September 2022 Monthly Investment Update

The Implications of Trying to ‘Buy the Dip’

“Moving first is a tactic, not a goal.” ― Peter Thiel

In a financial services world where many make a living by selling their thoughts and opinions about the future, we find it liberating to proclaim that we’re the opposite. We don’t make predictions, and we celebrate that fact. Our approach is different, and this difference tends to show up most when discussing market tops and bottoms.

Correctly picking a market top or bottom might give you a quick ego boost, but it has little to do with achieving the highest probability of investing success. Why? The risk of being wrong is too high both from a real and opportunity cost perspective.

Strategic Advisory Partners is not in the business of needing to be right. We are in the business of developing systematic investment processes that help our clients stay on the path toward achieving their long-term goals.

Why does this matter? In this month’s Note, we discuss the implications of trying to be “right” in U.S. and foreign developed equities by attempting to “buy the dip.” It might surprise you, but sometimes using a process that consciously avoids “buying the dip” can generate a better outcome.

But first, here’s a summary of our take on what transpired in the markets in August.

U.S. Equities

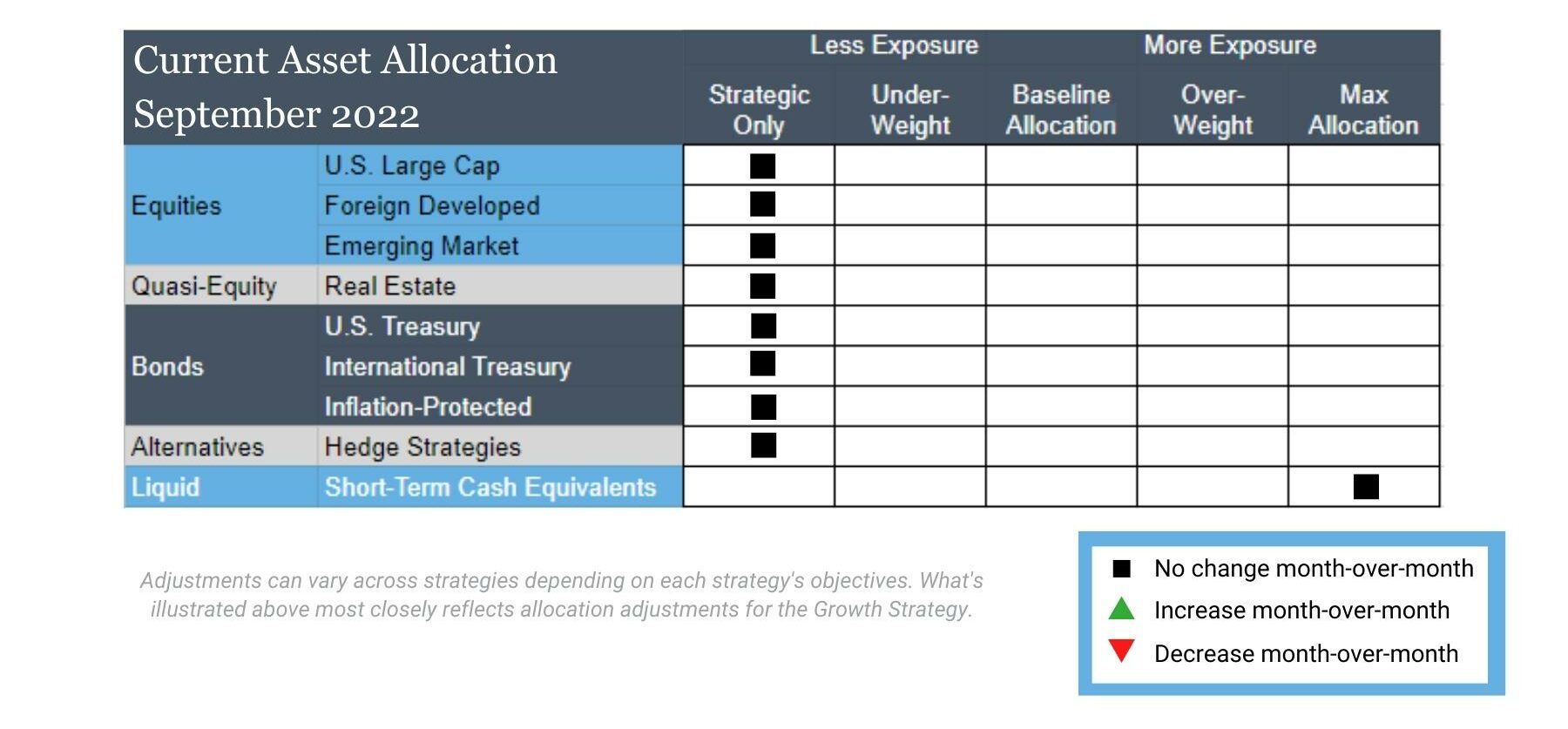

Exposure will not change from its minimum allocation, as both the intermediate- and long-term timeframes remain in downtrends.

Inflation-Protected Bonds

Exposure will not change and is at its minimum due to downtrends across both timeframes.

Intl Equities

Exposure will not change from its minimum allocation, as both foreign developed and emerging markets remain in downtrends across both timeframes.

Alternatives

xposure will not change and is at its minimum allocation due to downtrends across both timeframes.

U.S. & Intl Treasuries

Exposure will not change and is at its minimum allocation due to downtrends across both timeframes.

Real Estate

Exposure will not change from its minimum allocation, as both the intermediate- and long-term timeframes remain in downtrends.

Short-Term Fixed Income

Exposure will not change, as it is already at its max allocation due to previously taking on exposure from equities, real estate, alternatives, and longer-duration fixed income.

Asset Level Overview

Equities & Real Estate

Despite a promising start in August, U.S. equity markets yet again failed to achieve two consecutive positive months in 2022. Instead, indexes retraced earlier August gains and some of July’s rally following news of the Fed’s hawkish stance on reducing inflation. Mid-caps and small caps were stronger than their large-cap counterparts, but all segments remain weak. Early in the month, it looked as though the trends might change and we were preparing for a potential increase in exposure for September, but the end result is our portfolios will remain at their minimum equity allocations.

A theme for years now is the underperformance of international equities versus their U.S. counterparts. August repeated this theme, as both developed and emerging market equities continue to lag YTD. As a result, exposure to these assets will remain at their minimum exposures, except for short-term duration fixed income.

Like equities in general, real estate related stocks raced out to a strong start in August only to swoon later in the month after the Fed’s comments. The result is continued downtrends. All our portfolios will remain at minimum allocation.

Fixed Income & Alternatives

Fixed income instruments of any meaningful duration appeared poised to join U.S. equities in an intermediate-term uptrend as we entered the halfway point of August. This would have been the first increase in exposure in more than a year, but quickly faded as prices resumed their slide, and rates increased. Exposure will remain at its minimum in favor of ultra-short duration, where applicable.

Like fixed income, gold began to show promise of an intermediate-term uptrend but quickly faded in the second half of August. As we enter September, this asset class continues to experience downtrends.

3 Potential Catalysts for Trend Changes

Central Banks:

The central bankers of the world returned to Jackson Hole, Wyoming, after a three-year break due to the pandemic. “For the first time in four decades, central banks need to prove how determined they are to protect price stability,” said Isabel Schnabel, who sits on the European Central Bank’s six-member executive board. Some economists outside the Fed are increasingly divided over how aggressively the U.S. central bank should continue lifting rates. One camp says Fed officials are still underestimating how high rates will need to rise and think those officials should prepare financial markets for interest rates to climb above 4% or 5%.

Rain Needed:

Severe droughts across the Northern Hemisphere – stretching from the farms of California to waterways in Europe and China are snarling supply chains and driving up the prices of food and energy, increasing stress on the global trade system. Parts of China are experiencing their longest sustained heat wave since record-keeping began in 1961, leading to manufacturing shutdowns due to a lack of hydropower. The drought affecting Spain, Portugal, France, and Italy is on track to be the worst in 500 years. In the American West, a drought that began two decades ago now appears to be the worst in 1,200 years.

Powell’s Speech:

Speaking at Jackson Hole, the Fed Chairman signaled his expectations, with our own bolding added for emphasis: “Restoring price stability will take some time and requires using our tools forcefully to bring demand and supply into better balance. Reducing inflation is likely to require a sustained period of below-trend growth. Moreover, there will very likely be some softening of labor market conditions. While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation.”

Dip-Buying: Trend-Following Edition

“Markets are never wrong, only opinions are.” —Jesse Livermore

By the end of July, U.S. equities made a substantial move off the current bear market bottom reached around mid-June. Despite the increase, it was not enough to trigger an intermediate-term uptrend, and as a result our exposure did not change. August provided another near-miss.

This gives rise to a question we frequently hear about trend following: How much risk is there that we will re-enter equities “too late” and therefore miss a rally and its opportunities for great returns? In answering that question, we first need to point out that we will never buy the bottom. This is an intentional and inherent part of our process. Given the nature of our process, we encourage our clients to remember that:

- Our first priority is to react decisively to falling markets to limit losses.

- The eventual level at which we re-enter can be the same or well below what might be perceived to be an opportunistic buy-in point in the moment – but, in hindsight, prices that seemed opportune in the moment can turn out to be early.

Take the S&P 500 as an example. After the decline in January 2022, the initial, absolute best opportunities to buy a dip would have been between 4150-4350 in late January, late February, and/or early March. As August draws to a close, the S&P 500 is actually below those levels. Thus, using a trend-following strategy like ours (which is currently defensively postured) raises the probability that investors will participate at or below the initial “dip-buying opportunity.” The tradeoff is the added benefit of 60 days or more of information and a potential bottom being formed.

Another, and a perhaps even more interesting example, is foreign developed equities. Using the Vanguard FTSE Developed Markets ETF (VEA), one must go back to September 2021 to find the most recent all-time high. Since then, there have been not one, not two, not three, but 37 new lows! At this point, since a trend-following strategy has been waiting for the price trends to reverse, an investor is likely to re-engage at a price that’s around 19% below the initial “dip-buying opportunity.”

When buying an asset below its prior all-time high, you basically have two options:

- Guess at the bottom

- Follow a set of rules that tells you when to purchase

Following rules will likely never give you the opportunity to be able to tell friends you bought XYZ stock at the bottom, but it’s a small price to pay if you, like us, are not in this for ego. We are in it to achieve long-term success. Specifically, we are motivated by the idea that our clients can rest easy knowing that their portfolios will systematically and decisively react to what is happening in the markets. That means exiting when risk is high and re-entering when trends strengthen. We think this is the most reliable way to avoid unknown declines and participate in unknowable rallies.

We have the benefit of thousands and thousands of hours researching the data. We know that things won’t always transpire exactly the way we want, but we have complete confidence that we are increasing the odds of financial success.

Disclosures:

Strategic Advisory Partners is an investment advisor registered pursuant to the laws of the state of North Carolina. Our firm only conducts business in states where licensed, registered, or where an applicable exemption or exclusion is afforded. This material should not be considered a solicitation to buy or an offer to sell securities or financial services. The investment advisory services of Strategic Advisory Partners are not available in those states where our firm is not authorized or permitted by law to solicit or sell advisory services and products. Registration as an investment adviser does not imply any level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. For more information, please visit adviserinfo.sec.gov and search for our firm name.

Past performance is not indicative of future results. The material above has been provided for informational purposes only and is not intended as legal or investment advice or a recommendation of any particular security or strategy. The investment strategy and themes discussed herein may be unsuitable for investors depending on their specific investment objectives and financial situation.

Opinions expressed in this commentary reflect subjective judgments of the author based on conditions at the time of writing and are subject to change without notice.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission from Strategic Advisory Partners.