September 2024 Investment Update

As we fall into September, the financial markets are abuzz with speculation about the Federal Reserve’s upcoming policy meeting on September 17-18, 2024. While some expect a possible rate cut due to recent market fluctuations, there is also an interesting phenomenon that happens each year: The September Effect.

While you’re surely asking yourself, “What is the September Effect”… First… here’s a snapshot of the markets in August.

August Market Recap

The first week of August brought a nearly 10% correction in stock prices, driven by revised employment numbers, record-high consumer debt, and challenges in the housing market. Despite this rocky start, markets rallied, and most indexes ended the month higher than they began.

August was marked by significant volatility, which we expect to continue in the coming months. It’s important to remember that volatility doesn’t always mean a decline—markets can trend upward as well. Throughout August, we held our allocations steady, following the adjustments made in July, and will continue to monitor and make rebalancing decisions as needed

U.S. Large Cap Equity

U.S. Large Cap Growth Equity

U.S. Small Cap Equity

International Equity Developed Markets

International Equity Emerging Markets

U.S. Bond Market

“The big money is not in the buying and selling, but in the waiting.”

— Charlie Munger

OK, so what is the September Effect?

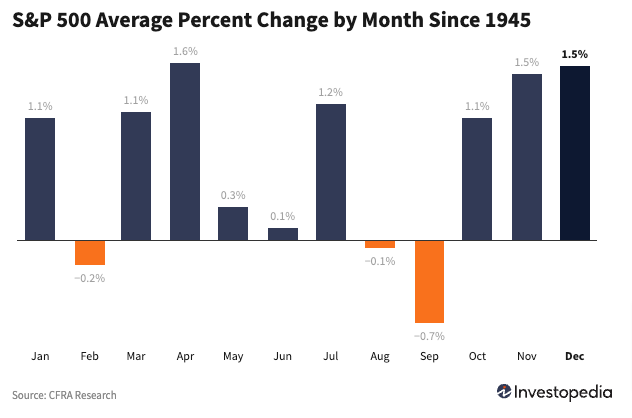

The September Effect is a well-documented occurence where markets historically experience increased volatility and a potential decline in stock prices during September. September has been the market’s worst-performing month in the last 10 years, 20 years, and since 1950. This trend can often be attributed to a range of factors, including a lull in the end of summer trading, tax-related actions by institutional investors, and seasonal adjustments in investment strategies.

Investopedia. (2024). The September Effect: Election Year Impact on the Stock Market. Retrieved from https://www.investopedia.com/stocks-september-effect-economy-presidential-election-inflation-fed-2024-8705709

And why does it matter?

For investors, September can be a challenging month. The increased volatility and market shifts present both risks and opportunities. Our approach to investment management internalized these kinds of seasonal trends, aiming to minimize risks and capitalize on potential opportunities.

Strategic Advisory Partners employs a trend-following investment strategy designed to adapt to changing market conditions, including those influenced by the September Effect. By leveraging this approach, we can adjust our portfolio strategies in response to market movements and historical patterns, ensuring that our clients are well-positioned to navigate periods of heightened volatility.

Our strategy is grounded in rigorous analysis and data-driven insights, allowing us to stay agile and responsive while removing as much emotional bias as possible. This proactive approach helps us to manage risks effectively and optimize returns, even in the face of seasonal market fluctuations.

As we head into September, our focus remains on providing our clients with the best possible guidance and strategies to manage their investments. By staying informed and adaptable, we can navigate the September Effect and other market challenges with confidence. We are dedicated to helping you achieve your financial goals through thoughtful investment management.