Straightforward

Financial Planning

Helping clients navigate their most important financial concerns.

Talk to An

Advisor

Helping clients navigate their most important financial concerns.

Who We Serve

Managing and preserving wealth for individuals and institutions

Whether you want to explore your investment options, create a retirement plan, or develop a sound financial strategy for the future, Strategic Advisory Partners can help. Our clients value advice delivered with experience and intentionality. We will listen to your needs and provide objective recommendations that address your unique, comprehensive financial picture.

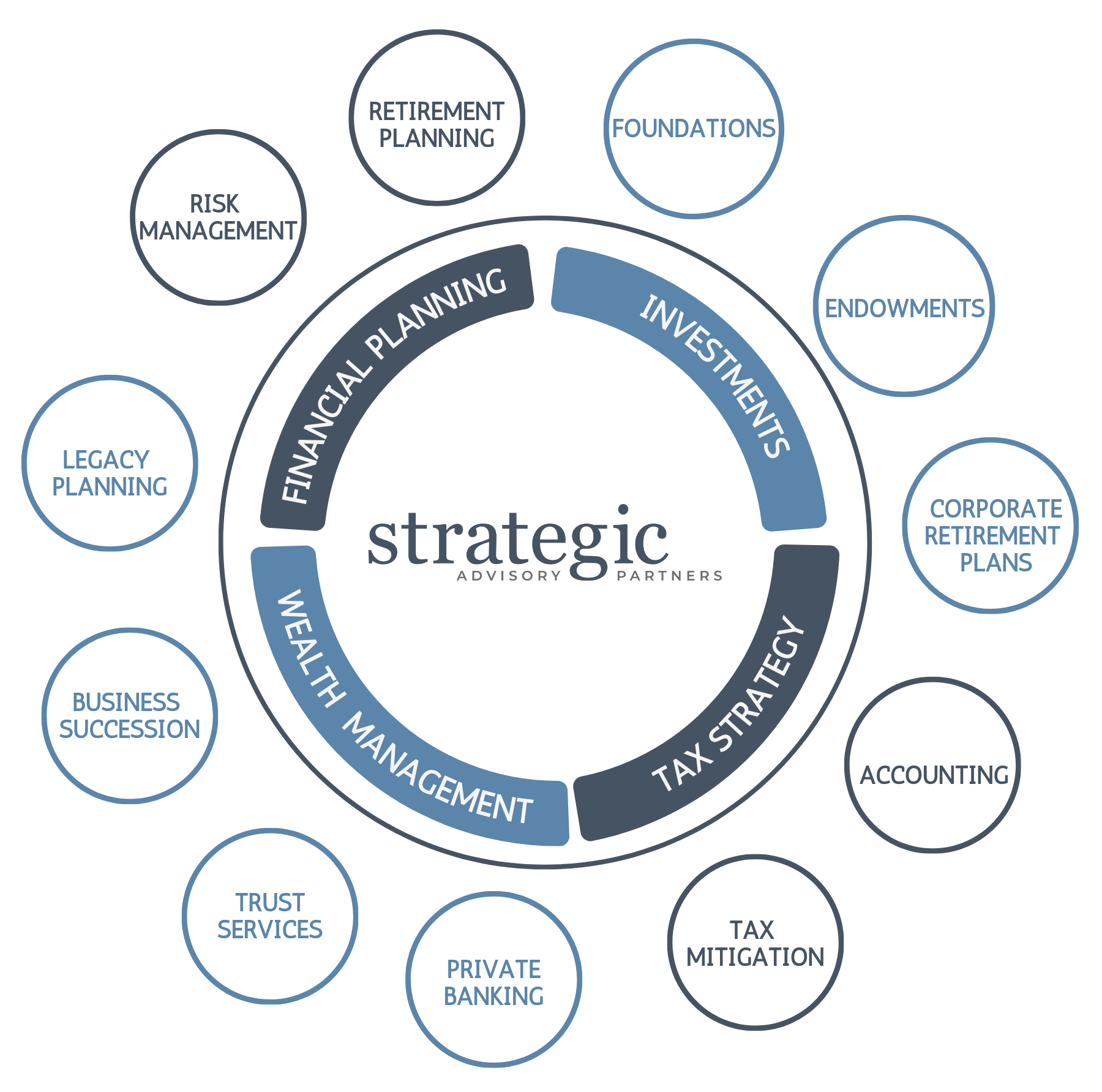

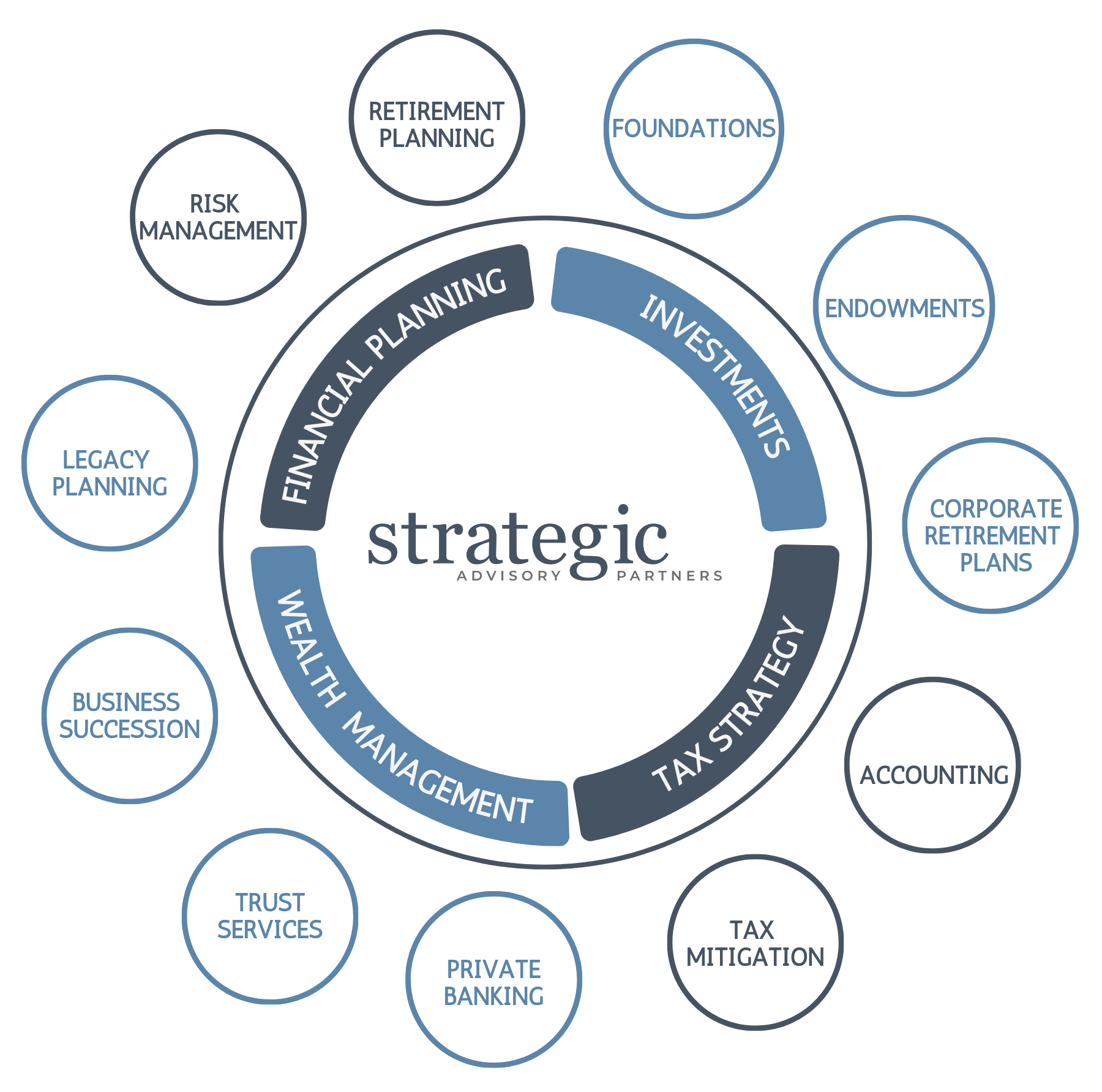

Our Services

As your wealth expands, managing it becomes more complex. But don’t worry, keeping tabs on every detail won’t consume all your time. We collaborate with your team, ensuring a streamlined process and serving as your single point of contact to oversee it all.

We’re “All In”

We get it! Mapping out your financial future can be stressful, especially when there is a volatility in the market place. You have goals and it’s tough to know when to pivot your investment strategies.

Whether you want to explore your investment options, create a retirement plan, or develop a sound financial strategy for the future, Strategic Advisory Partners can help. Our clients value advice delivered with experience and intentionality. We will listen to your needs and provide objective recommendations that address your unique, comprehensive financial picture. One that is easy to understand and provides peace of mind.

Here’s How It All Works

Schedule a Strategy Call

It starts with a simple conversation about the challenges that you’re facing today. We’ll explore opportunities to break through those challenges.

Receive a Customized Plan

Through a collaborative and educational approach, we’ll develop personalized, step-by-step recommendations so you feel informed and empowered about your financial life.

Focus on Enjoying Life

Success is driven by consistent, proactive decisions over a long period of time. Let us handle the strategy and implementation, while you focus on living life to the fullest!

Recent Viewpoints

From Market Mayhem to Steady Gains

Yesterday: What you need to know Global stock markets experienced a significant downturn, starting with Japan's Nikkei 225 index, which fell 12%—its steepest decline since 1987. This drop was driven by concerns over weaker-than-expected U.S. employment data and an...

What Comes After Winning

Winning a gold medal represents the culmination of years of dedication, sacrifice, and relentless pursuit of excellence. As we see with many athletes, the end of their competitive careers often brings an unexpected challenge—finding purpose and fulfillment after reaching their ultimate goal. This transition can be a significant hurdle, as the sense of identity and purpose that once drove them may suddenly seem elusive.

401(k) vs. IRA

Are you prepared for retirement? Choosing between a 401(k) and an IRA can be pivotal in shaping your financial future. Understanding the nuances of each retirement plan—whether it’s maximizing employer contributions with a 401(k) or enjoying the investment flexibility of an IRA—can significantly impact your retirement savings strategy. Join us as we delve into the essential differences, advantages, and considerations of these retirement vehicles. Let’s empower your journey towards a secure and prosperous retirement.