VOLATILITY GOES BOTH WAYS – NOT JUST DOWN

– Blaise Stevens, Strategic Advisory Partners

When you make an argument based on the reasoning that’s just plain wrong, it’s a logical fallacy. One of the most well-known is the “strawman argument.” The strawman argument is arguing against a position your opponent doesn’t actually hold.

We regularly encounter a logical fallacy (more specifically, the strawman) offered by those who believe that buy-and-hold is the best way to succeed in the financial markets.

When discussing different approaches, such as dynamic allocation strategies, one will typically hear something like, “But, what about the best 10 days rule?”

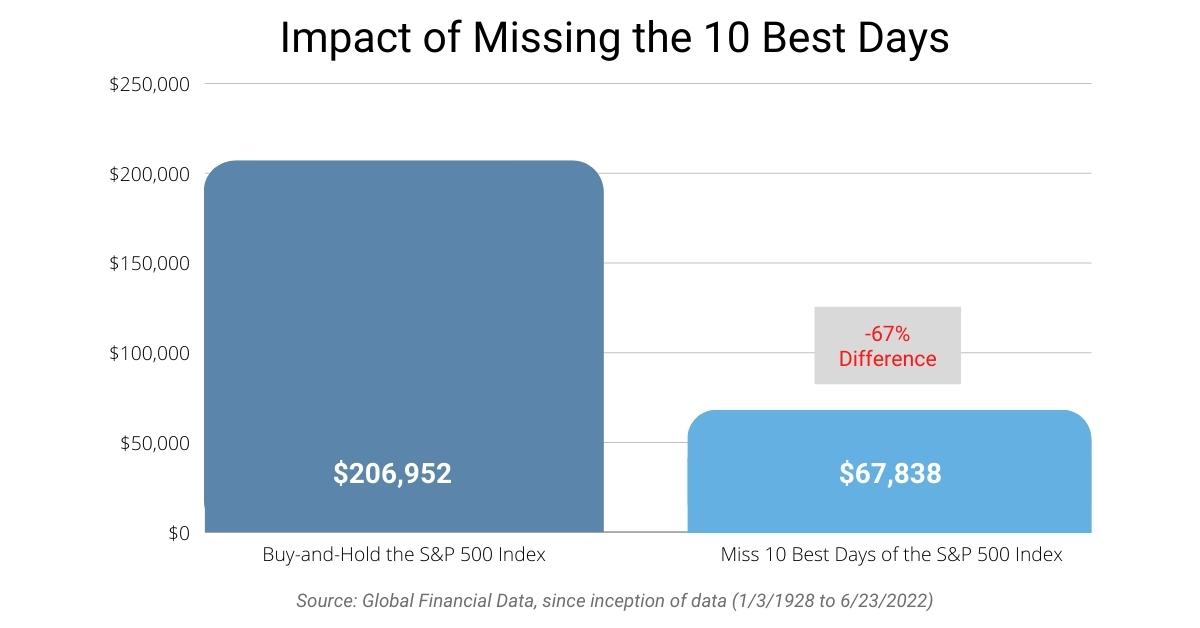

The best 10 days rule is the concept that missing just the 10 best days in the stock market dramatically reduces your long-term return. This is almost always used as a justification for staying fully invested in stocks regardless of the environment.

What makes it a strawman argument is that it leaves out critical information and misrepresents what an alternative approach might do instead. It also assumes that one would intentionally develop a strategy that misses only the best days in the market, which is ridiculous.

Complicating matters is that the argument is technically true – missing ONLY the top 10 BEST days does reduce return. In fact, it cuts the portfolio return by 63% for an initial $1,000 investment made in 1928.

But this is not the whole story of this strawman.

Volatility goes both ways… not just down.

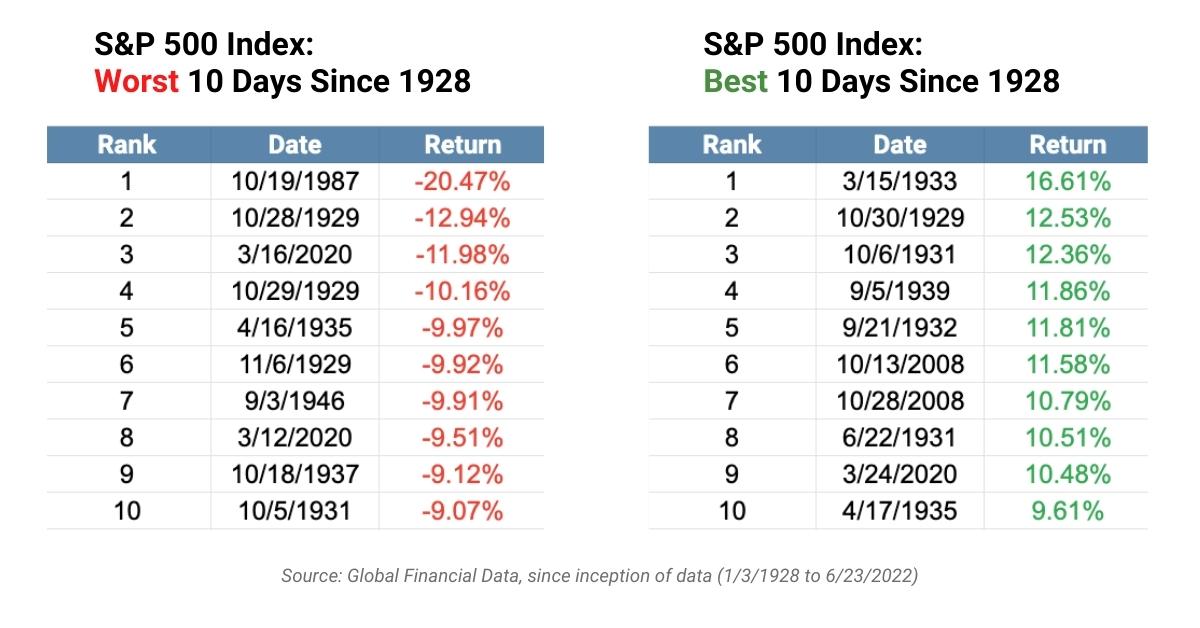

The tables below show the best 10 and worst 10 days since 1928.

Astute readers will recognize something interesting about the timing of the best 10 days and worst 10 days. Many of the dates on the 10 best list occurred during not-so-favorable environments; during periods of instability and uncertainty.

In other words, volatility begets volatility.

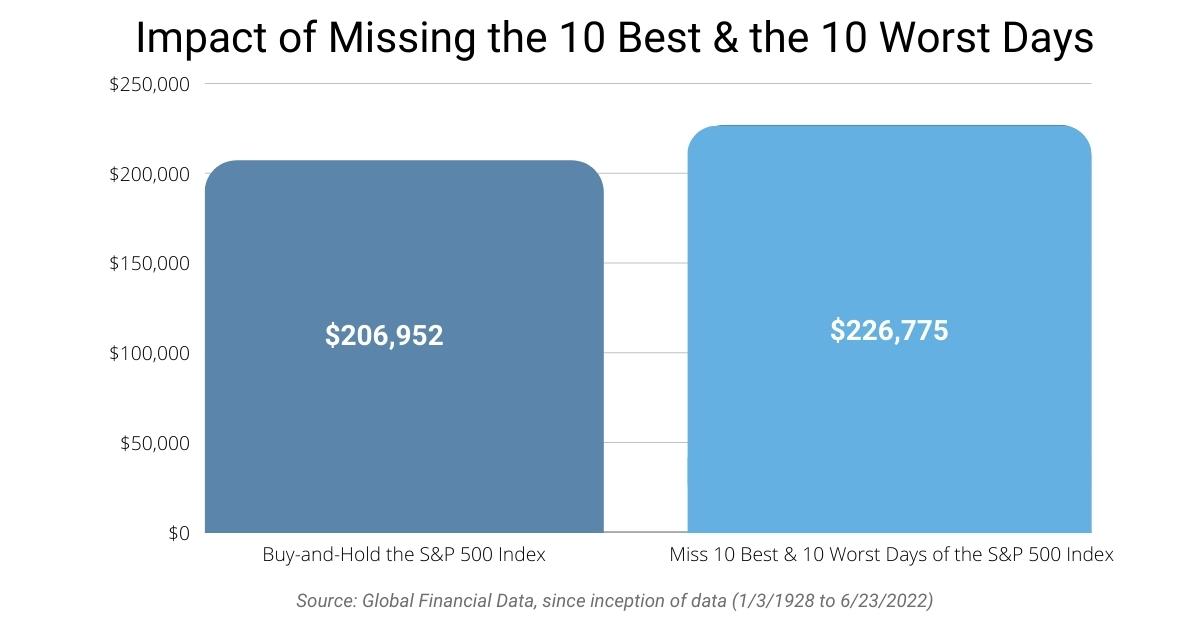

What matters most? Participating in the best, missing the worst, or avoiding both extremes?

The next question a reader may ask is, “If volatility clusters, then what happens if you avoid both the best AND worst days? Further, is there a reliable way to do so?” The answer is an emphatic “yes!”

It just so happens that a simple trend following strategy that bought (or held) when the average close of the last 10 days was above the average of the last 100 days and sold when the inverse was true, would have avoided all 10 of the worst days since 1928.

On the flip side, you would have missed/sacrificed eight of the best days.

According to the basic idea of the best 10 days rule, one might assume that performance of this trend-following strategy would be severely hindered because it captured just two of the best days.

The graph here compares the performance of buy-and-hold versus missing BOTH the 10 best AND 10 worst days. It turns out that missing both provides a greater return than buy-and-hold – and with less volatility. This ratio leads to better risk-adjusted returns. It also likely would provide a better investor experience, given the more palatable outcomes.

The journey matters.

The best 10 days rule is a compelling thought, but upon deeper inspection, it is a distraction from the importance of financial consistency along your path to your financial goals.

Absolute returns are the destination, but the journey matters. More importantly, it helps you stay the course during unprecedented periods in market history.

Blaise Stevens

Managing Member

Helping clients define and reach their financial goals with integrity, boldness, accountability, and passion.