If you are a parent, you likely had a flood of thoughts and emotions run through your head when you saw your child for the first time. Somewhere in that processing—or maybe it was during one of those sleepless nights early on—you likely thought about your kid going to college and how you were going to pay for it.

As a parent, we always want what is best for our children and tend to sacrifice our own wants and needs to ensure theirs are met. When it comes to paying for college, I can’t stress enough that sacrificing your own retirement security by prioritizing your kids’ college is NOT the answer. Although it may seem like your options are limited and the time is quickly coming to pay for school, there are many ways to address college without giving your children mental health issues later in life.

Sacrificing your own retirement security by prioritizing your kids’ college is NOT the answer.

When I hear the term “college” I, like many, often associate that with a 4 year institution. In truth, I believe that one of the struggles our country is currently facing—the labor shortage—is a result of many years of an overemphasis on 4 year schools as the only option after high school. The need for trades like HVAC, electrical, plumbing, etc. are greater than ever. All of the options that I discuss below are applicable to all universities, colleges, community colleges and trade schools.

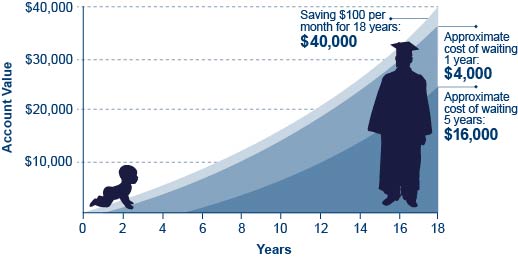

Depending on when you start thinking about paying for school, it may or may not make sense to invest in an educational savings account. The most well known is a 529 plan, named after the IRS code that allows for the tax advantaged build up in the investment account. Funds are deposited into the account after tax, however, the growth in the account is tax deferred and if the money is used for high education expenses, it is never taxed again. If you are starting earlier in your child’s life, this type of a plan is effective because there is enough time for the money to grow significantly before you need to spend it. If your child is closer to needing the money, the effectiveness of the account will be diminished because most of the account balance will be money you have deposited. Recent changes in the tax code now allow beneficiaries to use the funds (up to $10,000 per year) to pay for tuition for elementary through high school education.

529 plans are sponsored by individual states but you do not have to choose the plan offered through your state. You are free to choose the best plan for you. There are no income limits on families to contribute and anyone can contribute to a 529 plan (I’m talking to you grandparents out there) up to the gift tax limit ($15,000 in 2021). There are a few other nuances that allow for greater contributions in a year that are beyond the scope of this discussion.

Coverdell Education Savings Accounts (ESAs) are the other educational savings accounts out there. It is much more restrictive than a 529 plan in many ways and, with the recent changes that allow 529 plans to pay for tuition for elementary through high school, it has essentially become an obsolete planning tool for paying for college.

Much like Coverdell ESAs, Uniform Gift to Minors Act (UGMA) and Uniform Transfers to Minors Act (UTMA) are not useful for college planning because the 529 plan has all of the benefits that these types of accounts used to provide before 529 plans came into existence.

If you find yourself planning to pay for college much closer to the event, it is important to know that there are ways to still get through college without accruing student loan debt. Even if 529 plans don’t make sense because you won’t be able to take advantage of the compound growth, all is not lost. As a financial planner, I talk with clients daily about the significant headwind that student loans create and the frustration they have with not understanding how impactful starting out with tens of thousands of dollars in debt would have on their financial future.

Regardless of when you are thinking about paying for continuing education there are options that can help reduce your tuition bill. Each year, scholarships go unused because no one applies for them. Additionally, an untold number of scholarships have very few applicants and the likelihood of winning that scholarship is high. If you or your child is looking at paying for school, applying for scholarships should be part of your daily routine. Websites like www.collegescholarships.org, www.cfnc.org (for NC residents), www.salliemae.com are all great resources to find thousands of scholarships available. There are plenty of other sites that pop up with a quick Google search.

Identifying what you want to go to school for will also help in controlling the cost. Going to a 4 year institution because you don’t know what else to do is a bad plan. Without a clear direction going in, you are likely to spend 5 or 6 years figuring things out and taking classes that you otherwise wouldn’t need to take—if you finish at all. It is not uncommon for students to change majors, but having a plan that can be tweaked is much more efficient than showing up without any idea which way you are heading.

Community colleges offer very affordable tuition and the general education classes that are the foundation for any major. If you are unsure of what you want to do specifically, your local community college may make sense to knock out some of the classes you will have to take, regardless of the major you ultimately decide. If you go this route, work with an academic advisor to make sure you are taking classes that will ultimately transfer to the institution you want to attend.

Trade schools that offer vocational skills are an option that we have neglected for many years. As a result, the demand for these careers are high and the pay is significant. It is not uncommon to come across plumbers or electricians who are making six figures. The training period is much shorter and the ability to make a higher income right away gives people who go this route a leg up on their peers who spend four years or more at a much higher priced school before they ever enter the workforce.

Finally, and I can’t stress this enough… there is nothing wrong with working and going to school. I can assure you that paying for school as you go to limit or reduce the need for student loans will never be a regret you have as an adult. And if you are a parent reading this, the accountability that your child will assume when they are responsible for some, if not all, of their own tuition and fees will be a great life lesson.

Each family dynamic is different and the ability to pay for school varies as well. If you are able to cash flow tuition for your child, or save in a 529 plan, then you are giving your child a gift that they will only realize once they are in the working world themselves. I always encourage clients to talk openly and honestly with their kids about what they can and are willing to do when it comes to paying for higher education. The most well adjusted young adults have an understanding of the costs and sacrifices it took from their families to give them the education they need to be successful.