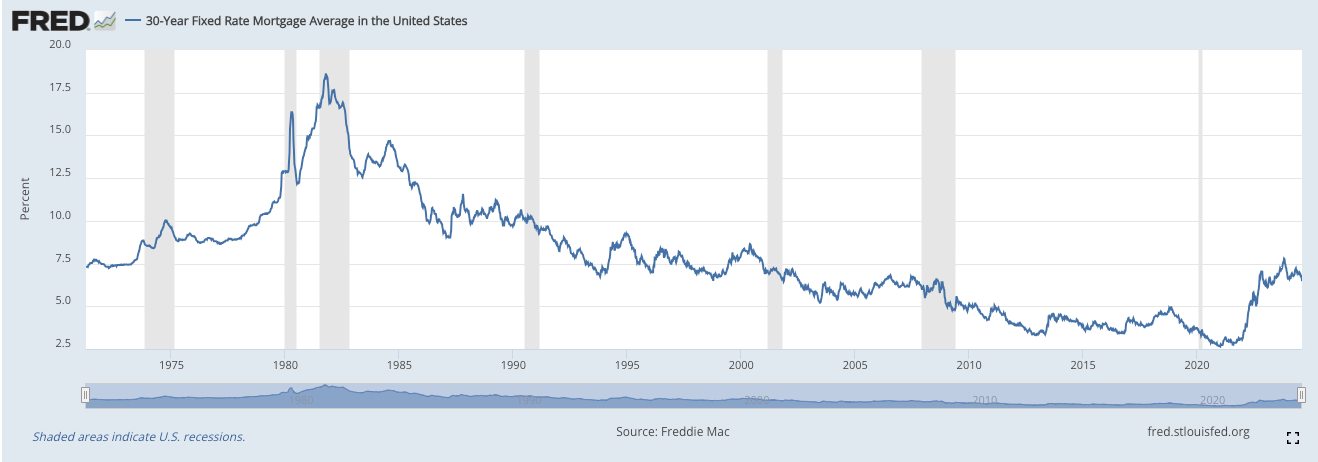

When it comes to mortgage rates, it’s easy to get caught up in the numbers and compare today’s rates with the recent past. Many consumers are feeling concerned about rates being higher than they were in 2022, when they were at record lows. However, a broader look at historical data can provide a clearer perspective and help us understand where today’s rates really stand in the grand scheme of things.

Where We Stand Today

As of August 8, 2024, the 30-year fixed mortgage rate is 6.47%, and the 15-year fixed rate is 5.63%. While these rates are higher than the record lows we saw in 2020 and 2021, they are still relatively low compared to historical averages.

A Historical Look at Mortgage Rates

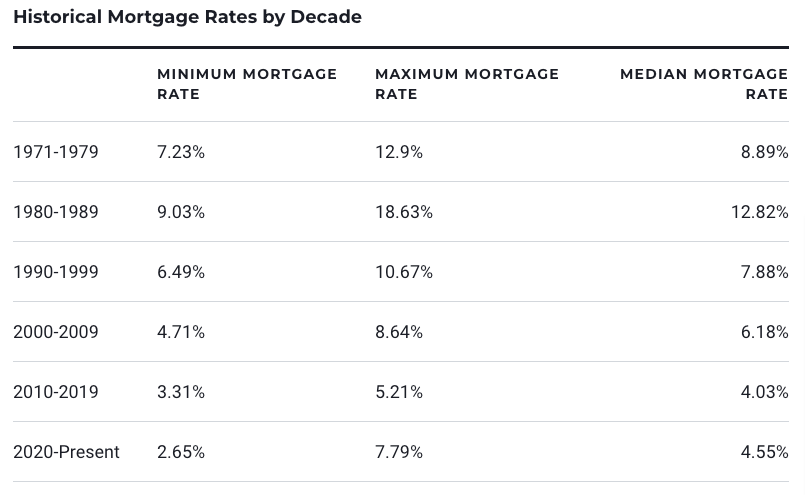

To better understand where current rates fall, let’s take a trip down memory lane and examine mortgage rates by decade:

- 1970s: Rates ranged from a minimum of 7.23% to a maximum of 12.9%, with a median rate of 8.89%.

- 1980s: This decade saw much higher rates, with a minimum of 9.03% and a maximum of 18.63%. The median rate was 12.82%.

- 1990s: Rates began to decrease, with a minimum of 6.49% and a maximum of 10.67%, settling at a median of 7.88%.

- 2000s: Mortgage rates continued their downward trend, ranging from 4.71% to 8.64%, with a median of 6.18%.

- 2010s: The era of historically low rates began, with minimum rates of 3.31% and maximum rates of 5.21%. The median rate was 4.03%.

- 2020s: Recently, we’ve seen rates fluctuate from 2.65% to 7.79%, with a median rate of 4.55%.

Why Perspective Matters

When we look at the historical data, it’s clear that today’s rates are quite moderate compared to the highs of the past. The peak rates of the 1980s, for example, were significantly higher than what we are experiencing now. Understanding this can help put today’s rates into perspective and alleviate some of the concerns that come with comparing them to recent lows.

Given this historical context, here are three important considerations for making smart financial decisions about mortgages:

Rates Are Not Going Back to 3%

It’s unrealistic to wait for rates to drop back to the historically low levels we saw in 2020 and 2021. If rates do fall significantly from where you borrowed, refinancing could be an option, but don’t put your plans on hold hoping for another drop.

Math is Still Math

Lower rates don’t necessarily mean you should stretch your budget to afford a more expensive home. Similarly, if the cost of living in your area is higher than other parts of the country, your budget should reflect that, not necessarily the lower rates.

Focus on RIGHT Rates

If you’re not currently buying or selling, it doesn’t matter, right? It IS however, important to consider where your money is earning the best return.

Example: Maximizing Returns on Your Money

Let’s say you have $100,000 that you’re keeping in two different accounts: a personal savings account and a business account. Here’s how different interest rates can impact your financial situation:

> Savings Account or Money Market:

Interest Rate: 1.00%

Annual Return: $100,000 x 1.00% = $1,000

> High Yield Savings Account:

Interest Rate: 3.00%

Annual Return: $100,000 x 3.00% = $3,000

Comparison

By keeping the $100,000 in the personal savings account, you’re earning $1,000 annually. If you moved the same amount to a business account with a higher interest rate of 3.00%, you’d earn $3,000 annually. That’s an additional $2,000 in interest over the course of a year!

Why This Matters

Even if you’re not buying or selling property, the rate of return on where you keep your money can significantly impact your financial health. In this example, the business account offers a much higher return, which could be used for further investments or savings. This additional income could help offset some of the costs associated with higher mortgage rates or simply improve your overall financial position.

Understanding the importance of rate of return on your savings is crucial, especially in times of fluctuating mortgage rates. By making informed decisions about where to place your money, you can maximize your returns and better manage your finances.