Straightforward

Financial Planning

Helping clients navigate their most important financial concerns.

Talk to An

Advisor

Helping clients navigate their most important financial concerns.

Who We Serve

Managing and preserving wealth for individuals and institutions

Whether you want to explore your investment options, create a retirement plan, or develop a sound financial strategy for the future, Strategic Advisory Partners can help. Our clients value advice delivered with experience and intentionality. We will listen to your needs and provide objective recommendations that address your unique, comprehensive financial picture.

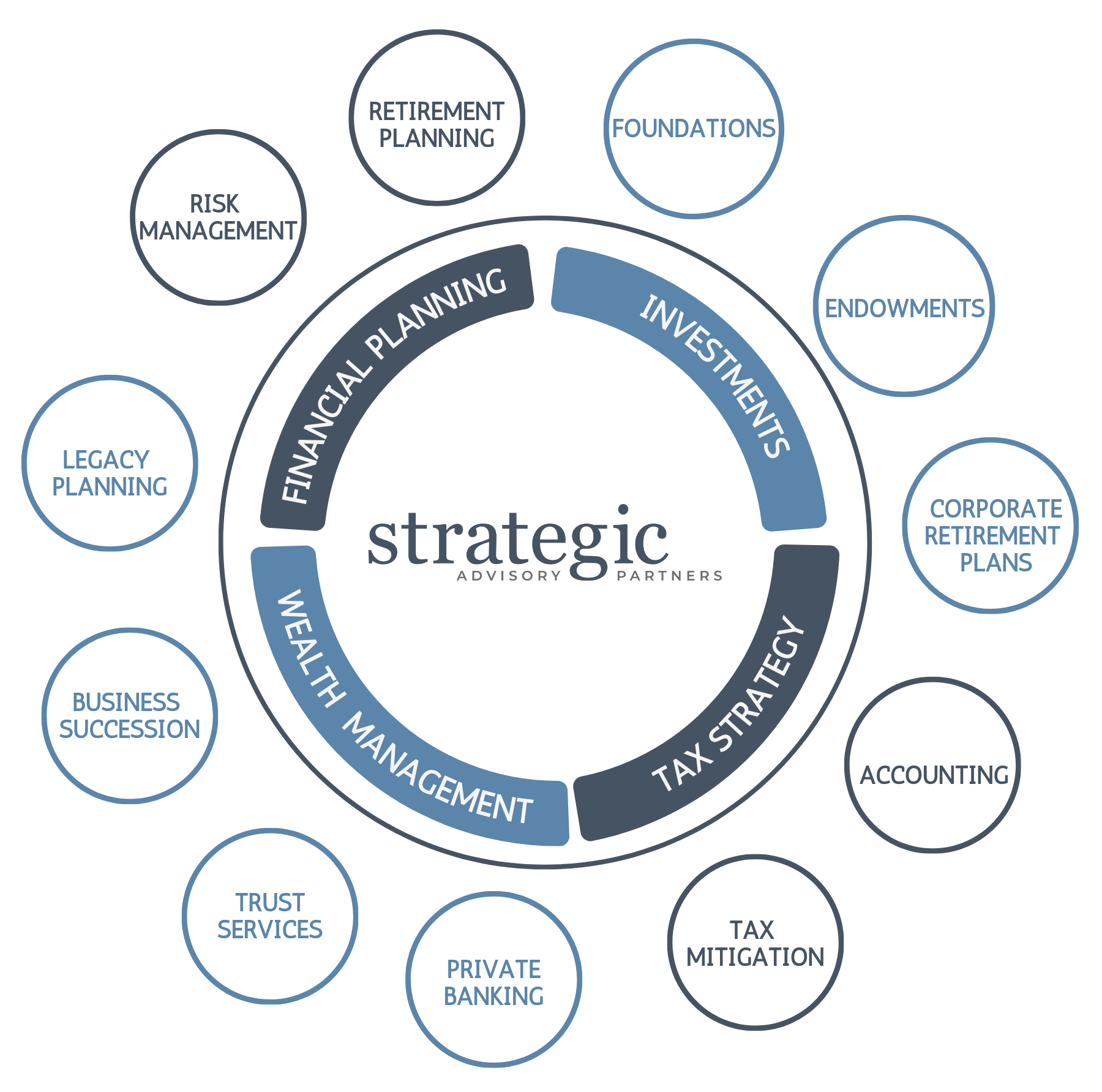

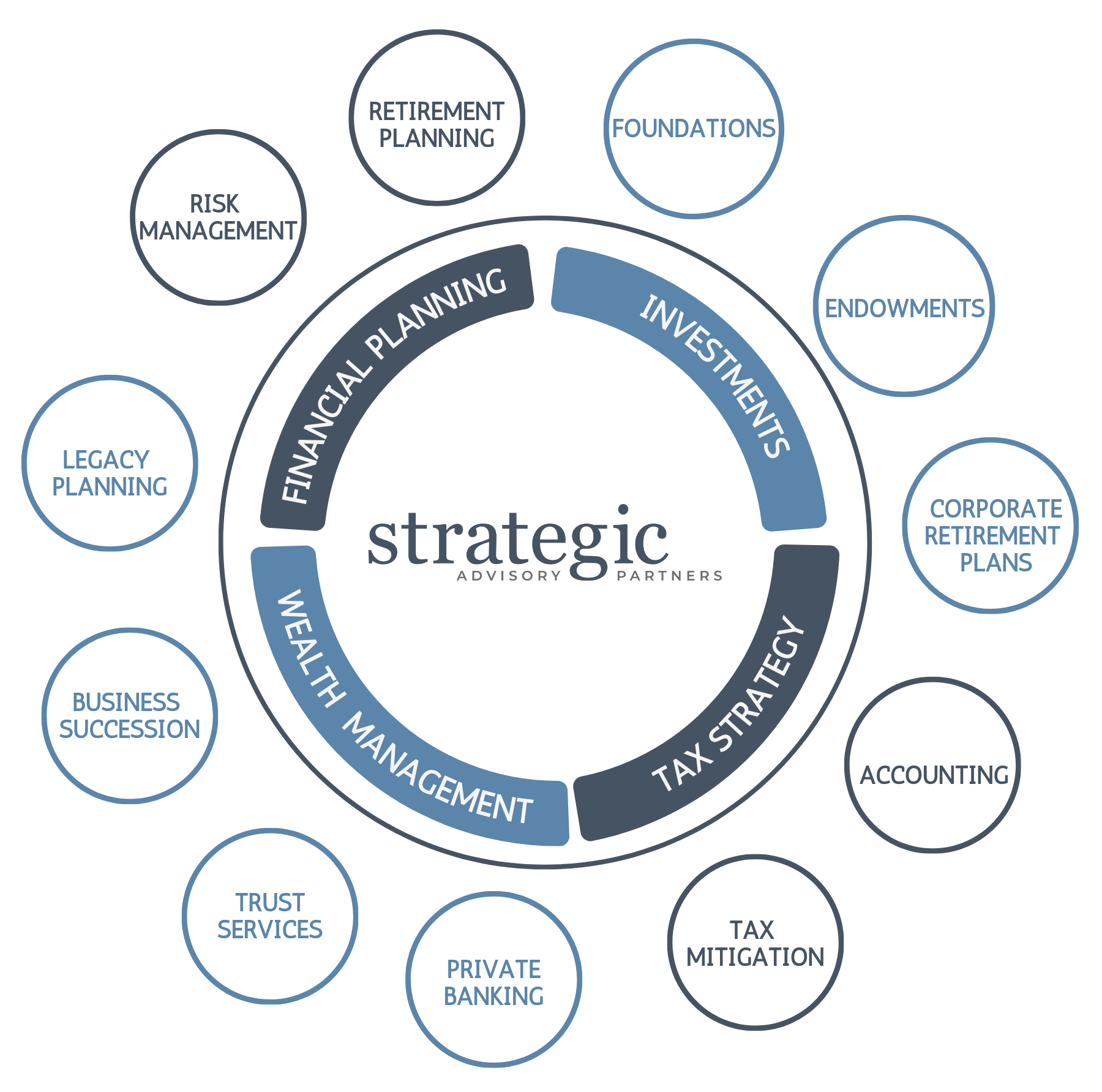

Our Services

As your wealth expands, managing it becomes more complex. But don’t worry, keeping tabs on every detail won’t consume all your time. We collaborate with your team, ensuring a streamlined process and serving as your single point of contact to oversee it all.

We’re “All In”

We get it! Mapping out your financial future can be stressful, especially when there is a volatility in the market place. You have goals and it’s tough to know when to pivot your investment strategies.

Whether you want to explore your investment options, create a retirement plan, or develop a sound financial strategy for the future, Strategic Advisory Partners can help. Our clients value advice delivered with experience and intentionality. We will listen to your needs and provide objective recommendations that address your unique, comprehensive financial picture. One that is easy to understand and provides peace of mind.

Here’s How It All Works

Schedule a Strategy Call

It starts with a simple conversation about the challenges that you’re facing today. We’ll explore opportunities to break through those challenges.

Receive a Customized Plan

Through a collaborative and educational approach, we’ll develop personalized, step-by-step recommendations so you feel informed and empowered about your financial life.

Focus on Enjoying Life

Success is driven by consistent, proactive decisions over a long period of time. Let us handle the strategy and implementation, while you focus on living life to the fullest!

Recent Viewpoints

Family Wealth Education and Governance

Ensuring the longevity and prosperity of family wealth involves more than just financial planning—it requires a strategic approach to educating future generations. Discover effective strategies for imparting essential financial management skills to heirs, establishing robust family governance frameworks, and fostering a culture of financial literacy. Learn how these practices can empower your family to preserve and grow its wealth responsibly, fostering unity and stewardship for generations to come.

The Great Wealth Transfer

Get ready for the monumental impact of the Great Wealth Transfer, with a staggering $84 trillion set to shift from Baby Boomers to younger generations over the next two decades. In this blog, we explore essential wealth management strategies such as estate planning, financial education, and tax-efficient investing. Our goal is to ensure that this historic transfer of wealth not only secures financial stability but also promotes wealth accumulation for Gen X and Millennials.

Striking the Right Balance

Discover the importance of portfolio diversification and learn how to strike the right balance in your investments. This blog explores the fundamentals of diversification, highlighting its role in managing risk and mitigating losses. Understand the signs of under-diversification, such as high concentration in a single asset, and the pitfalls of over-diversification, like excessive holdings and minimal performance deviation. By evaluating your asset classes, industry sectors, geographic regions, company sizes, and investment styles, you can determine if your portfolio is diversified enough to meet your financial goals. Achieving the right level of diversification is crucial for long-term financial security and peace of mind.