 5/25/2023

Sourcing for section (3):

The Wall Street Journal, “Home Prices Posted Largest Annual Drop in More Than 11 Years in April,” 5/18/2023; The Wall Street Journal, “Inflation Hit Americans’ Finances Last Year, Fed Finds,” 5/22/2023; and The Wall Street Journal, “More High-School Grads Forgo College in Hot Labor Market, 5/29/2023

Sourcing for section (4):

Fortune.com, “Cathie Wood says ARK dumped Nvidia shares before 160% surge because it’s ‘just pivoting’ to other A.I. plays,” 5/26/2023 and Barchart.com, Tesla Inc (TSLA), 1/1/2022 to 5/26/2023

Disclosures:

Strategic Advisory Partners is an investment advisor registered pursuant to the laws of the state of North Carolina. Our firm only conducts business in states where licensed, registered, or where an applicable exemption or exclusion is afforded. This material should not be considered a solicitation to buy or an offer to sell securities or financial services. The investment advisory services of Strategic Advisory Partners are not available in those states where our firm is not authorized or permitted by law to solicit or sell advisory services and products. Registration as an investment adviser does not imply any level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. For more information, please visit adviserinfo.sec.gov and search for our firm name.

Past performance is not indicative of future results. The material above has been provided for informational purposes only and is not intended as legal or investment advice or a recommendation of any particular security or strategy. The investment strategy and themes discussed herein may be unsuitable for investors depending on their specific investment objectives and financial situation.

Opinions expressed in this commentary reflect subjective judgments of the author based on conditions at the time of writing and are subject to change without notice.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission from Strategic Advisory Partners.