March 2023

Monthly Investment Update

Hunting For Weeds So the

Flowers Can Bloom

“Beware the investment activity that produces applause; the great moves are usually greeted by yawns.” –Warren Buffett

In honor of Berkshire Hathaway’s annual letter being released this past weekend, we thought the best way to introduce this monthly note was to borrow brilliance from the man often known as the world’s greatest investor. In this year’s letter, Warren Buffett highlighted a few of Berkshire’s most impactful investments during the last 58 years. In his customary way, he informed and educated investors and shareholders alike about timeless principles.

For us, we can’t help but read the annual report (or anything else, really) through the lens of trend following. And, in our view, trend following shares many of the timeless virtues espoused by famous investors like Warren and Charlie Munger of Berkshire, as well as Howard Marks of Oaktree Capital. The excerpt that stood out the most to us from the 2023 letter was in Warren’s discussion about the distribution of investment outcomes.

In trend following parlance, this quote describes the notion of cutting your losses short, and letting your winners ride. In practice, trend followers do not allow the weeds to wither; instead, we go hunting for weeds to remove. But the idea that over the long run a few winners generate the lion’s share of gains is spot on. A systematic investing process attempts to put you in a position of the highest probability of success by using the information you have in the moment. No predictions, gut feelings, or prognostications.

In this monthly note, we look at the current environment as a good news/bad news scenario and discuss the merits of systematic investing through the framework of risk management and timeframe selection.

Here’s a summary of what transpired in the markets in February.

U.S. Equities

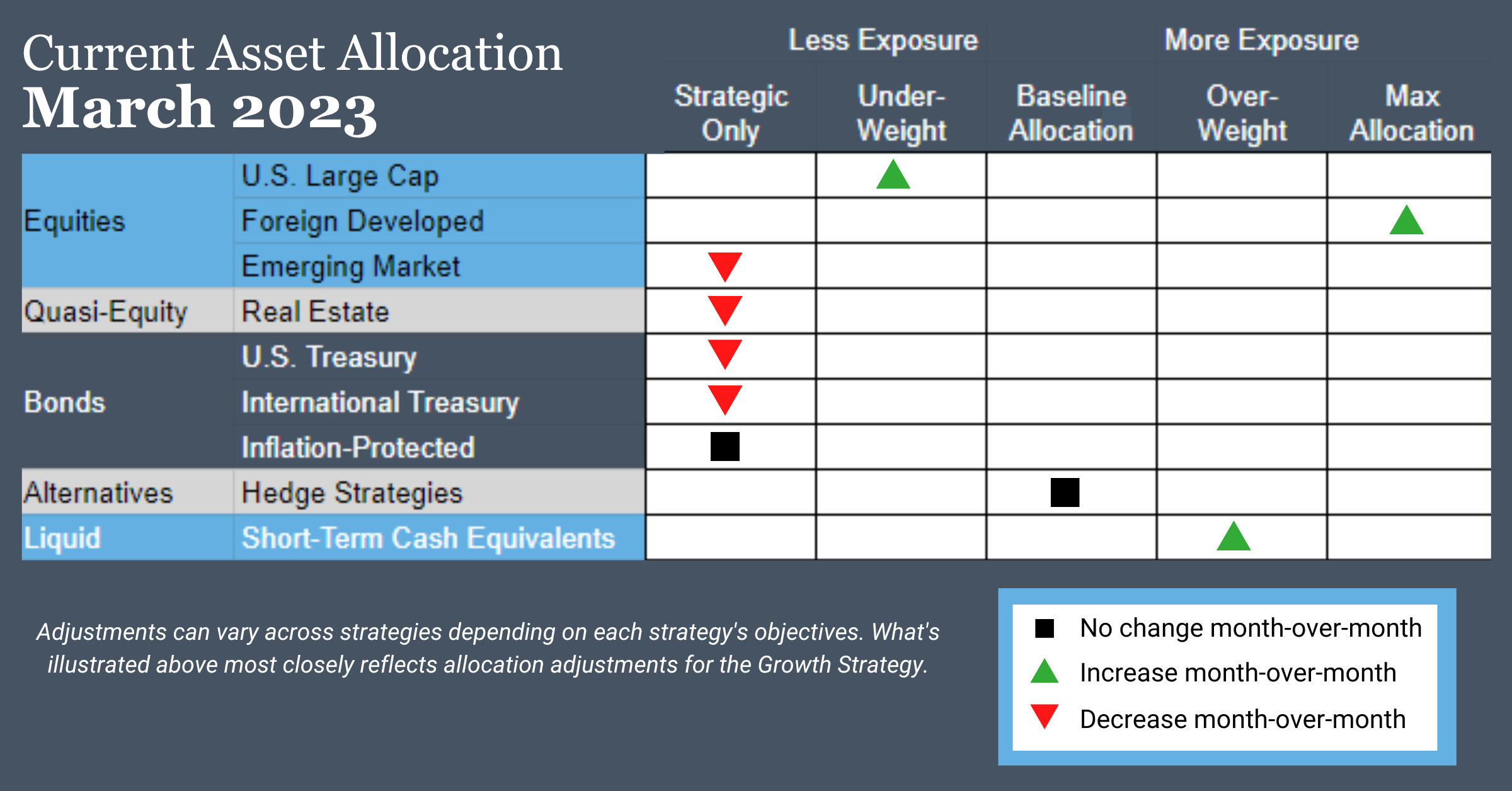

Exposure will increase. The intermediate-term time frame remains in an uptrend, while the long-term timeframe is in a downtrend. The additional exposure will come from taking on the allocation vacated by real estate securities.

Intl Equities

Overall exposure will not change but the mix will shift more toward foreign developed equities, which continue to experience uptrends across both timeframes. The intermediate-term trend in emerging market equities has reversed into a downtrend, re-joining the long-term downtrend.

Real Estate

Exposure will decrease, as the intermediate-term timeframe reverts to a downtrend, joining the negative long-term trend. The vacated exposure will be handed off to U.S. equities.

U.S. & Intl Treasuries

Exposure will decrease to its minimum levels, as U.S. Treasuries join their international counterparts in reverting to downtrends across both timeframes.

Inflation-Protected Bonds

Exposure will not change and is at its minimum allocation due to downtrends across both timeframes.

Alternatives

Exposure will not change. The baseline allocation for gold is also our highest limit, so we are at the maximum allocation as the asset class continues to experience uptrends over both timeframes.

Short-Term Fixed Income

Exposure will increase, receiving allocations from weakening U.S. and international Treasuries.

Asset Level Overview

Equities & Real Estate

U.S. equities started off February with a bang before a wave of negative news extinguished the short-lived rally. As we end the month, large cap equities find themselves below the fourth quarter high and searching for direction. On the bright side, large caps did manage to (unconvincingly) break the downtrend line established at the start of 2022.

Likewise, the end of month declines in mid and small caps have only brought them back to retest Q4 highs with small caps joining mid caps in uptrends over both timeframes. These conditions are expected if a longer-term uptrend is to be established. These movements could also be a sign of a sideways pattern that could persist for some time.

The end result is our portfolios will experience a small increase in exposure to small and large caps as it receives exposure from weaker real estate securities, but remain underweight overall versus the baseline allocation for mid caps.

Foreign developed equities retraced a bit but remain relatively strong compared to U.S. equities so far this year. Our portfolios moved into an overweight status in February for the first time since late 2021, and they will remain here in March. In fact, foreign developed exposure will increase to its maximum, as it takes on the allocation vacated by emerging markets.

Emerging market equities flirted with triggering a long-term uptrend to join the intermediate-term one in February, then tumbled to end the month, and ultimately re-entered downtrends across both timeframes. All our portfolios remain underweight and at their minimum allocation.

Of the equity and equity-like asset classes, real estate securities have done the least to break the pattern in place since the start of 2022. The retracement in the second half of February generated a downtrend over both the intermediate- and long-term timeframes. For now, all our portfolios continue to be underweight.

Fixed Income & Alternatives

As was seen in multiple equity segments, U.S. and international treasuries experienced their own decline in February. The decreases are enough to cause these asset classes to have downtrends across both timeframes. All our portfolios will move back to their minimum allocations. This exposure will be handed back to ultra-short duration fixed income instruments.

After steep increases since the beginning of November, gold fell hard in February. Gold is holding its uptrends, but has retested the Q4 highs. For now, our portfolios remain at their baseline allocation for March. If conditions continue to deteriorate, we would expect a reduction in exposure as early as April.

3 Potential Catalysts for Trend Changes

Real Wage Loss:

Wage growth is declining from previously high levels; welcome news for central banks around the world that have raised interest rates to combat a potential wage-price spiral. Avoiding this means wages are more likely to decline without a significant increase in unemployment. For workers, it is less beneficial. Workers’ inflation-adjusted purchasing power was lower last year than in 2019, before the pandemic.

Consumer Spending Priorities:

Consumers are spending more on food and less on electronics, apparel, and home improvements. Inflation and changing habits have dried up demand for more discretionary goods. As an example, Walmart and Home Depot have enjoyed elevated sales post-COVID as people looked for bargains or fixed up their homes. Now, more of shoppers’ budgets are going to higher-priced groceries and travel.

Millennial Debt:

Americans in their 30s have piled up debt at a historic clip since the pandemic. Total debt balances hit more than $3.8 trillion in the fourth quarter, a 27% jump from late 2019, according to the Federal Reserve Bank of New York. It is the steepest increase of any age group and is the fastest pace of debt accumulation over a three-year period since the 2008 Financial Crisis. Unfortunately, this buildup of debt could worsen a generational wealth gap that was already rising for millennials who graduated into the 2008 crisis era.

There’s Good News…And There’s Bad News

As was covered in the Asset-Level Overview section, we’ve got good news and we’ve got bad news for equities…

The good news is:

- U.S. large caps have broken the downward trending pattern reinforced throughout 2022.

- Value and dividend segments are moving within single-digit percentages from the highest levels in 20 years.

- Mid and small caps are consolidating in a range above their intermediate and long-term averages.

- Foreign developed equities have established solid, positive trends across both timeframes.

And the bad news is:

- While nearly establishing a long-term uptrend, U.S. large caps experienced a very weak close to the month and failed to follow through, leaving the longer-term downtrend in place.

- Value and dividend stocks have failed highs and are laggards in 2023 after leading in 2022.

- No major equity asset class is seriously threatening new all-time highs as we close out February.

- Inflation and employment data continue to support the narrative of more rate increases, not cuts.

It appears that we have a stalemate between the bulls and the bears at the moment. Equities (and bonds for that matter) have yet to seriously retest lows from 2022, but as mentioned above are not threatening new highs either. There seems to be an underlying desire from investors to push the market higher, they are just looking for a reason to buy. Economic data and subsequent Federal Reserve commentary continues to stand in the way.

Some could argue that directionless markets are the Achilles heel for trend following strategies, but we want to highlight two areas that show why systematic portfolio management via trend following still shines.

Generally Low Cost of Risk Management

We often talk about how risk management is “baked in the cake” with our systematic investing process. If your rules are designed to allow for participation in ascending markets, while stepping out of declining markets, then all you have to do is consistently follow them and you should generally achieve that objective.

The rules that allowed our portfolios to have generally high equity participation in a market like 2021 are the same rules that generated sell signals in 2022 and caused our portfolios to have low or no exposure to the risky assets in 2022.

It’s fairly easy to compare the performance of our portfolios from 2021 and 2022 and see how they held up better than most 80/20 or 60/40 stock/bond portfolios. 2023 is more difficult because as some of these standard, passive portfolios rebound, our portfolios may lag briefly, as the markets seek direction.

Our clients should rest assured that despite the extremely short-term underperformance, the same rules and systems that drove 2021 and 2022 are at work today. Our process is designed to constantly look for trends that can capture burgeoning uptrends while continuing to run from downtrends.

Time Frame Selection

That takes us to time frame selection.

We are often asked why we don’t choose shorter term timeframes to trigger more trades. Besides turnover and taxes, another big reason is the inevitable periods of choppy markets like we are experiencing now.

In our research, the effects of sideways movement are exacerbated if shorter trend-following rules are used. So, in our opinion, the positives of a shorter-term system are far outweighed by the negatives.

We have deliberately chosen the timeframes we use to provide what we believe is an optimal balance of minimal turnover, tax awareness, risk management, and opportunity targeting.

Final Thoughts

Our hope is that our constant, tireless focus on discipline and service allows you to rest easier. History has taught us that better times are usually ahead, and you are best positioned to benefit from those better days when you remain committed to your financial plan.

Disclosures:

Strategic Advisory Partners is an investment advisor registered pursuant to the laws of the state of North Carolina. Our firm only conducts business in states where licensed, registered, or where an applicable exemption or exclusion is afforded. This material should not be considered a solicitation to buy or an offer to sell securities or financial services. The investment advisory services of Strategic Advisory Partners are not available in those states where our firm is not authorized or permitted by law to solicit or sell advisory services and products. Registration as an investment adviser does not imply any level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. For more information, please visit adviserinfo.sec.gov and search for our firm name.

Past performance is not indicative of future results. The material above has been provided for informational purposes only and is not intended as legal or investment advice or a recommendation of any particular security or strategy. The investment strategy and themes discussed herein may be unsuitable for investors depending on their specific investment objectives and financial situation.

Opinions expressed in this commentary reflect subjective judgments of the author based on conditions at the time of writing and are subject to change without notice.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission from Strategic Advisory Partners.