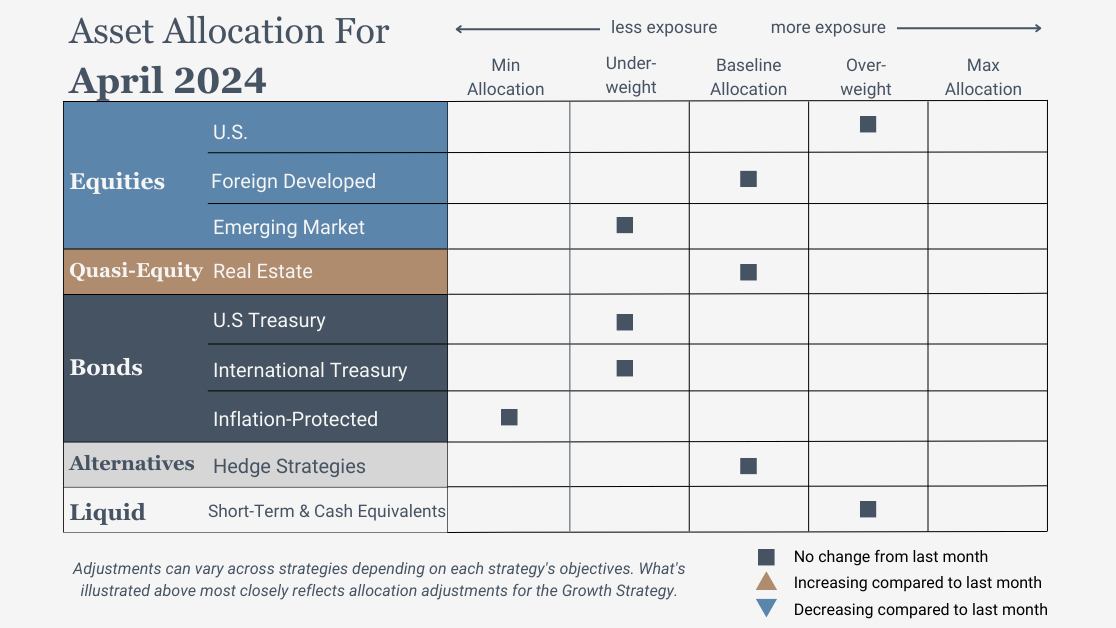

April 2024 Asset Allocation Update

What Does This All Mean?

U.S. Equities

Exposure will not change and remain overweight. Trends over all timeframes are positive. Within U.S. equities, exposure continues to be tilted toward growth and large caps. Value, mid, and small caps continue to have uptrends over all timeframes but remain relatively weaker.

International Equities

Exposure will not change and remain underweight overall. Trends are positive across all timeframes but the segment is weaker than its U.S. counterparts.

Real Estate

Exposure will not change and will be at its baseline allocation, with uptrends across both timeframes.

U.S. & International Treasuries

Exposure will not change and remains underweight. Trends are mixed with intermediate-term trends generally negative and long-term trends generally positive.

Inflation-Protected Bonds

Exposure will not change due to the relative weakness of the asset class versus nominal Treasuries.

Alternatives

Exposure will not change. The baseline allocation for gold is also our highest limit, so we are already at the maximum allocation as trends in gold remain positive across both timeframes.

Short-Term Fixed Income

Exposure will not change as it maintains exposure previously vacated by longer-duration fixed income instruments.

Get In Touch

3817 Lawndale Dr. Suite D1

Greensboro, NC 27410

(336) 790-2560

info@StrategicAdvisoryPartners.com