Straightforward

Financial Planning

Helping clients navigate their most important financial concerns.

Talk to An

Advisor

Helping clients navigate their most important financial concerns.

Who We Serve

Managing and preserving wealth for individuals and institutions

Whether you want to explore your investment options, create a retirement plan, or develop a sound financial strategy for the future, Strategic Advisory Partners can help. Our clients value advice delivered with experience and intentionality. We will listen to your needs and provide objective recommendations that address your unique, comprehensive financial picture.

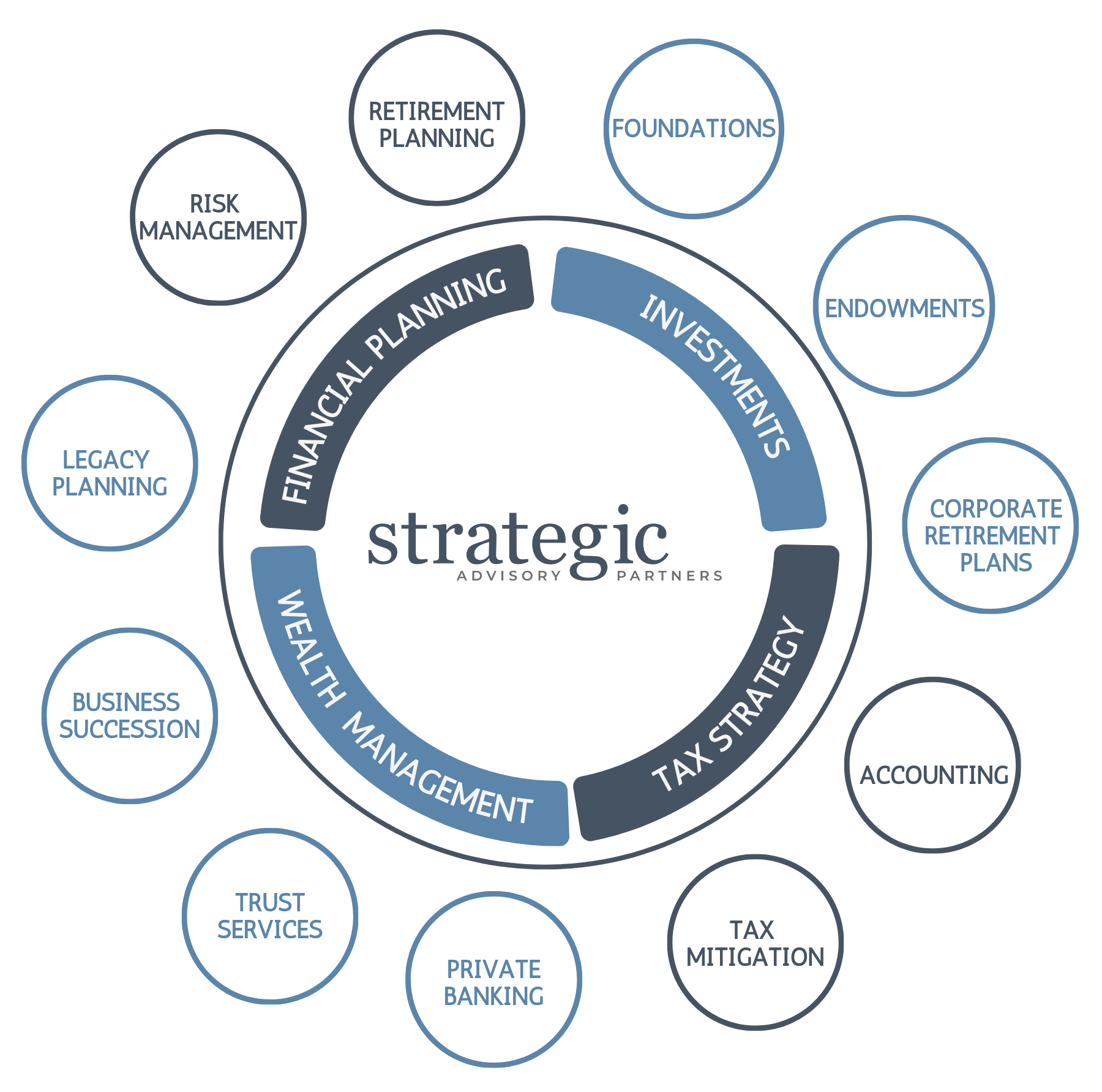

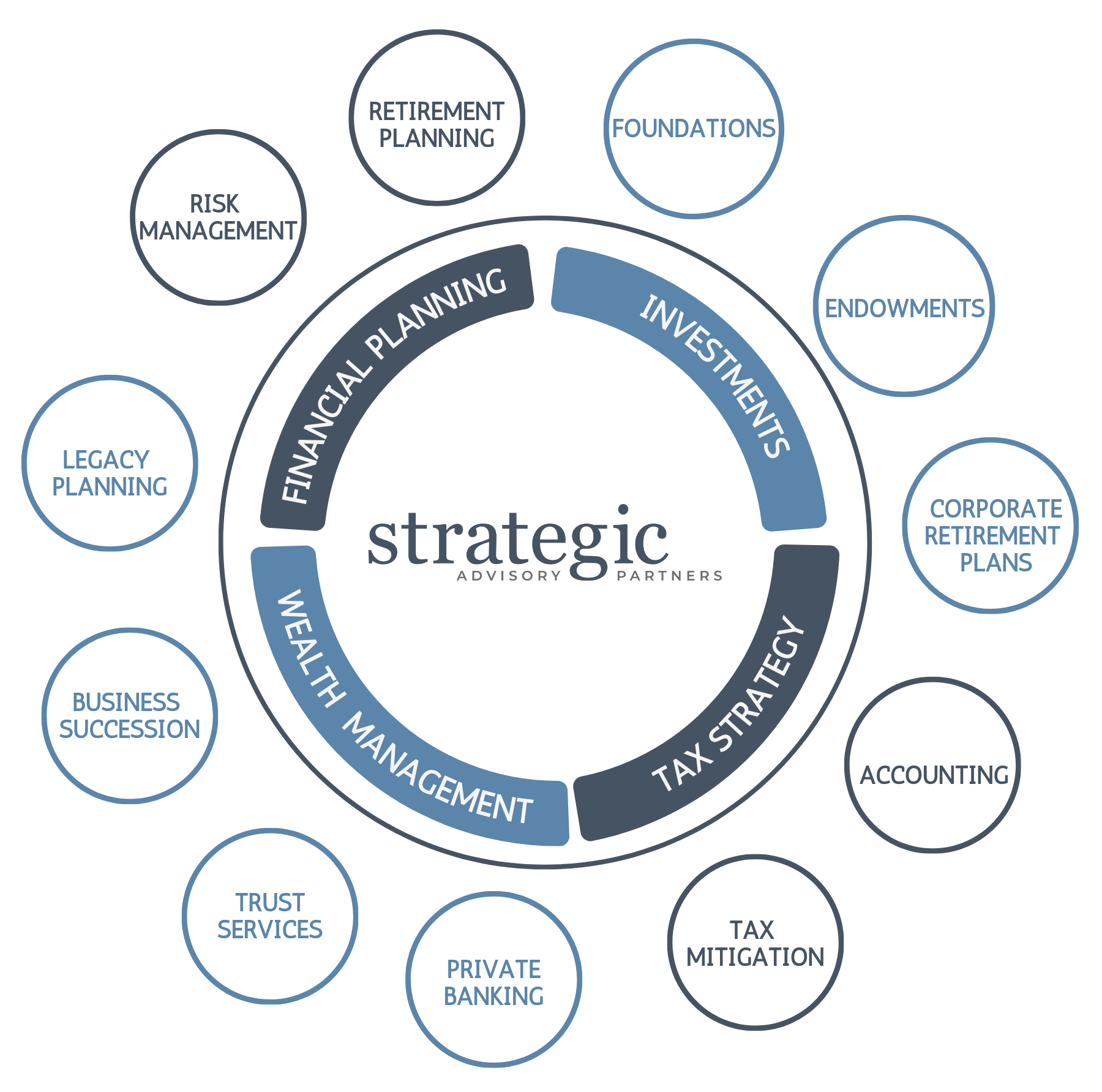

Our Services

As your wealth expands, managing it becomes more complex. But don’t worry, keeping tabs on every detail won’t consume all your time. We collaborate with your team, ensuring a streamlined process and serving as your single point of contact to oversee it all.

We’re “All In”

We get it! Mapping out your financial future can be stressful, especially when there is a volatility in the market place. You have goals and it’s tough to know when to pivot your investment strategies.

Whether you want to explore your investment options, create a retirement plan, or develop a sound financial strategy for the future, Strategic Advisory Partners can help. Our clients value advice delivered with experience and intentionality. We will listen to your needs and provide objective recommendations that address your unique, comprehensive financial picture. One that is easy to understand and provides peace of mind.

Here’s How It All Works

Schedule a Strategy Call

It starts with a simple conversation about the challenges that you’re facing today. We’ll explore opportunities to break through those challenges.

Receive a Customized Plan

Through a collaborative and educational approach, we’ll develop personalized, step-by-step recommendations so you feel informed and empowered about your financial life.

Focus on Enjoying Life

Success is driven by consistent, proactive decisions over a long period of time. Let us handle the strategy and implementation, while you focus on living life to the fullest!

Recent Viewpoints

Why Do We Keep Printing Money?

In our recent “Invested Interest” podcast discussion, we tackled the complex relationship between rising interest rates and inflation. We explored the purpose behind increasing rates, highlighting their role in encouraging savings and dissuading borrowing as a measure to control inflation. We recognized that the recent influx of newly created money and the mechanics of fractional reserve banking have played their part in elevating inflation rates.

Paying For College

College savings can seem daunting, with horror stories of massive student loan debt. But remember, college grads often earn over a million dollars more in their lifetimes than high school grads, especially in high-demand fields. So, investing in a degree can be wise. How do you fund it smartly without excessive debt? Explore these strategies before considering loans.

Navigating Social Security

Our mission at Strategic Advisory Partners is to simplify intricate financial concepts, making them accessible and comprehensible to everyone. Today, let’s dive into the intricacies of Social Security – a critical component of your retirement strategy. In this guide, we’ll explore the Top 10 Mistakes People Make With Social Security, offering insights to ensure you make informed decisions aligned with your financial goals.