Straightforward

Financial Planning

Helping clients navigate their most important financial concerns.

Talk to An

Advisor

Helping clients navigate their most important financial concerns.

Who We Serve

Managing and preserving wealth for individuals and institutions

Whether you want to explore your investment options, create a retirement plan, or develop a sound financial strategy for the future, Strategic Advisory Partners can help. Our clients value advice delivered with experience and intentionality. We will listen to your needs and provide objective recommendations that address your unique, comprehensive financial picture.

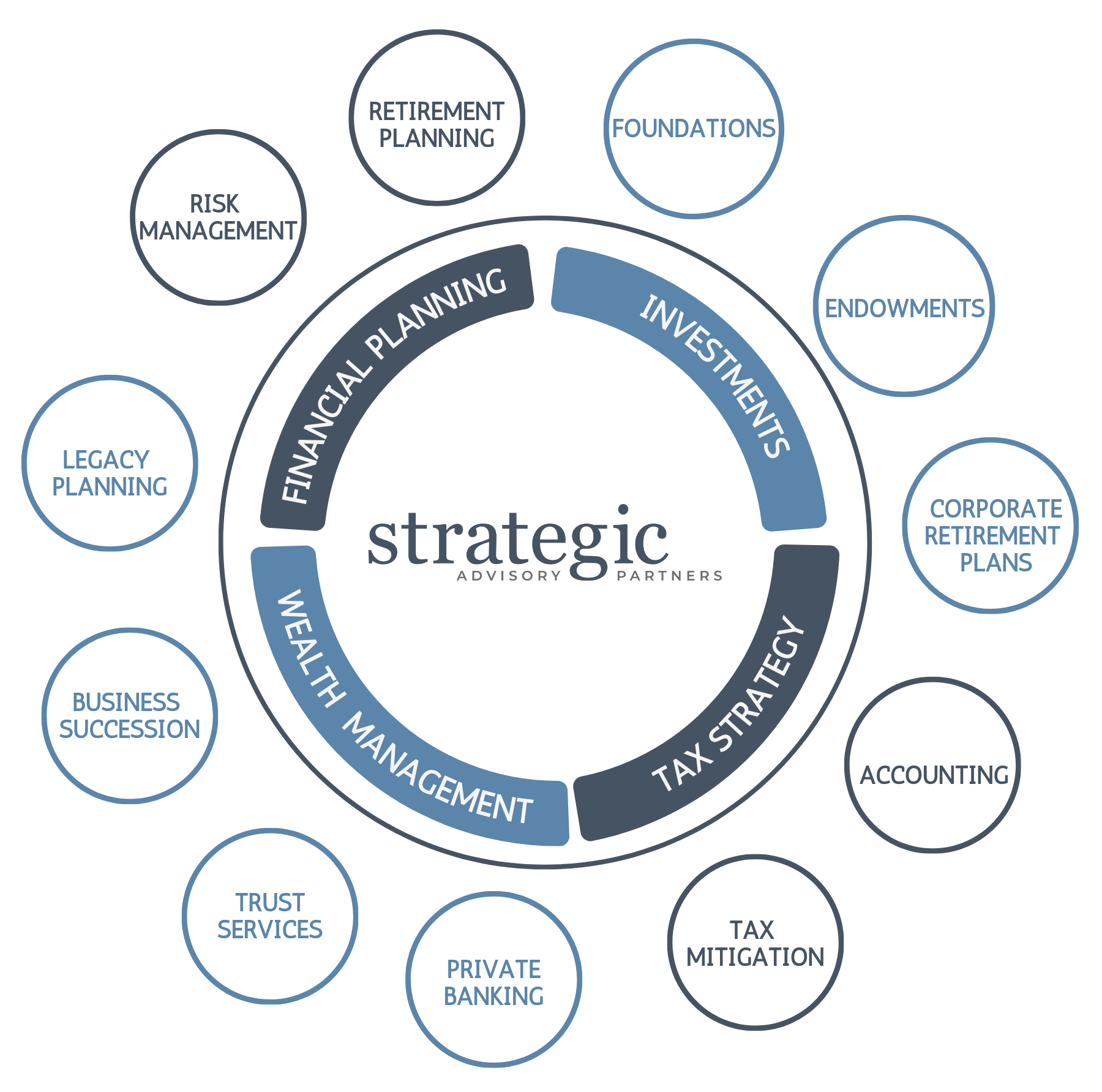

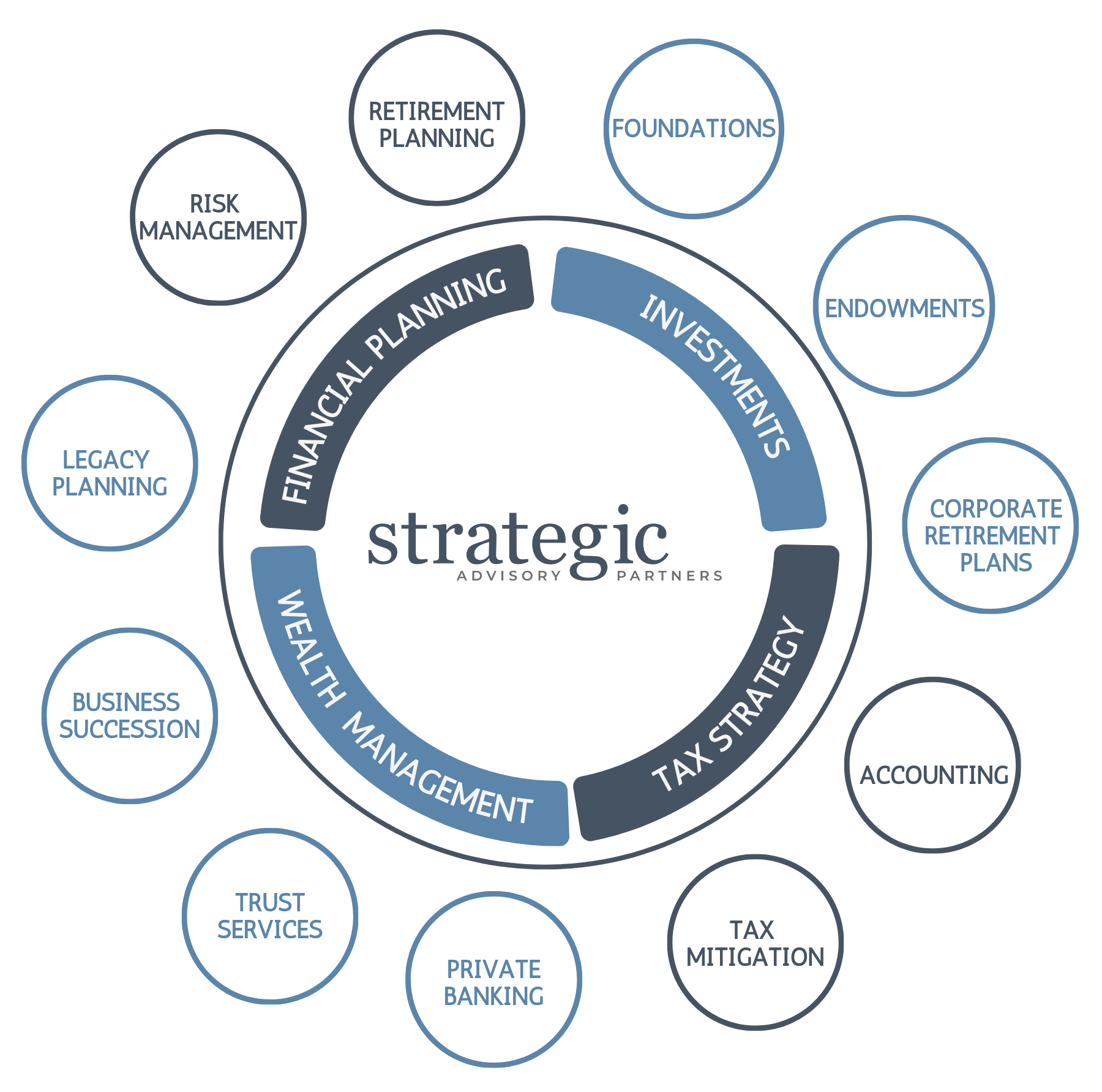

Our Services

As your wealth expands, managing it becomes more complex. But don’t worry, keeping tabs on every detail won’t consume all your time. We collaborate with your team, ensuring a streamlined process and serving as your single point of contact to oversee it all.

We’re “All In”

We get it! Mapping out your financial future can be stressful, especially when there is a volatility in the market place. You have goals and it’s tough to know when to pivot your investment strategies.

Whether you want to explore your investment options, create a retirement plan, or develop a sound financial strategy for the future, Strategic Advisory Partners can help. Our clients value advice delivered with experience and intentionality. We will listen to your needs and provide objective recommendations that address your unique, comprehensive financial picture. One that is easy to understand and provides peace of mind.

Here’s How It All Works

Schedule a Strategy Call

It starts with a simple conversation about the challenges that you’re facing today. We’ll explore opportunities to break through those challenges.

Receive a Customized Plan

Through a collaborative and educational approach, we’ll develop personalized, step-by-step recommendations so you feel informed and empowered about your financial life.

Focus on Enjoying Life

Success is driven by consistent, proactive decisions over a long period of time. Let us handle the strategy and implementation, while you focus on living life to the fullest!

Recent Viewpoints

Navigating Market Volatility with a Trend-Following Strategy

By maintaining a keen eye on trends, adapting asset allocations, and emphasizing risk management, we show how to navigate these uncertain waters with a steady hand. Our goal is to ensure your investments are poised to thrive, even in the face of market turbulence, providing you with the confidence and support you need to secure your financial future.

Insurance vs. Fee-Only Advisors

When it comes to managing your finances and securing your future, the guidance of a financial advisor can be invaluable. However, not all financial advisors are created equal. Two common categories of advisors you’ll encounter are those who sell insurance products and fee-only advisors. In this blog, we’ll explore the key differences between these two types of advisors, helping you make informed decisions about your financial future.

Guide to Purposeful Giving

Charitable giving is a powerful way to make a positive impact on the causes and organizations you care about. At Strategic Advisory Partners, we understand that aligning your financial goals with your philanthropic aspirations can be both fulfilling and strategically advantageous. In this blog, we will explore the strategies for incorporating charitable giving into your financial plan, including the use of donor-advised funds and planned giving techniques.