Straightforward

Financial Planning

Helping clients navigate their most important financial concerns.

Talk to An

Advisor

Helping clients navigate their most important financial concerns.

Who We Serve

Managing and preserving wealth for individuals and institutions

Whether you want to explore your investment options, create a retirement plan, or develop a sound financial strategy for the future, Strategic Advisory Partners can help. Our clients value advice delivered with experience and intentionality. We will listen to your needs and provide objective recommendations that address your unique, comprehensive financial picture.

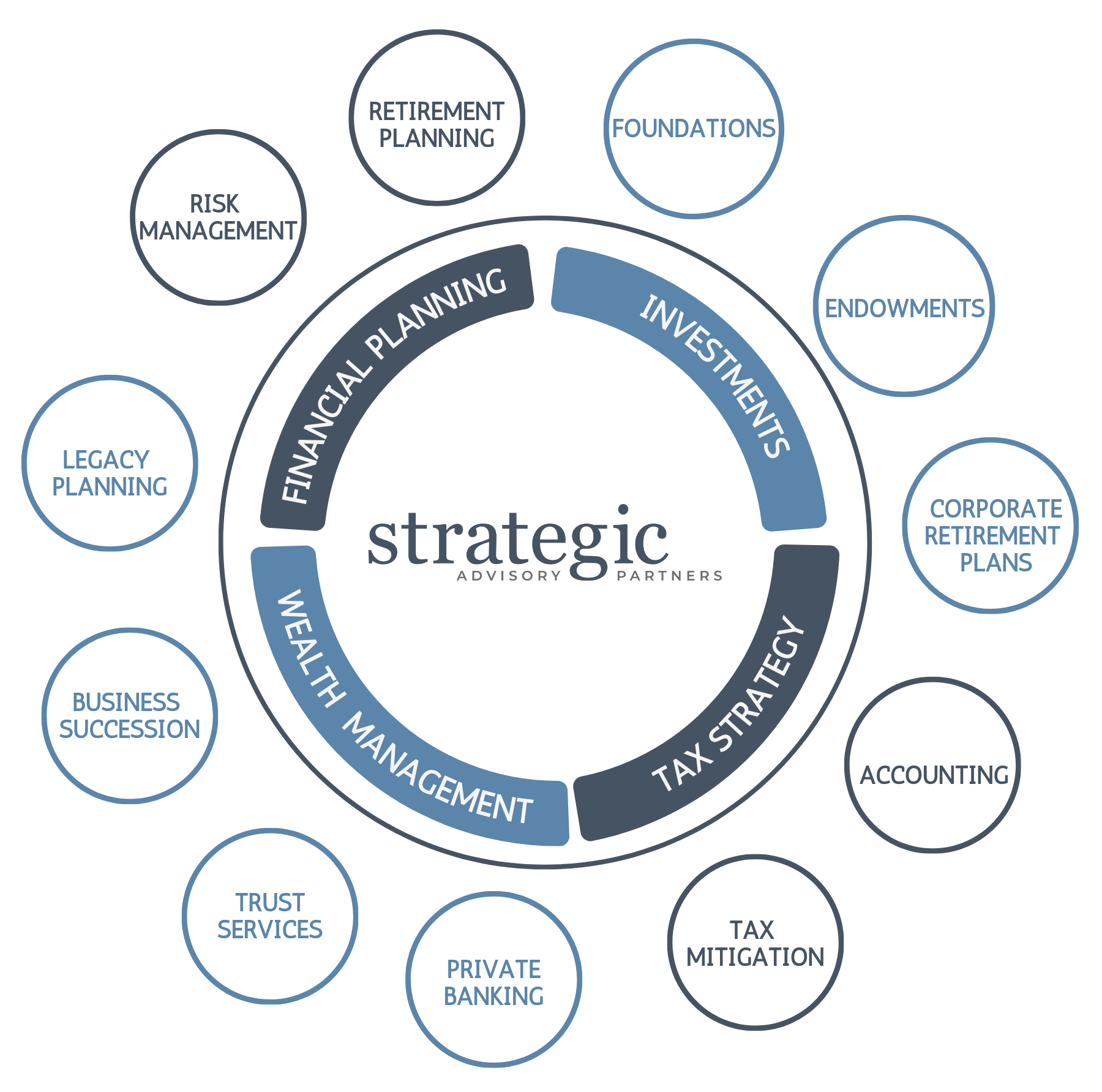

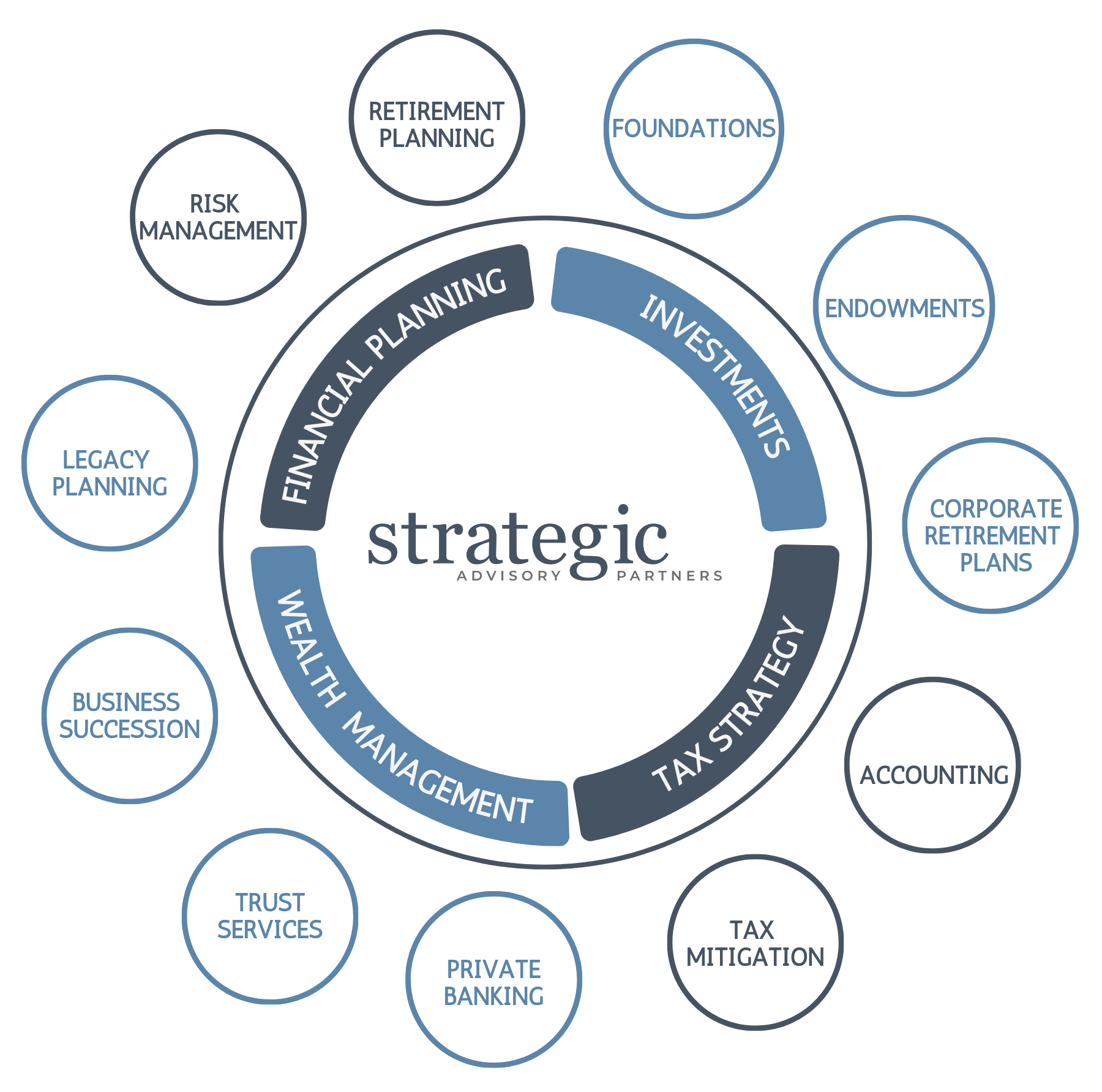

Our Services

As your wealth expands, managing it becomes more complex. But don’t worry, keeping tabs on every detail won’t consume all your time. We collaborate with your team, ensuring a streamlined process and serving as your single point of contact to oversee it all.

We’re “All In”

We get it! Mapping out your financial future can be stressful, especially when there is a volatility in the market place. You have goals and it’s tough to know when to pivot your investment strategies.

Whether you want to explore your investment options, create a retirement plan, or develop a sound financial strategy for the future, Strategic Advisory Partners can help. Our clients value advice delivered with experience and intentionality. We will listen to your needs and provide objective recommendations that address your unique, comprehensive financial picture. One that is easy to understand and provides peace of mind.

Here’s How It All Works

Schedule a Strategy Call

It starts with a simple conversation about the challenges that you’re facing today. We’ll explore opportunities to break through those challenges.

Receive a Customized Plan

Through a collaborative and educational approach, we’ll develop personalized, step-by-step recommendations so you feel informed and empowered about your financial life.

Focus on Enjoying Life

Success is driven by consistent, proactive decisions over a long period of time. Let us handle the strategy and implementation, while you focus on living life to the fullest!

Recent Viewpoints

Nurturing Financial Literacy: Spotlighting Chris Harris

Discover how Chris Harris, Chair of the Finance Department at Elon University and Financial Advisor at Strategic Advisory Partners, is empowering communities through financial literacy education. Explore his innovative approach to personal finance and learn how his passion for financial wellness extends beyond traditional wealth management.

Fiduciary Bingo — A Simple Guide For Employers

Discover the complexities of fiduciary roles in retirement planning, tailored for business owners. From the oversight responsibilities of 3(16) administrators to the investment guidance provided by 3(21) advisors and the risk management handled by 3(38) managers, we delve into the intricacies of each role. Gain clarity on the fiduciary duties that impact your retirement plan and learn how to navigate these complexities effectively to safeguard your employees’ financial future.

Biden’s Proposed Tax Policy Changes

Explore the potential impact of proposed tax policy changes under the Biden administration. From inheritance taxes to capital gains and corporate taxes, learn how these adjustments could affect your financial future and estate planning strategies. Stay informed and prepare with insights from our comprehensive guide.