Should I Still Be Investing?

– Chris Harris, Strategic Advisory Partners

It’s easy to turn on the news or get into a discussion with friends or coworkers about the markets and the current volatility we are experiencing. Recent events in the world have caused many to feel concerned about the future. World conflict, inflation, supply chain problems, and shortages all impact how people feel.

One of the questions many ask is: “Should I still be investing?”

This is a common question and one where it will help to look at history. There have been many times in history when people wondered if the economy was going to totally collapse – and when people felt a lot of fear about their financial future. Just within recent memory, there was the Great Financial Crisis in 2008, and the technology bubble collapse between 1999-2001.

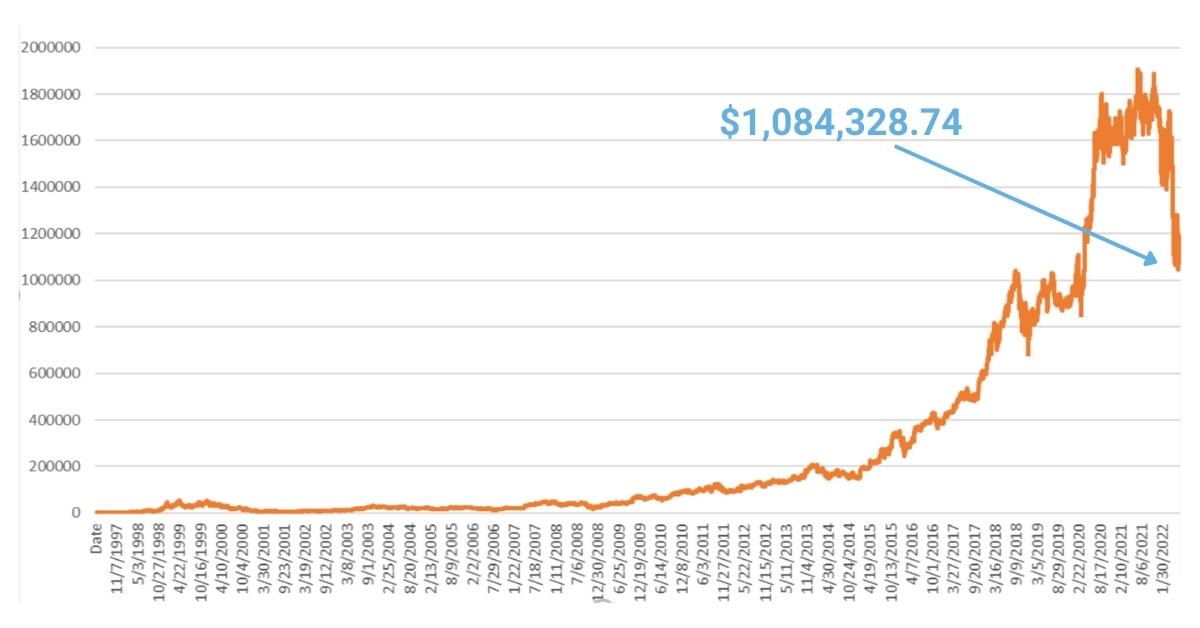

Even now, with four significant stock market declines in the last 23 years (1999, 2008, 2020, 2022), there has been a tremendous opportunity to invest and grow wealth through investing. Amazon is one of the best examples of this.

Amazon became a public stock through what is known as an Initial Public Offering (IPO) in 1997 with a share price of $18. As the price has increased over time, the stock has been split on multiple occasions. When a stock splits, the share price is divided and the number of shares of stock is multiplied by the value of the split (for example, Amazon completed a 20 for 1 split in June 2022. This means that the share price was divided by 20 and the number of shares multiplied by 20).

Stock splits occur when the share price increases significantly, making it harder for retail investors (the general public) to be able to afford a share of stock. When accounting for the fact that the stock has had several splits, it would be the same as saying the stock had an IPO price of $.075!(1)

At the end of the second quarter of 2022, Amazon’s stock price closed at $109.56. It is incredible to understand that even in a world environment that has had financial crises, stock market crashes, and world conflict, an initial investment of $1,000 in Amazon stock would be worth over $1,000,000 at the end of June 2022!

Value of Initial $1,000 Amazon Investment

How does this happen?

Even in a world filled with uncertainty, there is still an opportunity for businesses to have an impact. Companies that can innovate, create, and offer something that people want will grow over time. The value of a stock, and subsequently, the stock market, reflects the value that companies add to the economy.

Amazon may be a unique case due to it’s extreme growth, but the reality is that even if you had bought the S&P 500 at the peak of the stock market bubble in 1999, the investment value would be 3 times higher today – plus you would have been receiving regular payments from firm profits, called dividends, during the past 23 years!

(Photo Credit: shutterstock_1399561361)

Innovation has not stopped.

There are companies right now working on technologies such as 3D printed body tissue, recyclable plastics, artificial intelligence, and many other new products and services that will change the way we live in the future. In 1999 we may not have seen what Amazon would become today, but by choosing to not be invested at that time, individuals missed out on the opportunity to grow with the new technology.

Similarly, we may not currently see which companies will have the greatest impact on the world over the next 20 years, but by investing consistently, we will enjoy the growth of the markets as the opportunities come.

Overall, it is still a good time to be investing – as long as you are investing with a plan.

There should be a strategy built around your personal financial goals and timelines that involves identifying which investments to own and when to buy and sell them.

Take a look at another one of our posts Having a Plan that goes into more detail about our philosophy around buy and hold strategies vs. active asset management.